Five best ways to invest £1,000: smart strategies for UK investors

So you've saved £1,000 and you want to start investing it? Investing your first £1,000 is an exciting step.

But, it’s important you understand how and where you can invest those hard-earned pounds.

Figuring out the best way to put your money to work takes some careful thought and research, though.

Maybe this is your first time investing. Or maybe you're just looking for a few more ideas on how to invest a thousand pounds. Either way, you're in the right place.

Let's explore the five best ways to invest your £1,000 and how you might think about growing your money over the long term.

What we’ll cover

- Why £1,000 is a practical starting point

- The five best ways to invest £1,000

- Comparing investment options

- How to choose the right strategy

- The power of compound returns

- Practical steps to start investing

- Common mistakes to avoid

- Frequently asked questions

Is £1,000 enough to start investing?

£1,000 is a great amount to start with because it gives you enough to spread across different investments while not risking too much of your savings.

But how should you invest your first £1,000? It's important to know that while opening an investing account can help your money grow over time, there's no guarantee you'll get back what you put in. That's why, as a general rule of thumb, you should only invest money you won't need for at least five years.

Questions to ask yourself before starting to invest

When deciding how to invest your £1,000, there are a few key questions to first ask yourself.

Can you afford to lose the money?

Although there are safeguards and regulations within the stock market, there are no guarantees that you’ll make money or even get back the money you originally invested.

It’s best to have roughly three to six months worth of living expenses set aside. This can be your emergency fund, or simply a cushion to give you some more breathing room.

What is your time horizon?

How long can you leave this money invested? The longer your timeframe, the more investment risk you might be willing to take for potentially higher returns over the long term.

If you're investing for retirement, a SIPP might be best for the tax relief benefits. If you need more flexibility, a stocks and shares ISA might be better than tying up funds in a pension.

What is your tax situation?

It likely makes sense to take advantage of tax-efficient accounts first. If you haven't used your annual £20,000 ISA allowance, start there to shield your investments from capital gains tax and income tax. Remember, tax treatment depends on your individual circumstances.

What is your investment experience?

If you're new to investing, you might be asking whether you want DIY vs robo advisor investing. If you choose to do it yourself, consider investments like index funds, which can help you learn without being potentially overwhelmed by individual stock picking.

The five best ways to invest £1,000 in the UK

When it comes to the best ways of investing 1,000 pounds in the UK, there are a lot of helpful tools at your disposal.

1. Invest £1,000 using a Stocks and Shares ISA

First up is the stocks and shares ISA. It’s a tax wrapper that lets you invest up to £20,000 per tax year in a range of investments, including stocks, funds, and ETFs. Any returns you make, whether from dividends or capital gains, are free from income tax and capital gains tax.

If this is your first £1,000 investment, a stocks and shares ISA is a great way to build solid foundations right from the start.

2. Invest £1,000 using a Self-Invested Personal Pension (SIPP)

If you're thinking about your long-term finances, then a SIPP could be an excellent home for your £1,000 investment. SIPPs are designed specifically for retirement savings and come with tax relief on contributions (20% for basic rate taxpayers, more for higher rate).

Your investments grow free from capital gains tax and income tax. But make sure you’re comfortable with having that money locked away until retirement age. Once you’ve added money to your SIPP you won’t be able to withdraw it until then.

3. Low-cost index funds and ETFs

Beyond investment accounts, you’ll also need to consider what you want to invest in.

Index funds and exchange-traded funds (ETFs) can be a straightforward way to start investing £1,000.

These funds track the performance of a particular market or index (say, the UK’s 100 largest public companies, the FTSE 100), offering instant diversification across hundreds or thousands of companies with typically low annual fees.

4. Low-cost investment platforms

And low fees really do play a vital part in your ability to be a successful investor. For example, if your platform has a £10 commission and you want to make 10 investments with your £1,000, that will cost £100. You’d then have to make an approximately 11% return just to break even.

Beyond commissions being annoying, ongoing fees are a pain too, because they can compound over time. When a platform advertises an ongoing fee of 0.5%, this might not seem terrible at first glance. But this seemingly small percentage can really eat away at your returns as your portfolio grows.

5. Dividend-focused investment trusts

Then there are investment trusts. Trusts can set aside 15% of their income when they have bumper years, so that they can bolster dividend payments in a downturn. That means they can help you generate regular income that can be reinvested to compound your returns.

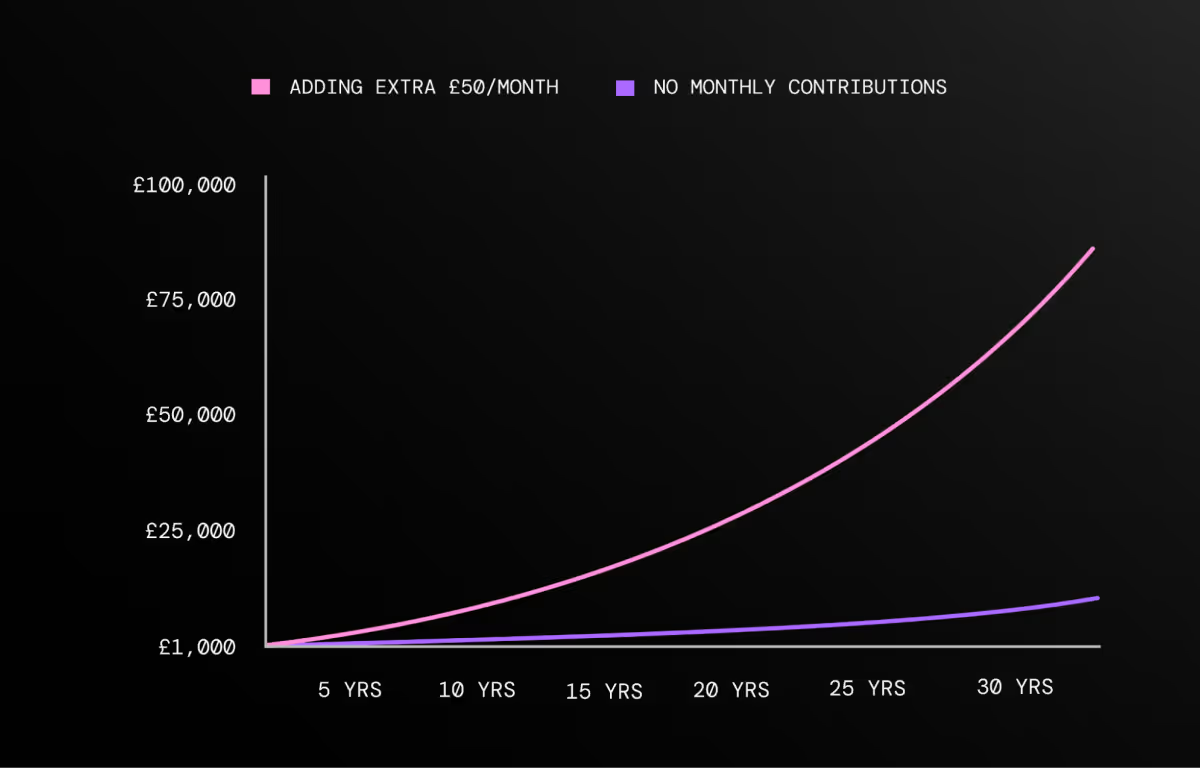

The power of compound returns

While there are no guaranteed shortcuts to wealth, the power of compound returns can indeed turn £1,000 into £10,000 – but it requires patience and consistency.

Let’s assume your portfolio grows at an average annual rate of 7%, based on the long-term historical performance of the S&P 500 when adjusted for inflation. At that pace, your £1,000 investment could roughly double every 10 years. That means it might take around 33 years to grow to £10,000 if you made no additional contributions.

However, by adding £50 a month, you could potentially reach that same goal in approximately 10 years, assuming returns are consistent.

Remember that investing is about steady progress rather than overnight success. By staying invested through market cycles, your £1,000 has the best chance to grow substantially over time.

This is a simplified example. In practice, returns will go up and down over time and are not guaranteed.

Five steps to start investing

If you feel ready to start investing, here are the first steps you can take:

- Choose an account type: Decide between stocks and shares ISAs, a SIPP, or general investment account based on your goals and tax considerations.

- Select a platform: Look for one with low fees, solid educational resources, and the investment options you want.

- Compare with savings accounts: Understand the difference between saving vs investing, the former of which offer less risk but typically lower returns.

- Start small: You don't need to invest £1,000 at once. You could start with a portion and add more as you gain confidence.

- Set up regular investments: Many platforms, like Freetrade, let you set up monthly recurring investments. These help you develop a consistent investing habit.

Common mistakes to avoid

When you're starting out with a £1,000 investment, these common pitfalls can significantly impact your returns:

Frequently Asked Questions (FAQs)

What's the best way to invest £1,000 for beginners?

For beginners, the best approach might be to start with a low-cost index fund or exchange-traded funds through a stocks and shares ISA account. This can provide you with instant diversification while minimising your fees.

Should I put my £1,000 in a stocks and shares ISA or SIPP?

If you're saving for retirement and want the tax relief boost, a SIPP might be a better choice. If you want more flexibility, a stocks and shares ISA is probably the best call. Don’t forget, you can have a SIPP and an ISA. You don’t really have to choose! But it might be easier for your first £1,000 investments to keep it in one place.

How do savings accounts compare to investing my £1,000?

Easy access savings accounts offer lower risk but typically much lower returns than investing. Meanwhile, the stock market can offer greater growth potential but with that comes a degree of risk.

Is £1,000 enough to start investing in individual stocks?

Yes, £1,000 is enough to start investing in individual stocks, especially through platforms that offer fractional shares. However, with this amount, you may want to consider exchange-traded funds first for better diversification.

When you invest, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you invest.Freetrade does not give investment advice and you are responsible for making your own investment decisions. If you are unsure about what is right for you, you should seek independent advice.

ISA and SIPP eligibility rules apply. Tax treatment depends on your personal circumstances and current rules may change.

A SIPP is a pension designed for you to save until your retirement and is for people who want to make their own investment decisions. You can normally only draw your pension from age 55 (57 from 2028), except in special circumstances.

At present, Freetrade only supports Uncrystallised Fund Pension Lump Sums (UFPLS) for customers who wish to withdraw funds from their SIPP after their 55th birthday. We strongly encourage you to seek financial advice before making any withdrawals from your SIPP.

.avif)