Technology is making investing truly low-cost in the UK, too

Low-cost investing is here, it’s just not evenly distributed

Each of us at Freetrade grew up in a different place, from Canada to the UK (that we call and love as our home now ❤️) to European countries. Still, most of us share a similar experience: we were ready to jump in with both feet and buy shares on our local exchanges as early as was legally possible — until we realised that brokerage commissions would consume sizable chunks of our investments. Disappointed, we had to wait years to gain better access to the stock market, missing out on returns over time.

Meanwhile, the fees that seemed enormous to us were already heading to the right direction. In the 1980s the average commission was $45 in the US, but it could climb much higher depending on the order size. And that was still an improvement over the $100 commissions before that.

Today, securities are dematerialised in virtually all countries; they exist electronically, as 0s and 1s in the central securities depository (CREST in the UK). The internet and technologies based on it have made the clearing and execution of trades cost a fraction of what they used to. The US market and certain types of investors (e.g. institutional) benefit from that already.

Stockbroking is broken in the UK

A profit margin is the amount of profit a business makes per pound of revenue. So, if something sells for £100 and the firm makes a £10 profit, its profit margin is 10%.

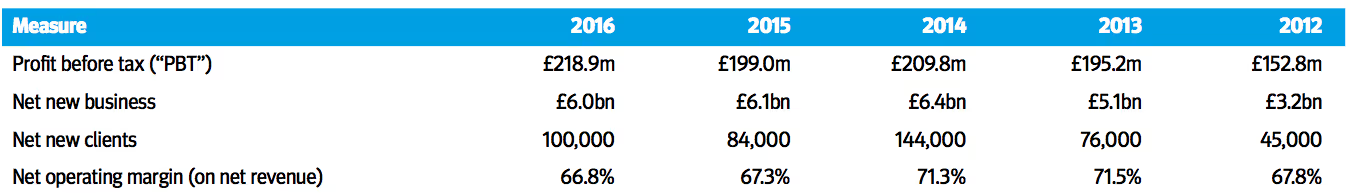

Old school online brokers in the UK make a lot of profit. To put their profitability in context, Marks and Spencer’s net profit margin is 1.09%. EasyJet’s is 5.4%, while HSBC’s is at 3.84%. Facebook’s is a super high 41.03%. Meanwhile, the same ratio for Interactive Brokers and Hargreaves Lansdown is 39.99% and 52.81% respectively. Yes, HL is more profitable than FB. 😲

If we want to go deeper, it’s not just the trading commissions. Stockbrokers have various revenue streams. Still, guess whom that revenue “streams” from? *shakes fist in air*

Technology and new business models disrupt monopolies and drive down prices

Nobody in their right mind would call the pricing that leads to the above profitability a “free lunch”, but neither is it a fairly priced meal. It might be akin to overpriced festival food. Staying with the analogy, we don’t provide a free lunch either, but ever heard of Sunday meal prep? (It’s quite neat; some people manage to push the cost of healthy, home-made lunch to £10/week.)

An aspect of how we can offer zero-fee trading is optimising costs:

- We’ll collect orders, and execute them in bulk at a given time of the day. This is a practice many other reputable investment firms do, including Vanguard (“we combine your activity with that of other investors and place bulk deals twice a day”) and Stockpile (“place your trade by 3 pm ET and have your stock by dinnertime.”)

- We’ll start with an optimal number of available securities to trade, similar to how Robinhood started off. The list will include the most popular stocks and ETFs on major US exchanges and naturally, in the UK — with a view to enhance the list based on user feedback.

Of course, optimising costs is only a part of how we can provide free trades. We have a freemium model, i.e. users will have the option to subscribe to premium services. Similar to how Amazon Prime offers unlimited fast delivery or how Spotify gives extra features like download, we’ll provide value-add premium services. It’s the global standard in tech. 📱

Some companies would give away X free trades (of certain equities) per month to “incentivise” signups, and try to sell you stuff you don’t need. But that’s not what we are here to do. In our survey, you were loud and clear: you want to be able to invest even small amounts in specific stocks, and often, flexibly, without arbitrary restrictions. We believe the only way to provide that is to guarantee free trades as the basis of our model.

We are doing it right, and that requires a bit of time

We’ve decided to be a different financial services company from the start. We are discussing technical details like the above, because we believe in transparency and openness. We are building an independent financial services company, because we believe that serves our users’ interest the best.

The UK market is structurally different from the US. It takes a bit of time to build a low-cost investing product here. We appreciate everyone’s patience, and we promise it will be worth it.

We are on a mission to open up investing for our generation. 🔥 Request your invite today.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Eligibility to invest into an ISA and the value of tax savings depends on personal circumstances and all tax rules may change.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).