Introducing annual subscriptions and tiered FX fees

We’ve brought our beautifully simple app to over 1.4m retail customers on our mission to get everyone investing.

The core of our proposition has always been commission-free investing, packaged up in a choice of three subscription plans: Basic, Standard, or Plus.

Today, we’re announcing the launch of annual subscriptions alongside changes to our foreign exchange fees and monthly subscription fees.

In making these changes, we've thought carefully about how we can deliver great value to our customers.

These changes reflect an evolution of Freetrade’s freemium business model with commission-free investing at its core.

You can see our new prices, as well as when they come into effect, below:

.avif)

For comparison, you can see our current pricing here.

Can I pay annually?

Yes! We’re introducing annual subscriptions from May.

For the Standard plan, this means you can pay £59.88 for the whole year. This works out to £4.99 per month, a saving of 17% on the new monthly price of £5.99.

Similarly, for the Plus plan, you can pay £119.88 for the year. This works out to £9.99 per month, also a saving of 17% on the new monthly price of £11.99.

Stay tuned for further details.

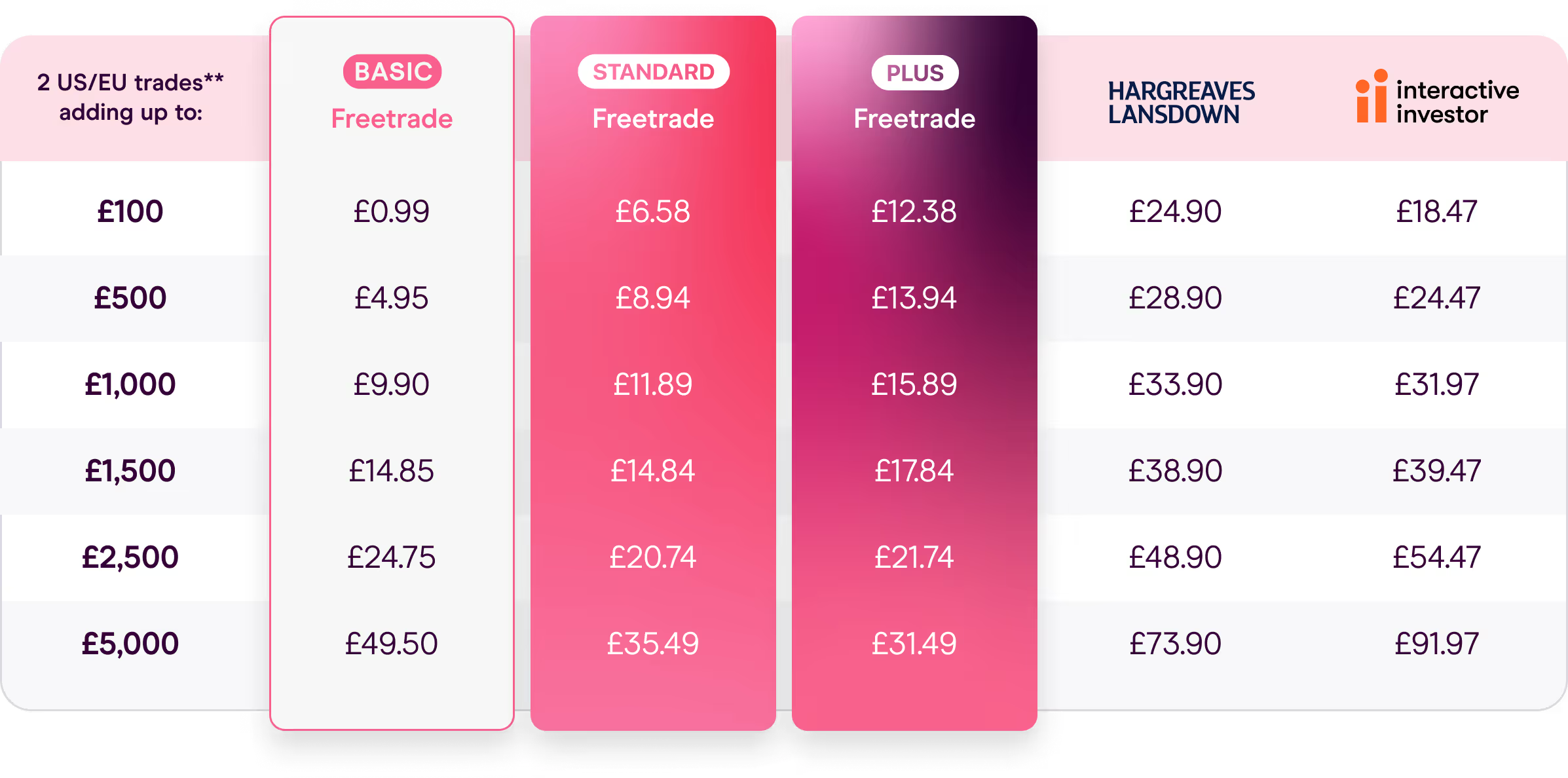

How does this compare to other providers?

The table below shows different examples of your monthly fees with Freetrade compared to other providers.

It assumes you make two US or European trades a month, and shows your monthly fees based on the total value of those trades, depending on your subscription plan. For instance, if you buy two US stocks, each worth £50 (for a total of £100 for the month) - this would cost you £6.58 with the Freetrade Standard plan vs £18.47 with Interactive Investor.

Which subscription plan is right for me?

If you’re an existing customer, this may be a good opportunity to consider if you’re on the right plan for you. Our Basic, Standard and Plus plans offer a range of benefits, including:

.avif)

Compare our plans to see which is best for you here.

**Comparisons to other providers are based on their published costs on their websites as of 8 March 2023 for trading shares within a share dealing account. They are shown for illustrative purposes only. For confirmation of their up-to-date charges and product information, you should visit their websites.

Hargreaves Lansdown: Based on trades in the previous month, the fee per trade is £11.95 per trade for 0 - 9 trades, £8.95 per trade for 10 -19 trades, and £5.95 for 20 or more trades. FX fee is 1.0% for the first £5,000, 0.75% for the next £5,000, 0.5% for the next 0.5% for the next £10,000 and 0.25% for over £20,000.

Interactive Investor: £4.99 account fee. £5.99 per trade. FX fee is 1.5% for trades between £0 - £24,999.99, 1.25% for £25,000 - £49,999.99, 1% for £50,000 - £99,999.99, 0.5% for £100,000 - £599,999.99, and 0.25% for £600,000 - £999,999.99.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Eligibility to invest into an ISA or a SIPP and the value of tax savings depends on personal circumstances and all tax rules may change. SIPPs are a pension product designed for people who want to make their own investment decisions. You can normally only access the money from age 55 (set to rise to 57 from April 2028).

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).