In our mission to get everyone investing, commission-free investing was only the start.

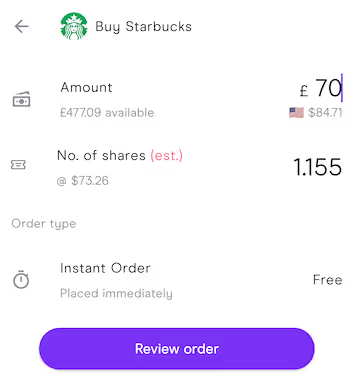

A number of US stocks cost upward of a thousand dollars for a single share, and many cost hundreds. A lot of people can’t afford that and miss out on investing in companies due to the share price being outside their budget.

Even if the share price is lower than that, sometimes you want to start small and build up your stock ownership in steps, or diversify your portfolio with smaller amounts of money.

That’s what we are solving with this latest upgrade.

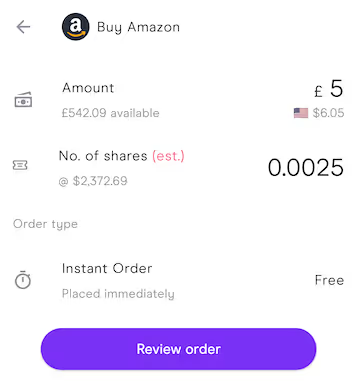

Investing in fractional shares on Freetrade is intuitive. Rather than choosing a number of shares to buy, you are able to specify the cash amount to invest. Freetrade will then get you as many shares as possible for the amount you entered, at the best available price.

This makes it easier to manage as part of a savings strategy and can enable features such as automated reinvestment of dividends in the future.

We’ve been beta testing the feature, including help from a great number of our community members, and are ready to roll it out to every Freetrade customer over the next few days.

Are fractional shares on Freetrade real shares?

Yes. With Freetrade, our customers own real shares, whole or fractional, which are held as client assets in accordance with FCA rules.

Can I specify my order in whole shares?

Since the beginning, we’ve built the user interface for buying shares with the intent to shift the focus from the number of shares to investment amount, which we believe is more meaningful and compatible with building a diversified portfolio. This rollout hasn’t changed that flow, the change is that you’ll end up with the maximum possible number of shares for your investment amount, including fractions.

Independent of building fractional share investing, we are also testing many improvements to the process of placing a trade, adding flexibility for more advanced order types such as limits and stops. While we always intend to deliver the simplest order flow possible, as part of such advanced orders we may include a version of whole-share purchasing in the future.

Why is there a £2 minimum?

The minimum trade size of £2 is based on the smallest value we are able to convert to US dollars with our currency exchange partner. For simplicity and to provide a consistent experience, we have set the minimum to be £2 across any trades placed.

Will I get fractional dividends?

Yes. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny.

What if I want to transfer my shares out of Freetrade?

Currently, you have to liquidate your portfolio and transfer the cash if you decide to move out of Freetrade. We’ll be working to make this process better, and we’ll build it in a way that takes fractional shares into account.

Which stocks does the fractional upgrade support?

US-listed stocks only — for now.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).