So many options

With confusing dates and so many exceptions to the rule, researching dividends can leave you feeling as though you’ve just followed Alice through the looking glass.

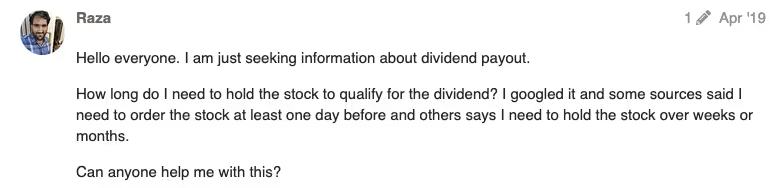

That hasn’t stopped our community of Freetraders from wanting to know more. Dividends are one of the most popular topics in the Freetrade Community.

Fear not Raza, all will be revealed

To make sure you understand everything, we thought it would be good to explain how a dividend payment moves from a company’s coffers to your Freetrade account.

Read on and you’ll see how dividends work on Freetrade and beyond. 🚀

Timings

Dividends are paid at different intervals by different companies.

In the UK, most firms will pay a ‘final’ dividend at the end of the financial year and an ‘interim’ dividend halfway through it.

American firms are different. They will usually pay out four times a year.

This difference is mainly due to financial reporting requirements.

Dividends are generally paid out just after a company releases a financial report.

American companies are required to release four reports in a year. UK firms, however, are only required to release two.

Like all things dividend-related, there are exceptions to this rule. Some companies will pay out dividends every month or even haphazardly throughout the year.

The practical stuff

Once a firm has examined its financial reports, it may recommend paying a dividend. Shareholders will then vote to approve this at the company’s annual general meeting.

There will be four key dates that then take place before you end up seeing any dividend earnings in your Freetrade account.

The Declaration Date

First off is the ‘declaration date.’ That’s when a company publicly announces that it will be paying out a dividend in the near future.

The Ex-Dividend Date

Next is the ‘ex-dividend date,’ though you may have heard this referred to as the ‘ex-date’ (we will use the two terms interchangeably in this article).

This is the date that the stock starts trading again without the value of the next dividend payment.

So if you held the stock before this date, you’d be entitled to the dividend — even if you sold your stock on this date! However, if you only bought the stock on or after the ex-date, you wouldn’t receive a dividend. We’ll elaborate upon this is in a second…

The Record Date

This is when a company looks through its record book of shareholders to determine who will be paid a dividend. The ex-date is usually 1 day prior to the record date.

You can see an example of the above in action with a recent HSBC dividend payment.

The bank announced that it would be paying a dividend on October 2nd — this is the declaration date.

The ex-date was set for October 11th and the record date was on October 12th.

In practice, that would mean any Freetrader that bought an HSBC share before October 11th would have been entitled to the dividend payment.

Any Freetrader that bought an HSBC share on or after October 11th would not have been entitled to that dividend payment.

Payment Date

The final step in the dividend process is the ‘payment date.’

This is the date that shareholders are supposed to receive their dividend payment.

If you hold shares with Freetrade then we act as your nominee. That means you are the beneficial owner of your shares but we will be listed in a company’s record book as the shareholder.

As a result, we will be the first to receive the dividend payment. Once we’ve received a payment we then allocate it to your Freetrade account.

We will always try to pay out dividends on payment day or within one working day.

But sometimes things outside of our control can happen. Share registrars, who are hired by companies to distribute their dividends, will sometimes make late payments to us or, if they’re old school, they might send us a cheque that takes longer than it should to arrive in the post.

Taxes on Dividends

If you are investing in UK stocks, you will have to pay tax on any dividends you receive.

How much tax you pay on dividends depends on how much you earn.

People making up to £50,270 will have to pay 8.75% on dividend earnings. If you earn more, you might have to pay a 33.75% or 39.35% tax on your dividend income.

Thankfully, there are some dividend tax exemptions for Brits.

First off, any dividends you receive in your ISA from UK stocks are tax-free. 🥳

The UK government also gives everyone an annual, tax-free dividend allowance outside of ISAs. This is currently set at £500.

So, if you earned £1,500 in dividends, you’d only pay tax on £1,000.

Be aware that if you have shares in companies outside of the UK, you’ll have to pay local taxes on dividends earnings — even if they are in your ISA.

Dividends on Freetrade

Viewing your dividends on the Freetrade app is simple.

Once we’ve paid you a dividend, we’ll send you a push notification to inform you of this. We’ll also send you an email with a breakdown of the dividend and the deposit will be listed in your activity feed in-app.

The dividend is paid directly into your Freetrade account as cash. You can do whatever you like with that cash. You could reinvest it by purchasing more stocks or withdraw it and buy yourself something nice. 🍾

We’re on a mission to bring fee-free investing to Europe and beyond. 🔥

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).