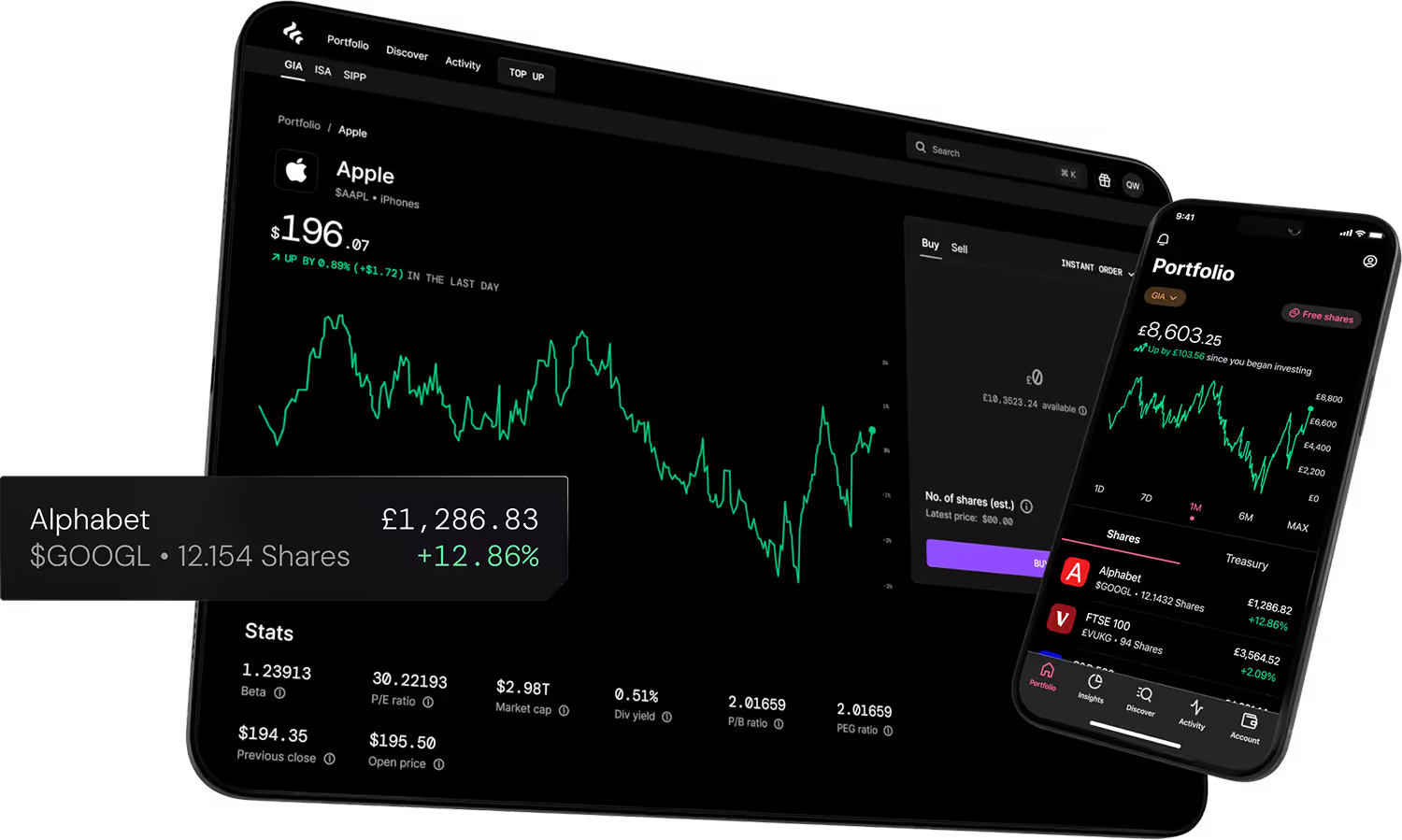

Build a portfolio to meet your goals

Invest commission-free in thousands of UK, US, and European stocks and ETFs.

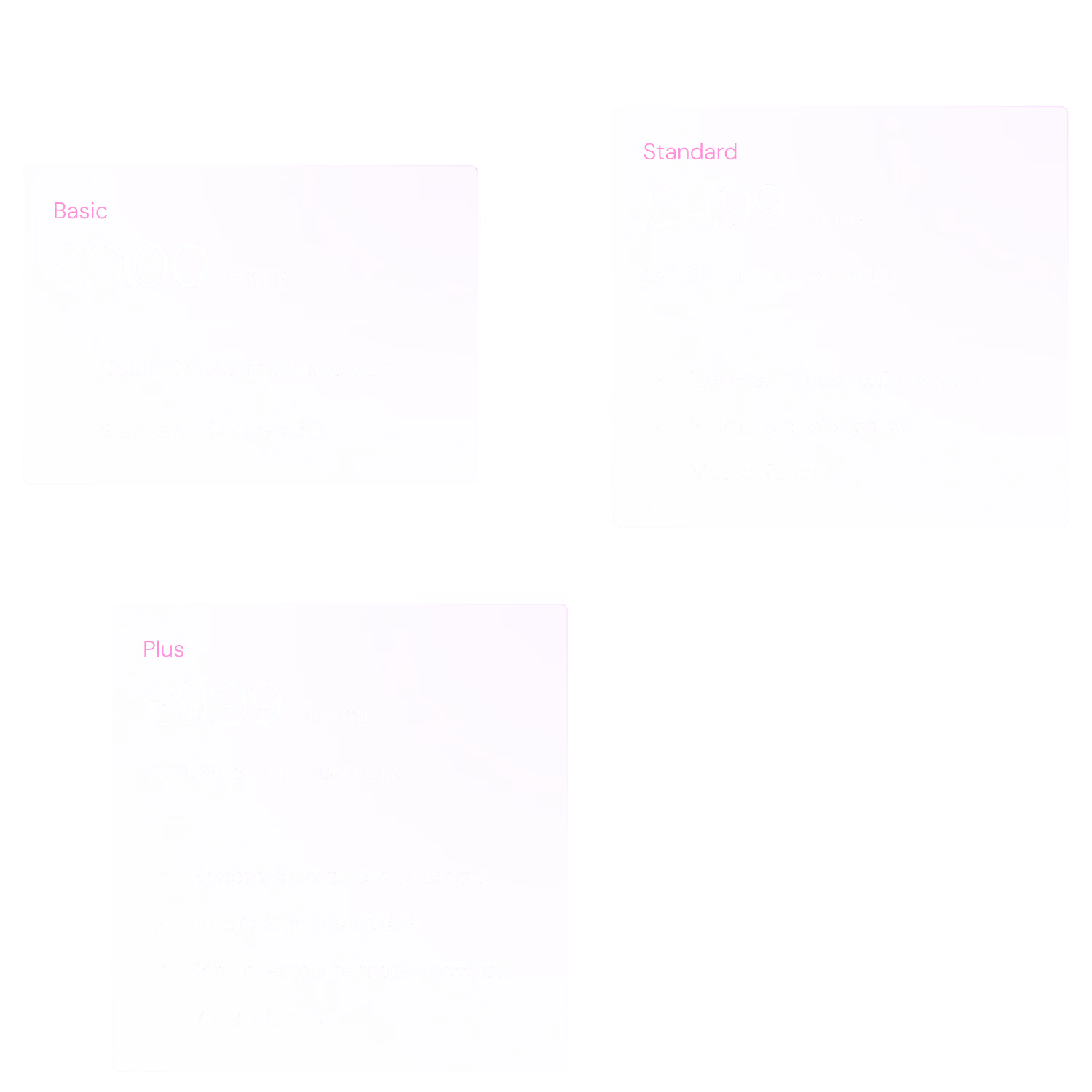

- Tax-wrapped accounts

- Unlimited commission-free trades

- Direct access to UK Treasury bills

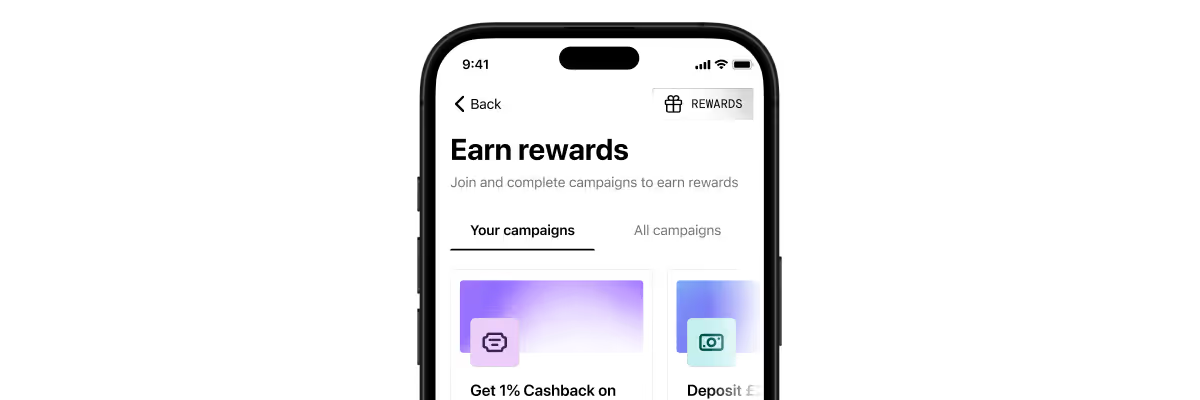

- Easy to use on desktop and mobile

- Voted Best online trading platform six years running at the British Bank Awards

.webp)

.avif)

.avif)