“Do you want to earn ££££ by doing nothing from home?”

If you haven’t seen a pop-up like this, you need to up your internet hours. Just promise me you won’t click on it - I have a sneaking suspicion it’s too good to be true.

One of the reasons these flashy boxes exist (and lure us in) though, is because growing our own cash savings these days has become so incredibly difficult.

That, and the internet is a weird place.

UK dividend stocks

With interest rates at all-time lows and negative rates (where you pay for the luxury of storing your money, madness) now a very real part of the conversation, investors and cash savers at the foot of the risk scale are being starved of income.

So where can they turn?

Well, looking beyond bank accounts and bonds to shares, for access to dividend-paying stocks, has been a necessary step for many to gain access to any yield at all, basically since 2008.

But dividends are never guaranteed. Cuts from some of the UK’s biggest dividend stocks in the face of the pandemic this year have a few income-seekers shifting in their seats.

It’s made a lot of us wonder if we’ve really got our dividend income strategies right.

Even with the blanket ban on UK banks paying out and cuts in top dividend stocks totalling around £60bn this year, the UK 100 dividend yield currently sits at around 4%.

This offers a far higher level of income than most cash accounts, the trade-off being climbing the risk ladder into shares.

But, as 2020 has shown, it’s not just a case of throwing yourself headlong into the market, expecting dividend income streams from UK companies to find their way to you.

So, whether you’re looking to rack up that sweet dividend income or planning to turn on the taps of your retirement savings and take regular payments (i’m insanely jealous) have a look at my five things to keep in mind when trying to generate an income from the stock market.

1. The best dividend stocks are ones that actually pay out

Let’s start with “what is a dividend?”

It’s a regular payout from a company to its shareholders as a thank you for being there, and also to keep investors sweet and invested.

The payment amount depends on the earnings that company makes.

So, rather than getting doe-eyed at headline dividend percentages, we need to make sure those earnings are strong and consistent enough to keep our dividends flowing.

In short, a company’s ability to pay a dividend matters more than the dividend itself.

Start by looking past the topline figure, to the dividend cover.

Is the firm actually going to be able to pay you that figure, and sustainably, or are you being hypnotised by the big number when the rest of the business is collapsing?

With a lot of dividends starting to reappear after hibernating during lockdown, it's also important to keep tabs on a company's share price.

Income payments might resume but if the share price stumbles across the bottom of the page it's not going to make your portfolio any happier.

back to dividend cover. You'll likely see it expressed as holding ‘2x’ or ‘3x’ the level needed to meet the next dividend.

Looking at the levels of cash on the balance sheet can help sort the leaders from the basket cases too.

Quite often the top dividend stocks of the moment stop being so good after that.

It’s about planning for long-term dividend income. Which leads us nicely onto how we find those consistent compounders.

2. Join the dividend heroes and aristocrats

A company’s dividend history will show you evidence of their commitment to dishing out dollars and pounds.

And while some can be sporadic, there’s a very select club of those who not only pay out regularly, but aim to continuously raise these payments.

To make it into the Dividend Aristocrats squad in the UK, a company has to raise its dividend, or at least keep it stable, for 10 consecutive years. For US companies it’s 25 years.

It’s not surprising that companies in this bucket have seen enormous investor attention in times of low rates.

Firms like Guinness-owner Diageo and Dove soap-manufacturer Unilever have huge stables of leading brands and a global reach.

Dominating their markets means earnings are commonly less volatile than challenger brands, which normally translates into more stable dividends too.

And you don’t have to endlessly wade through the stock lists for access to these companies.

There are handy ETFs which bundle all the big guns into one package.

Funds like the SPDR S&P US Dividend Aristocrats ETF, which tracks the 60 highest-yielding US stocks with 25 consecutive years of growing dividends, and the SPDR S&P UK Dividend Aristocrats ETF, which follows the performance of the best UK dividend stocks, are there to do the job for you.

I can be your hero, baby. Enrique just loves dividends

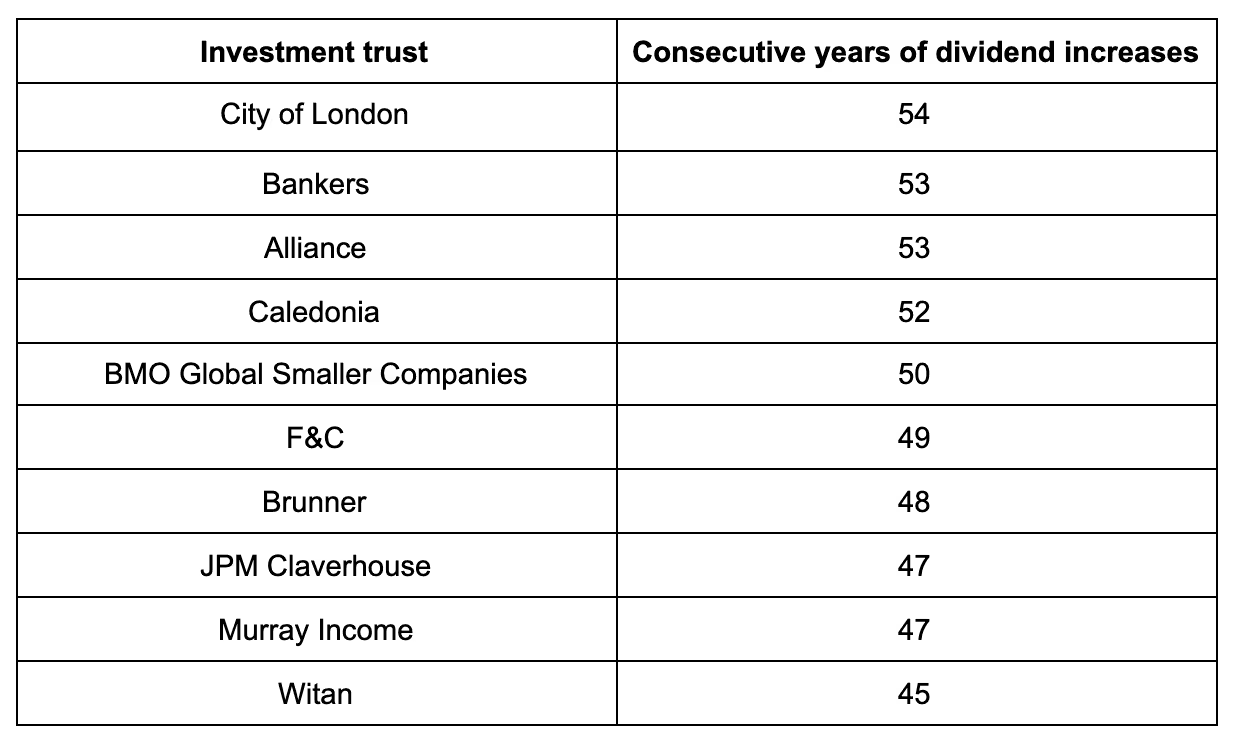

There’s another Avengers-style group doing a similar thing in the world of investment trusts.

To be a UK Dividend Hero, a trust has to consistently increase its dividend for at least 20 years, with some going much further than that.

Here are the top 10 with the longest track records of dividend increases.

These trusts don’t track any index, it’s up to the human manager at the helm to select the stocks they think hold the best opportunity for stable growth and income.

3. On that note, don’t sleep on investment trusts

This one deserves its own point.

Trusts can seem a bit fuddy-duddy because their long-term focus means their portfolio changes are often slow and methodical, with super long holding periods.

But a real highlight when we’re talking about dividends is their ability to reserve up to 15% of their income in the good periods so they can top up payments to investors when dividend income suddenly becomes hard to find.

This means payments can be kept relatively stable - a huge plus for people who need a dependable level of income, like retirees.

This year has given trusts the chance to put their money where their mouth is and show us how it’s done.

While 176 UK companies shelved payouts altogether in the second quarter this year, with another 30 cutting dividends, just two of the 182 UK investment trusts investing in equities have reduced income payments.

Top Hero City of London even announced a 2.2% rise in its annual dividend this year - power move.

Now, there aren’t bottomless money pits for these trusts to rely upon forever.

But, according to the Association of Investment Companies (AIC), of the 17 investment trusts in the equity income sector, at least eight would be able to raise dividends by at least 3% per year even if overall dividends fell by 30% in 2020 and 2021.

Luckily, dividends are returning to the wild. It’s not business as usual though and the journey back to normality will be bumpy. Some firms are realising deep dividend cuts might have been an overreaction but honestly, who’s going to get angry at a bit of caution this year?

The positive side of this is that income-seekers could start to feel more comfortable as the taps come back on, and trusts will feel less pressure to dip into their reserves.

4. Di-ver-si-fy

I can’t stress this enough.

If you had solely been getting your income from the big UK banks this year your dividends would have been completely wiped out in March.

That’s an insane prospect, and I get that it’s not a common occurrence… but it happened.

Spreading your income sources across sectors, the countries in which your companies operate, and different sizes of firms all help to reduce the impact specific events can have on your overall level of dividend income.

Investment trusts and ETFs are a good starting point to give you instant diversification, topping up any areas you want to focus on through individual shares.

This core and satellite strategy is the basis for a huge array of professional dividend strategies.

4b. Avoid dividend clumping

Side note: it’s incredibly easy to end up holding a huge amount of funds and stocks for their dividends.

But keep an eye on exactly what you hold and why.

The most popular mutual funds in the Investment Association’s (IA) equity income sector look incredibly similar to each other.

And I know I said diversify but if you hold a few similar funds, under the surface chances are you’re doubling or tripling up on the same companies.

Bizarrely, this can mean that while you think you’re diversifying, you’re actually concentrating your money on just a few companies.

Keep it simple, keep it diverse, and keep an eye on all of it.

Now back to our scheduled programming.

5. Look at regularity of payments and plan your year accordingly

If you’re planning your year around regularly receiving dividends, make sure your portfolio knows that’s your goal.

Monthly, quarterly, half-yearly, annually - dividend payouts from shares, ETFs and investment trusts all sit along the spectrum.

But it might not be much use to you if your holdings pay out in January and you don’t see them again until June.

It’ll take a bit of research to collect a range of assets that take turns to top up your portfolio throughout the year.

If you can deal with uneven income, or you’re reinvesting it anyway, it’s probably not that important to you.

But if you need a regular income stream to help pay the bills, it’s important to get this right.

An old colleague of mine, Maike Currie, covers this well in her book The Search for Income.

10/10, would read again.

And remember that, unless you’re firmly in the decumulation phase, you still need assets set on growth - either by including companies that don’t pay a dividend and instead reinvest in their own businesses to grow even more, or by reinvesting any dividends you receive, back into your portfolio.

Good growth companies should be aiming to put their profits to work to generate even higher profits for the company.

Professional investors call this return on capital employed (ROCE) and if company management is doing well at it, just let them carry on.

You can always become more dividend-focused when you’re nearer to actually using the money.

We think investing should be open to everyone. It shouldn’t be complicated, and it shouldn’t cost the earth. Our stock trading app makes it simple for both beginners and experienced investors. And costs are low. You can buy and sell shares commission-free and take advantage of fractional shares (buy just a part of a share).

Important information

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

.avif)