We launched!

After two weeks of Super Early Testing, we ignited the full launch of the app on Tuesday, covered in TechCrunch and Forbes.

To be clear, we’re still in testing mode and there’s plenty to iterate but we’re now comfortable that we can add users on a regular basis.

We’re now delivering the early access we promised to our investors in our first two crowdfunding rounds (July 2016 and March 2017).

We’ve already given access to all our iOS-using Round 1 investors and have started working through our Round 2 ones this week.

After that we’ll start working directly through the waitlist, starting with the top of the queue and our Round 3 investors who received a queue jump. Then we’re coming for all of you!

New joiners

The team is still growing at great pace. Just this week, our new Brokerage Ops Manager, Nicola, and Senior iOS Engineer, Josh, joined the team. Stay tuned for interviews with them very soon (as well as more team news next week).

Investing pays dividends

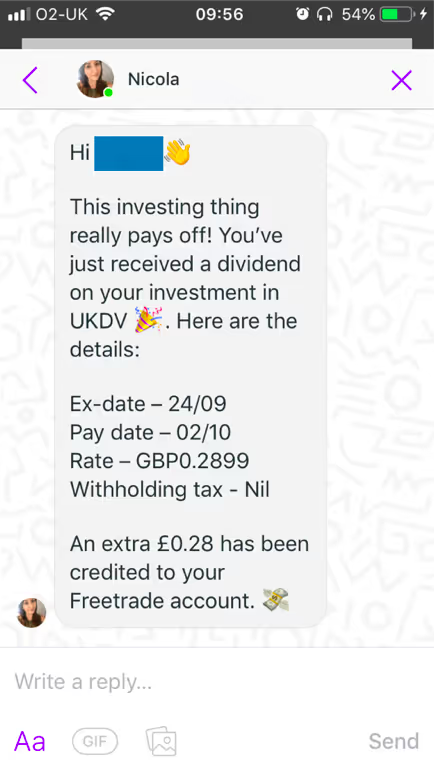

We issued our first dividends to customers. The dividend was suitably for the UKDV fund which focuses on high dividend paying UK-based stocks.

Nicola quickly sent out an Intercom notification to update all relevant users.

Fixes on the app 🔨

The activity feed in the app was getting pretty cluttered for a lot of users. In our latest release, you can now delete cancelled or failed orders to clean up the feed.

On the waitlist aspect of the app, in the latest version we’ve synced up the waitlist to remove the users who already have access. So if you’re checking your spot in the app, update to see it move to reflect that.

Remember your queue position does not vary by location! 😁

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).