Startups are hard. Fintech startups are harder. And a free stock trading startup is particularly so.

That’s because, in order to ship a product that our community will love and is 10 times better than their current experience, we need to go deep, to the fundamental level of building an independent, next-generation financial services company from scratch. One that not only feels clean, crisp and like a tech company, but is one.

Building a stockbroker with this vision in the UK comes with additional problems to solve. Share dealing is a space that — unlike banking, currency exchange or peer-to-peer lending — has not yet been shaken by fintech challengers.

While building Freetrade, we learned a lot about the reasons. Here are my personal top five take-aways.

1 — The share platforms print money, and innovation would hurt them

Old-school online brokers in the UK make a lot of profit. To put their profitability in context, here are the net profit margins of a few companies you know:

The net profit margin of the money-making machine known as Facebook is 41.03%. Meanwhile, the same for Interactive Brokers and Hargreaves Lansdown is 39.99% and 52.81% respectively.

So, Hargreaves Lansdown is more profitable than Facebook. 😲 Innovation is not going to come from the traditional guys. Why would they self-disrupt, right?

Still, disruption is inevitable, and serves a higher purpose. Stockbrokers print money because of the exorbitant fees they charge, which may be fine for a different generation that lived through a different economy.

Paying a £12 commission might be acceptable if you are making a sizeable investment, but it becomes a big chunk when you only want to invest a couple hundred pounds. Which you should do, by the way.

2 — Middlemen eat the savings you should get from the digital transition

Way back in the day, ownership of shares in companies was evidenced by paper certificates. And trading them was a laborious process involving multiple people agreeing to a transaction in person, and then a physical settlement process where the certificates changed hands.

These days, share ownership records are in digital form — no different than anything else on the internet — and the record is kept secure in a central securities depository (CSD), which is really just another database on a secure server.

Making a trade isn’t much more complex than agreeing terms with a counterparty (digitally, of course) and telling the CSD to update the share record once cash is paid to settle the bill (again, all electronically).

It’s all digital. So, why would that cost £12? Middle-men, taking their cut.

3 — Only going full stack will enable us to NOT charge commissions

To do away with commissions we needed to cut out the brokers and other intermediaries that inflate costs for everyone. A cosy group of financial institutions levy what is essentially a tax on anyone wanting to participate. Pricing for capital markets firms is as arbitrary as it is for telecom companies. Prices are completely detached from the underlying costs; they charge as high a price as they can get away with. Innovation is not a good thing for these old-school institutions. It means diluting their franchises.

Minimum ticket sizes, minimum transaction volumes, minimum capital requirements; it all serves its purpose to act as a barrier to entry for new players, keeping margins exceptionally high in the ‘Brokers Club’, and the riff-raff out.

Instead of banging at the door, we decided to bypass the brokers and go straight to the source.

‘Full stack’ for us is more than owning the tech stack, it also means becoming members of the organisations and institutions that the old guard would charge us to access (if they agreed to work with us at all).

Freetrade is in the process of becoming directly authorised by the FCA, with the same permissions as legacy stockbrokers. We’re also going to be direct members of the stock exchange and direct members of the central securities depository. The cost savings will be passed on to our customers — and we’ll undercut incumbents who have been overcharging for way too long.

4 — The UK consumers are socialized away from real shares

The UK talks a good game when it comes to Fintech. In some verticals it’s true, but not stockbroking. Britain still lives in the 20th century when it comes to investing in real shares.

Because of more lenient regulations in the UK, contracts-for-differences (CFDs) and spreadbetting became a popular alternative to trading real stocks starting in the 90s. There’s been lots of innovation in this sector since, and CFD firms have been so successful in exploiting sales of complex financial derivatives to retail investors that an FCA analysis found 82% of clients lost money on such products. The average among clients checked by the watchdog was a loss of £2,200 a year.

5 — Trades in the UK cost >10x more than in the US

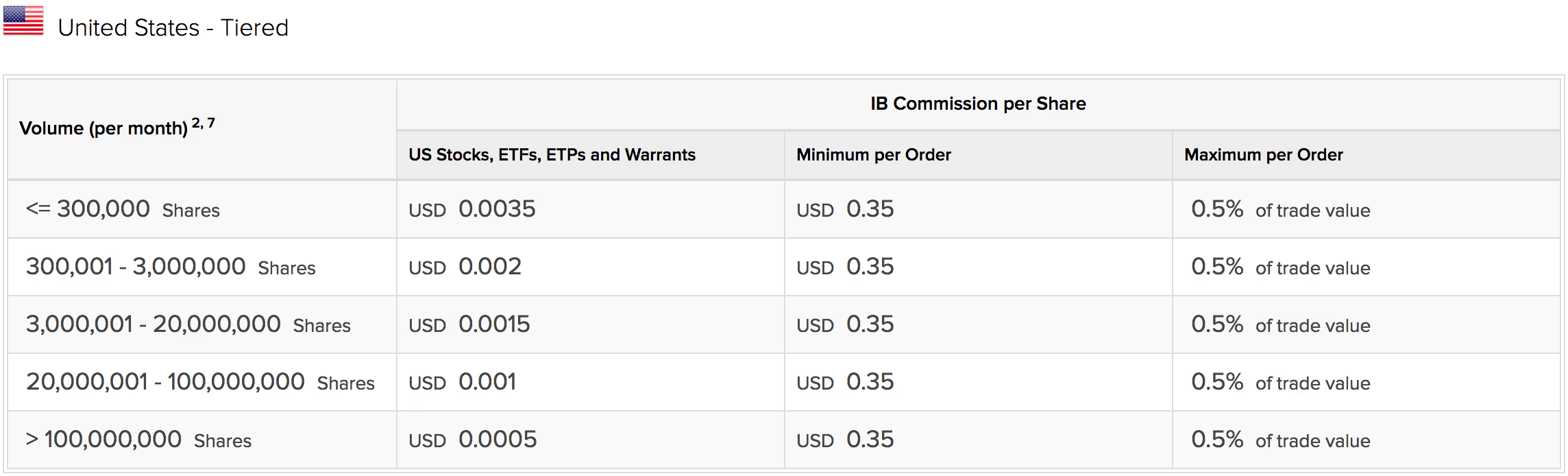

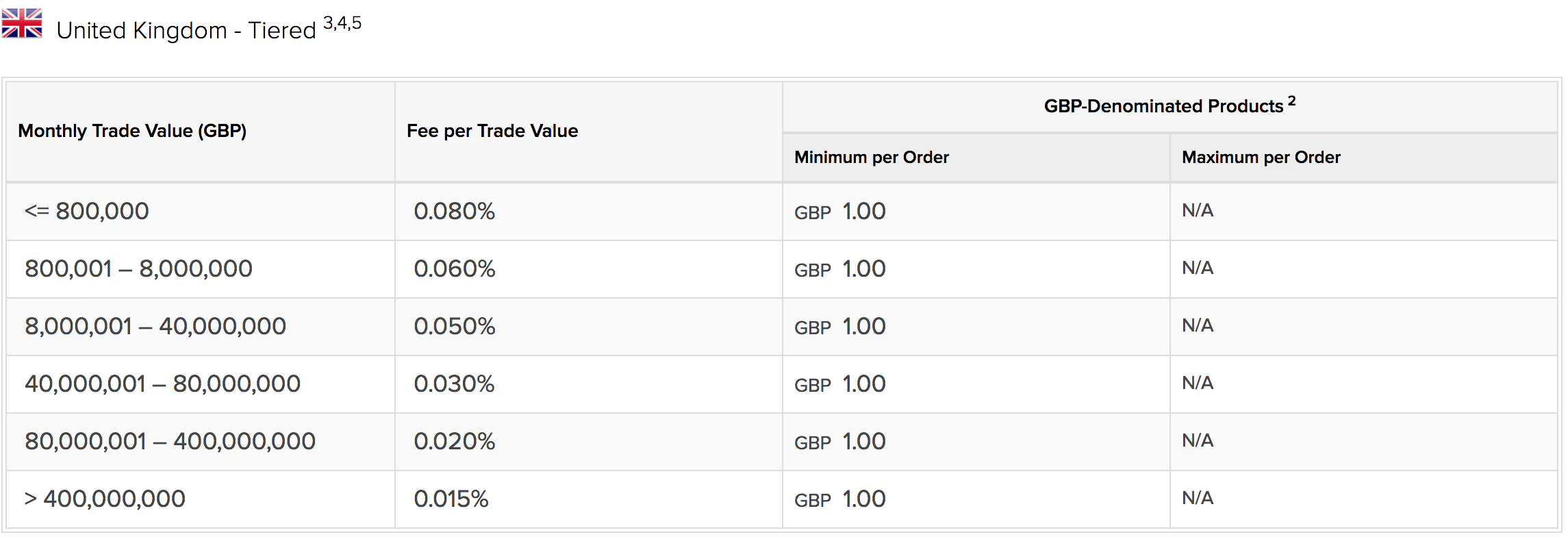

The US is a completely different story. Besides the fact that it’s illegal to sell CFDs to regular investors (they tend to invest into real shares instead), competition and innovation in the capital markets sector is far greater on the other side of the pond. This is true for both institutions and regular investors, who both benefit from next-to-zero costs for trading through a broker.

Consider buying one share of Facebook, which is currently trading around $170 per share.

In the UK, a big investor might pay a commission of 0.1% of the value of the trade, or 17 cents.

In the US the equivalent commission would be less than 1 cent.

Check out the example of Interactive Broker’s institutional pricing here:

Building no-fee stock trading takes time, but it will be worth it

We not only need to own our tech stack, but our entire “stockbroker stack”. As much as we’d like to blow up the stodgy old banks and brokers, we do still need to connect to the same pipes, and play by the rules. All of that takes time, but it will be worth it. It will enable a whole generation to properly invest.

The demand is huge. Our waitlist has doubled in just a few months, and keeps growing.

We’re building a new UK stockbroker fit for purpose in 2017. It’s coming. Get your invite now and be one of the first to see what investing is like in the 21st century.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).