This is not a sob story.

The time to lust after a bygone era of cheap housing, happily rising wages and gold-plated income-for-life pensions is over.

The inevitable conversations around deposits and “In my day…” prologues at Christmas family gatherings might be enough to maintain that dismal view of young people’s money hurdles.

But, rather than lament the fact that it’s getting very difficult to replicate the kind of life our parents led, if we actually think about how we want to live, we can plan our finances to match.

Once we do that, we can give ourselves a much clearer picture of what we’re investing for, and what assets can give us the chance to get there.

Covid made it all a bit clearer

What’s life actually like if you’re in your 30s? Let’s start with what we earn.

Coronavirus has had enormous and widespread effects across the age spectrum.

It delayed retirement for some people as the market took a dive in March 2020, taking equity-heavy pensions with it. But, just as importantly, it pulled the rug out from under young people most likely to be jettisoned from part-time work.

Specifically among younger people, it highlighted issues that had been bubbling away for years.

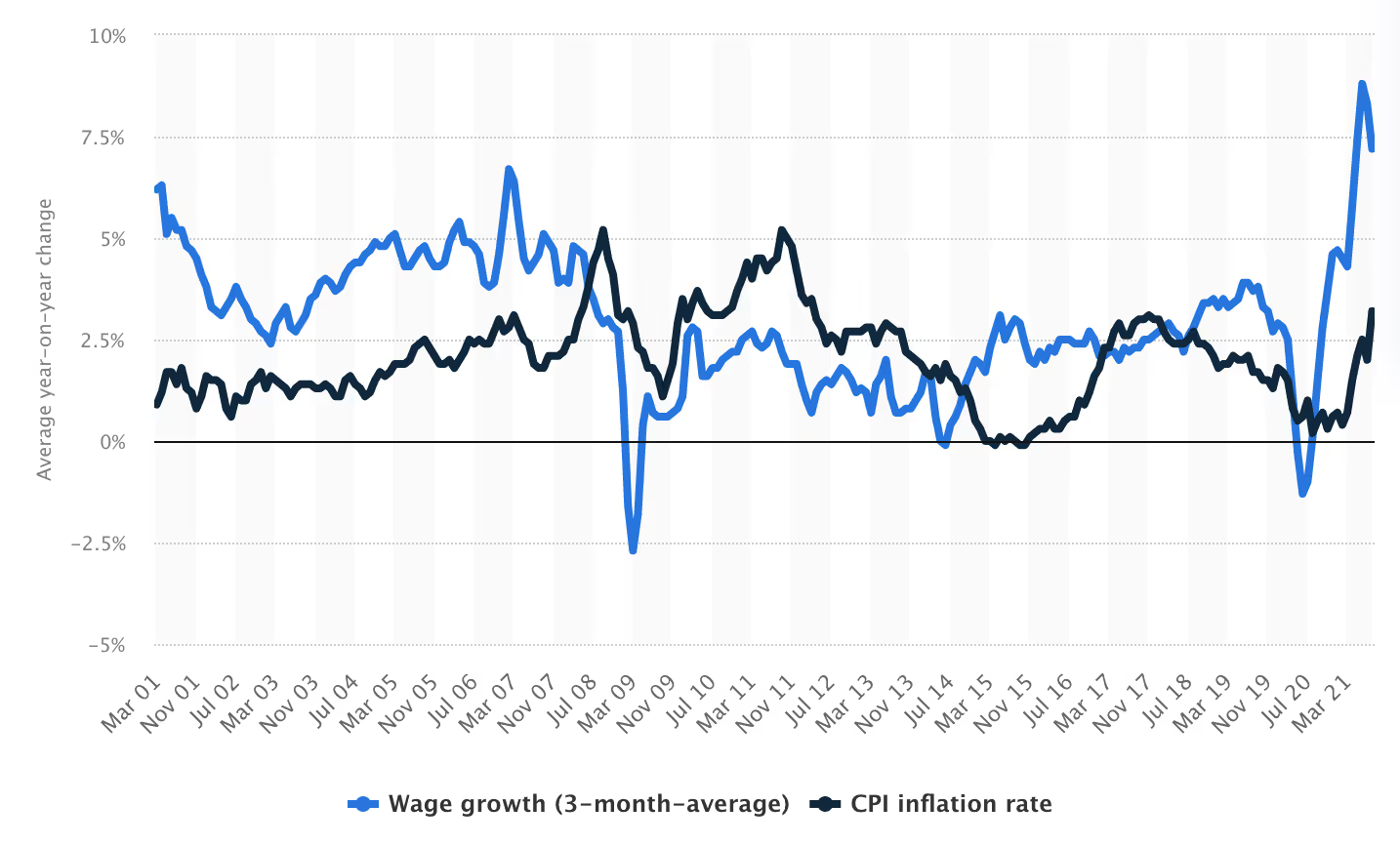

Wage growth and inflation have been snaking around each other for a while now and are a far cry off the kind of stability we saw before the financial crisis.

The takeaway here is that, as today’s 30-somethings entered the world of work they were hit by wages growing slower than inflation. The lines might have converged every so often since but the point is there has been a distinct lack of consistency compared with pre-2008.

Average growth of weekly earnings in the UK compared to inflation

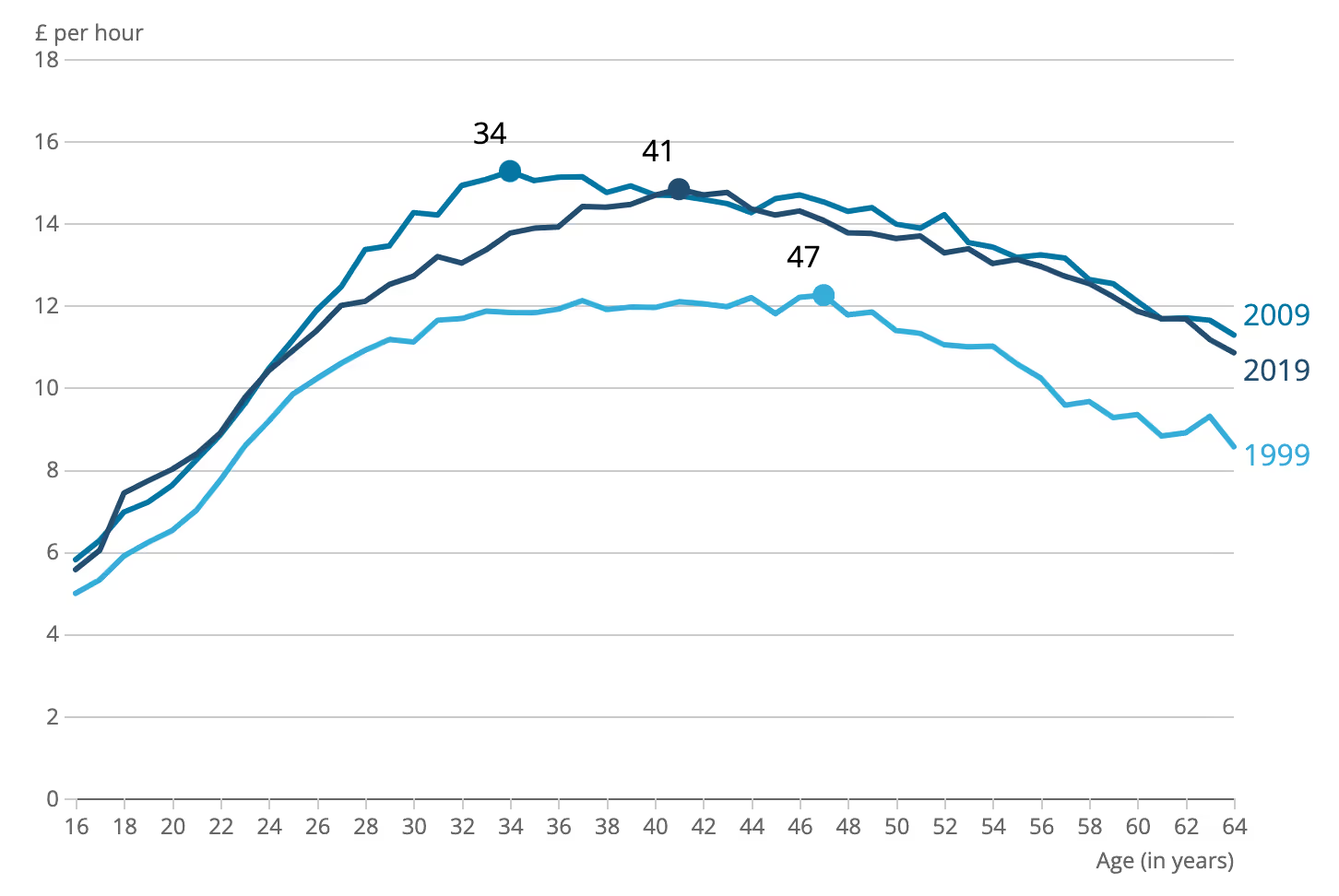

That post-recession hit to wage growth might be one reason why it’s taking longer to hit our peak earnings.

While UK workers reached their highest earning levels aged 34 in 2009, a decade later that road extended to 41.

We’re reaching our highest earnings level later

This is almost certainly a key factor in the general trend of young people pushing back major decisions like getting married and having children.

Married by 30? You’re the exception, not the rule

With the average UK wedding costing £31,974 according to nuptials-planning service Hitched, it’s no wonder we’re doing it later.

There are other factors at play here, not least the increasing comfort of cohabiting without ever committing to a ceremony. But financing a big day still sits among the top reasons to delay it.

Read more:

Your three-minute pension check in

Is £34k/year the key to a happy retirement?

Sign up to Honey, our free investing newsletter

It’s maybe not a surprise then that the 2016 ONS data (the most recently available) shows heterosexual men and women are marrying for the first time, aged 33.4 years and 31.5 years respectfully, up from 25.1 and 22.8 in the mid 1970s.

For same-sex couples that average has climbed to 40.8 for men and 37.4 for women since legalisation in 2014.

Throw in the fact that the average age of a first-time mum is now slightly over 29 (up from 26 in 1998) and you get a flurry of life moments all converging towards our early 30s.

We haven’t even mentioned house prices hitting record highs and commanding ever-larger deposits from already-stretched earners.

This isn’t a particularly handy combo.

30-somethings, bite the bullet

Having multiple financial goals like this can be like spinning plates. But we do have to think about them concurrently rather than one at a time.

The reason for this is that there is no substitute for the time we give our investments. If we were to approach those goals one after another, we’d have to drain our investment accounts and start again for the next goal. That would completely wipe out the compounding effect upon which all good investing is based.

Pushing out the timeline of our goals to accommodate more of them will likely be the hallmark of this generation but once we get past that there are three clear action points for investors.

- Invest regularly. History shows us that steady savers are likely to outperform even the investors who sit on the sidelines waiting for the market dips, thanks to the wonders of dividends and compounding. Market timers can’t make use of that snowball effect if their money isn’t in the market to begin with, regular investors can. Be the tortoise, not the hare.

- Consider your financial goal, time horizon and tolerance for risk. This is the most powerful triumvirate in personal investing. Keep revisiting these - there’s likely to be a compromise in there and the relationship between them will ultimately inform what is reasonable, given your situation. Are you expecting too much from your portfolio? Would reducing that goal mean you get there quicker? Make it personal.

- Never neglect your pension. Previous generations bought houses earlier, allowing them to get back to pension saving earlier too. That meant they got more time for compounding than we’ll likely get. All the more reason to think about our retirement savings alongside those other life goals.

Time really is money

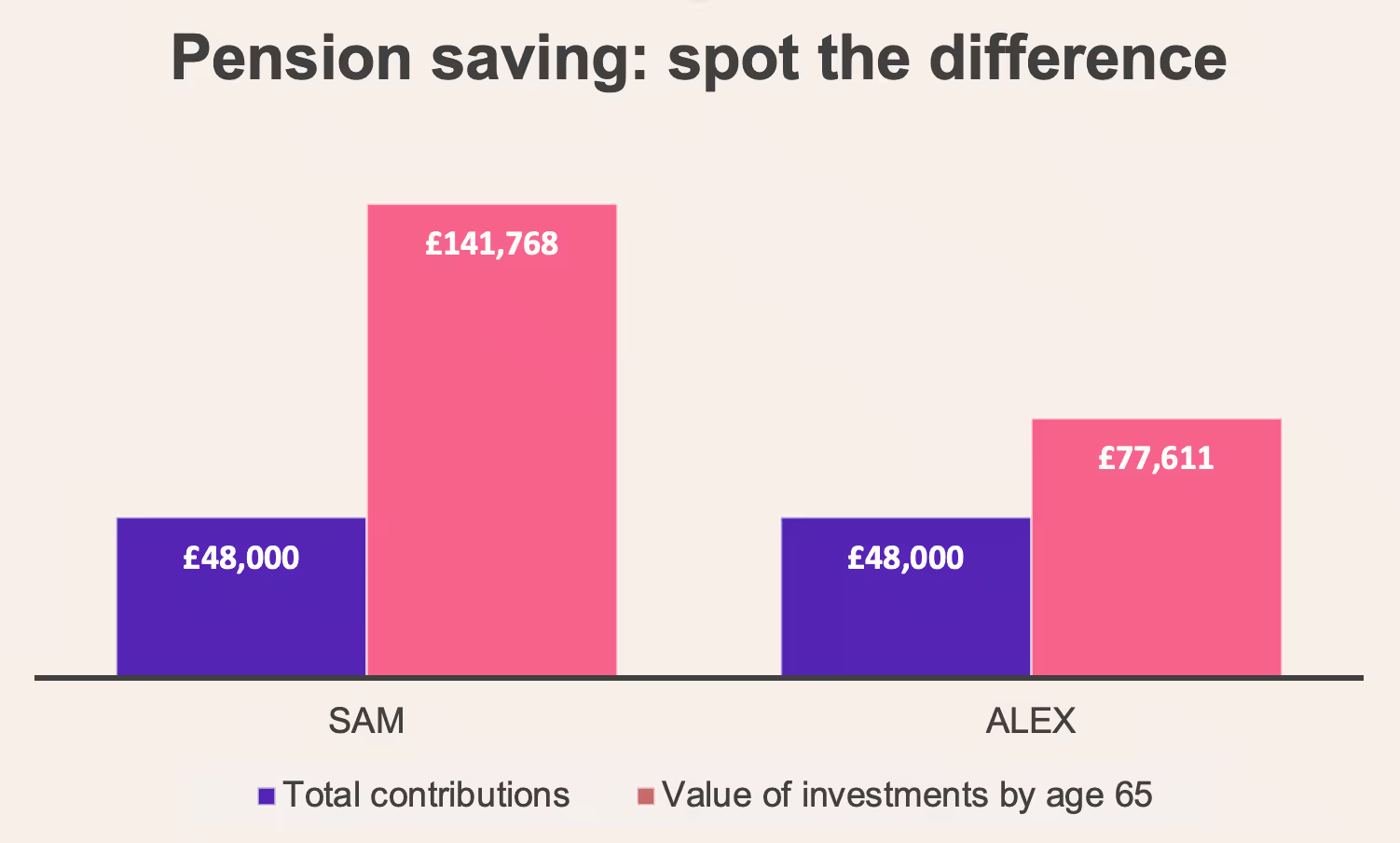

If we take the example of two pension savers, Sam and Alex, the need to factor in retirement savings early on becomes even clearer.

Sam starts investing £100 at the end of each month when they are 25 until the age of 65.

The total amount they end up putting away over that period is £48,000. And if their investments were to achieve a 5% annual return they’d finish with a pot worth £141,768.

On the other hand, Alex begins later but doubles up on the pension contributions to try to make up for it.

Alex invests £200 at the end of each month from the age of 45, hitting the same £48,000 by 65.

But even with the same 5% annual return on their investments Alex ends up with £77,611.

That’s over £64,000 less than Sam.

(If you want to play around the numbers and put in a few illustrations of your own, have a go here.)

Now, simply saying that saving as much as you can, as early as you can, and as often as you can is trite by any standard.

But the harsh reality is today’s 30-somethings have a tough task. We often can’t control how much we earn but we can control how quickly we get started investing. It doesn’t have to be huge sums to begin with, it’s much more important to get the ball rolling.

As the saying goes, the best time to invest was 50 years ago, the second-best time is today.

Build your financial knowledge and be in a better position to grow your wealth. We offer a wide range of financial content and guides to help you get the insight you need. For example, learn how to invest in stocks if you are a beginner, how to make the most of your savings with ISA rules or how much you need to save for retirement. Download our iOS trading app or if you’re an Android user, download our Android trading app to get started investing.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. Past performance is not a reliable indicator of future results.If you are unsure whether a product is right for you, you should contact a qualified financial advisor.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)