At Freetrade we believe regular investing is a healthy habit that can help to grow your money over the long term.

We know that taking charge of your own financial future can be really empowering.

But we also know that money and investing can be stressful.

During some of our recent user research, it’s become clear that the market’s ups and downs can take a negative toll on some people’s mental health.

Like the person that told us their trading activity could sometimes become addictive and ‘less fun’.

Or the experienced trader that told us they felt ‘burnt out’ and lost sleep over their trading at times.

And the person whose gambling addiction meant they’d used blocks to stop themselves gambling in the past.

In 2021, the FCA surveyed 1,000 people aged 18 to 40 who invest in high-risk investment products. Three quarters (76%) said they felt a sense of competitiveness when placing their money in an investment, with over two thirds (68%) likening it to gambling.

It’s important to note that Freetrade does not offer the high-risk products mentioned above, and that the FCA was looking at products such as CFDs and peer-to-peer finance. However, consumers often experience similar feelings and exhibit similar behaviours when it comes to any type of investment product, including shares.

We are however committed to promoting good investing behaviour, which includes putting protections in place for vulnerable customers.

Introducing trading breaks

That’s why we’ve launched our new trading break feature today.

The feature lets customers take a 24-hour break from trading by putting a block on the ability to buy shares.

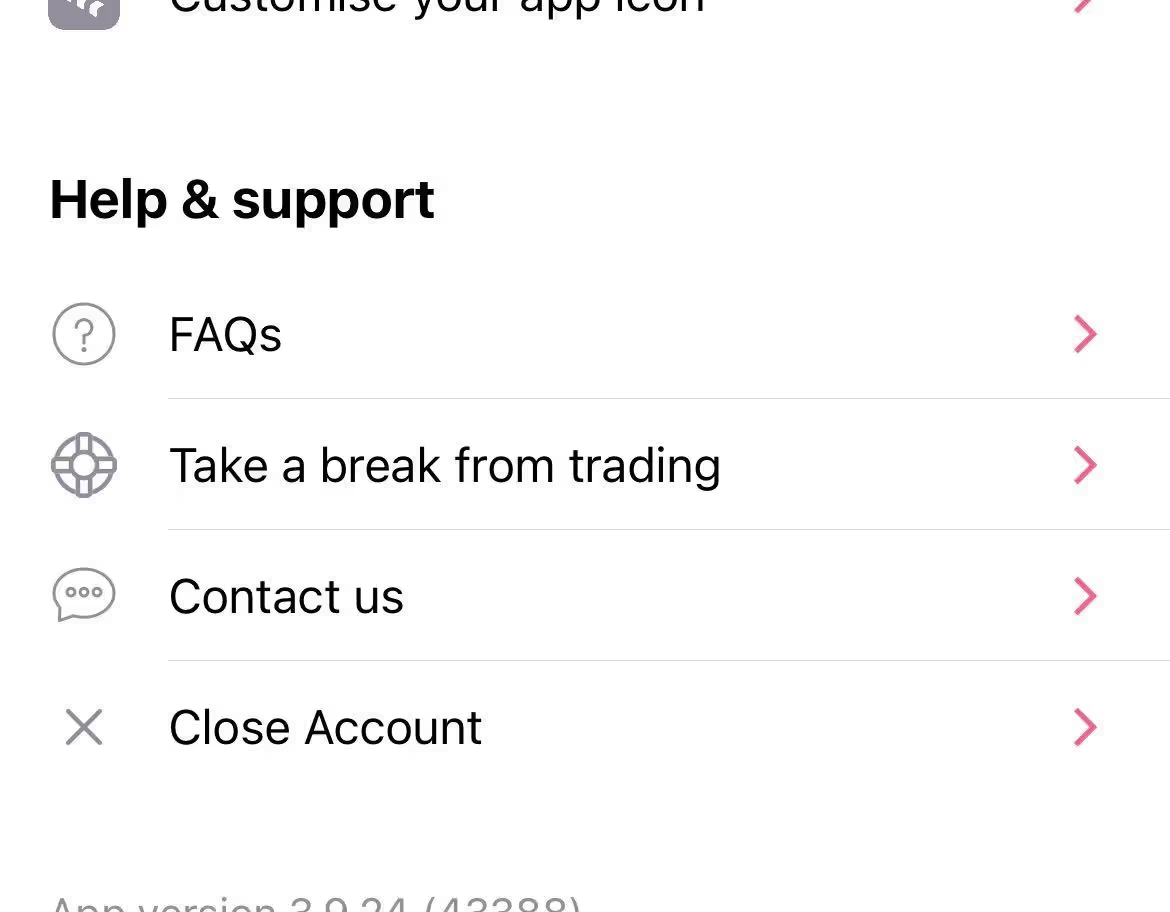

You can find the feature on your Profile tab, under ‘Help & support’ and set it up in just a couple of taps.

You won’t be able to buy anything on Freetrade during this time, but you will still be able to sell, top up and withdraw while the block is active.

Here for you

We’re here for you when you need us.

You can find a link on the trading breaks feature to this page with more resources and details of people who can help you, including information, advice and support for anyone concerned about money or harmed by gambling.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)