Investing in cannabis

When Biden was elected in 2020, the stock market responded as if his first port of call would be to legalise cannabis.

That didn’t turn out to be the case, and what followed was speculation galore. The press blasted headlines of new policies sure to pave the way for decriminalisation. Many investors continued to flock to cannabis stocks in hopes of benefitting from legalisation once it came in.

If, or when it happens, the profit taps aren’t just going to get turned on though.

Underneath a lot of hype, there are businesses to be run. And America’s legalisation wouldn’t magically catapult existing cannabis firms out of the weeds.

That’s because plenty of the listed cannabis firms offering recreational products already have operations and sales in Canada. So another country’s legislation wouldn’t guarantee their improved success. These firms should already be proving their merits in the market where they have existing legal operations. If new markets open up for the cannabis industry, at the very best, it will prop up the existing foundations of successful businesses. It’s unlikely to pull struggling ones out of a slump.

Is cannabis legal?

Cannabis is segmented by its intended use, either recreational or medicinal.

Only Canada and Uruguay have federally legalised the commercial sale of recreational marijuana.

While several other countries, states and territories have legalised recreational use, they still don’t outright permit commercial sales of the products. As a consumer, that essentially means you’re allowed to consume cannabis recreationally, but firms can’t simply set up retail locations to sell it.

The more common approach has been a state-by-state or jurisdiction-based policy, where cannabis sales are allowed in specific areas as opposed to throughout an entire country.

For instance, the Netherlands tolerates recreational cannabis sales in licensed coffee shops and it’s decriminalised for personal use, but the drug is still illegal overall.

Frankly, it can all get a bit fuzzy. But the legality tends to be clearer when it comes to medical cannabis.

Medicinal cannabis is legal in around 50 countries. Though many countries have specific conditions (such as no other treatment options being available) which must be met before cannabis is prescribed.

How to invest in marijuana stocks

The stock exchange where a cannabis firm is listed isn’t as obvious as you might think.

Many recreational marijuana stocks are listed on the Toronto Stock Exchange (TSX). Since cannabis is legal in Canada, any cannabis firm can list on the Canadian exchange.

Often, these firms are actually American-based companies with American operations and sales. Many might not even sell cannabis in Canada, and if they do, it may only be a small fraction of their revenue.

The reason these firms list on a Canadian exchange as opposed to an American exchange is that cannabis is not legal across the US. Even though some states have their own policies on recreational and medical cannabis use, from the federal point of view, it’s illegal.

So any cannabis-related companies listed on American stock exchanges can only do so if they don’t have US operations. Most of these firms actually operate from Canada and serve the Canadian market or other international markets where recreational cannabis is legal.

Medical marijuana vs recreational marijuana

A marijuana plant is made up of over 100 chemicals, or ‘cannabinoids’. Each one has a different impact on the body.

The most popular cannabinoids for medical marijuana are tetrahydrocannabinol (THC) and cannabidiol (CBD). Medical marijuana usually has higher CBD content than THC, while recreational marijuana has more THC than CBD.

Both have psychoactive properties, but THC produces a ‘high’ while CBD doesn’t.

Medical cannabis firms come in a variety of forms. Some conduct research and development for treatments that use cannabinoids. They’re somewhat similar to biotech stocks, given they’re investigating how to treat a condition with no certainty that their research will succeed. Assuming it does and they then obtain regulatory approval, these firms can take their products to market.

This long and tedious process is why these companies typically take longer to pull in a return (if they ever even do) than recreational marijuana firms operating in legalised countries.

GW Pharmaceuticals (now owned by Jazz Pharmaceuticals) took 19 years to secure US Food and Drug Administration (FDA) approval for its epilepsy drug treatment.

Other medical cannabis firms sell CBD products, the legality of which tends to vary on a country-by-country basis. Depending on the country’s legislation, these might require a prescription, or they could be available to buy in your everyday grocery store. These firms are less involved in drug research and are more about making consumer goods like CBD oils or CBD-infused foods.

Finally, some medical cannabis firms produce whole-plant cannabis branded for medicinal use. These firms tend to sell recreational cannabis products as well.

Recreational cannabis firms have a business model which looks similar to a consumer goods producer or supplier. They’re usually creating products for smoking, eating or drinking cannabis. Some of these firms will cultivate the marijuana themselves too. Others purchase it from suppliers, then package and sell it through third-party stores or their own retail locations.

When firms have medical and recreational marijuana revenue streams, it’s the medical products that tend to drive the lion’s share of the revenue pie. Typically, these products claim to use higher quality cannabis plants, so they can charge a premium compared to lower-end adult-use products.

Plus, recreational consumers are increasingly demanding lower-cost products. Medical cannabis users can get coverage through insurance providers, so they tend to be less sensitive to price increases.

What cannabis stocks or ETFs are actually on Freetrade?

Freetrade has plenty of cannabis stocks listed across a number of different stock exchanges with operations in numerous countries. These firms tend to operate in medicinal or recreational cannabis, but there are plenty of other cannabis stocks providing ancillary products and services from hydroponics to fertiliser.

10 popular cannabis stocks on Freetrade

Before we get stuck in, it’s important to highlight the below list is a wrap-up, not a suggestion or recommendation that you buy or sell any of the securities mentioned.

Everyone has their own goals and unique financial circumstances. These, along with your tolerance for investment risk and time horizon, should inform the mix of assets in your portfolio.

Our resource hub for investing in the stock market might be able to help make that blend a bit clearer for you and our guide on how to invest in stocks is a great start for first-time investors. And if you are still unsure of how to pick investments, speak to a qualified financial advisor.

Source: 10 most popular pureplay cannabis stocks bought in 2021 on Freetrade.

The above list does not include companies with only segments or divisions offering cannabis products. These are exclusively ‘pureplay’ cannabis stocks, meaning their operations are entirely reliant on the cannabis sector.

There are loads of other firms providing investors with access to cannabis-related operations.

For instance, ABF isn’t just the owner of Primark. It also has hundreds of thousands of cannabis plants to its name. 45-acres worth (read: 720 tennis courts) to be exact.

ABF’s British Sugar division cultivates cannabis plants with high levels of CBD and very little THC (think calming effects rather than hallucinogenic ones), so they’re mostly for medical use. It’s a major supplier for Jazz Pharmaceuticals, the only firm with UK approval to produce licensed cannabis drugs.

An investment in ABF is a far cry from a full investment in cannabis. But the firm proves there are a plethora of ways for your portfolio to get exposure to the industry without investing in the usual suspects. Investors looking for a less volatile route into the marijuana industry can opt for firms with diversified revenue streams. They offer the opportunity to dip your toe into cannabis investments - no cannonball needed.

How to evaluate cannabis companies

Rather than just focusing on what a cannabis firm could do, look at what it’s done so far too.

Has it proven itself in a market where products are already legal? Or is it twiddling its thumbs, awaiting impending legalisation to pave the way into future markets?

A floundering firm failing to capture the Canadian recreational cannabis market isn’t likely to flourish in America if the nation legalises usage. Ultimately, these firms’ ability to perform in existing markets is a good gauge of how they would operate in additional markets, should they come to be.

US weed stocks

The reality is, the US isn’t all too friendly to cannabis stocks listing on its exchanges. As we’ve mentioned, that’s because it’s federally illegal. If that were to change, the US might see an influx of local cannabis companies list on local exchanges. But at the moment, if a cannabis firm is listed on an American stock exchange, that means it doesn’t have any recreational cannabis operations in the country.

If a firm has cannabis operations in America, then it’ll probably be listed on a Canadian stock exchange. Still with us?

NASDAQ-listed Tilray is an example of a Canadian firm on a US stock exchange. Tilray is a Canadian cannabis company with most of its revenue stemming from recreational cannabis and cannabis beverage sales.

In its latest quarterly earnings, revenue from Tilray’s Canadian recreational cannabis fell 14.9% to $49.5m. It goes to show just because cannabis has generally received growing political support, that doesn’t mean heightened demand automatically follows. It’s an especially challenging market given how stiff the competition is among the increasingly growing number of producers.

Legalisation doesn’t mean demand automatically hops the fence from the black market over into the legal market. Canada’s legalisation story has broadly shown many recreational users are still opting to buy cannabis illegally. Largely, the bulk of the growth once envisioned for Canada’s cannabis market hasn’t come to fruition.

Canadian weed stocks

Though that’s not to say there haven’t been some emerging winners among the bud duds.

Aurora Cannabis is the largest Canadian medical cannabis firm by market share. It also has some of the loftiest gross margins compared to its competitors.

In its fourth quarter of 2021, the Canadian company reported medical cannabis sales growth of 9% to $35m. Meanwhile, Aurora’s consumer cannabis sales plummeted 45% on the previous quarter to $19.5m. Its kilograms of cannabis sold also tumbled by 32% to 11.3m.

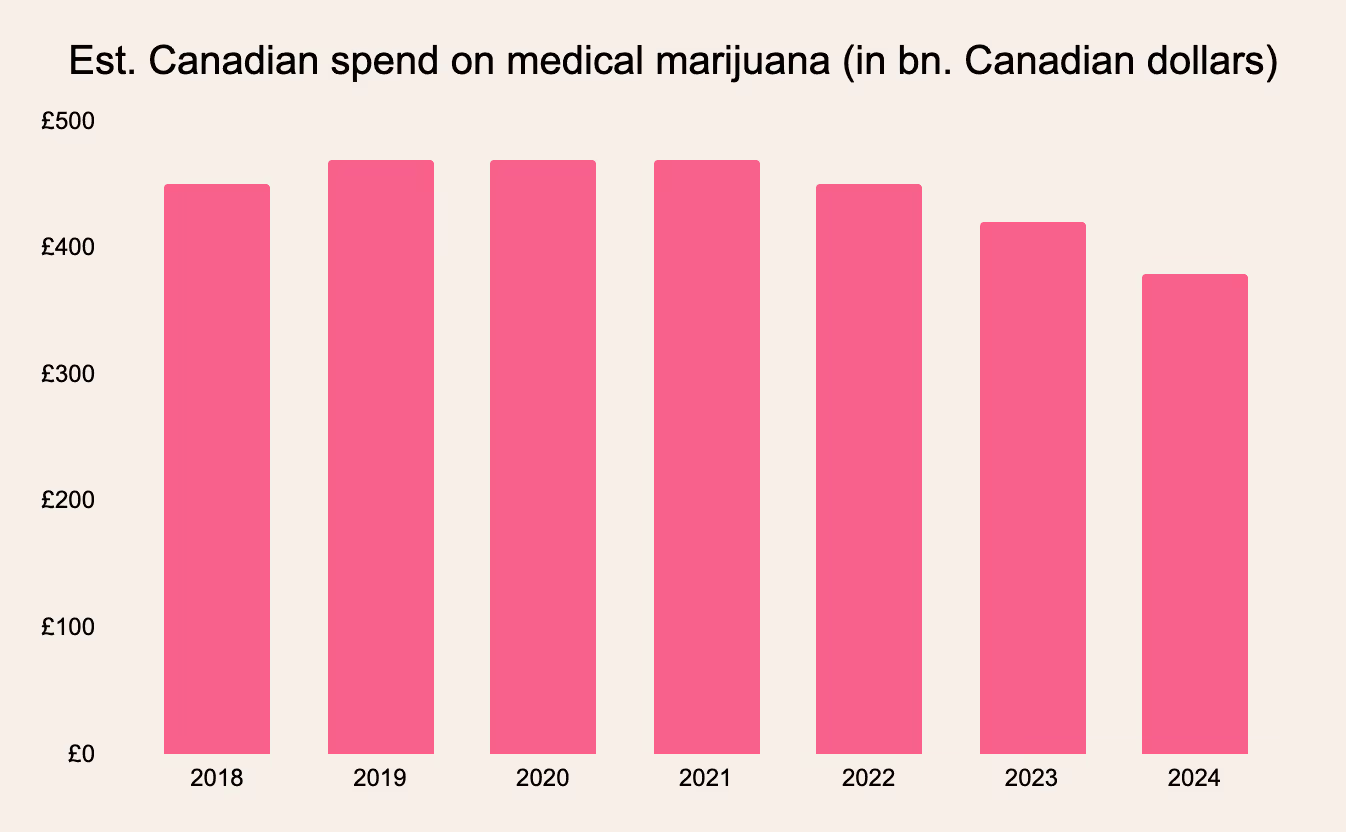

Aurora is twice as large as its closest medical cannabis competitor. But as the chart above shows, that’s a market which has been relatively stagnant and is forecasted to start shrinking.

Declining demand is far from ideal, no matter the firm or the industry. But it’s especially concerning for a firm producing commodity-like products. Greater demand tends to unlock greater potential benefits from advantages of scale. A contracting market warns of the exact opposite. It will become increasingly costly for firms to produce cannabis if demand falls and their crops become less valuable.

💡 Learn more about investing

Top five UK dividend stocks for 2025

Invest in tech stocks

Cannabis penny stocks

Contrary to their name, penny stocks aren’t guaranteed to only cost you a coin.

Usually, a penny stock is one with a share price under $5 in the US or £1 in the UK. Their market cap tends to fall under £100m for UK-listed firms or $300m for US-listed firms. Because of their size and price, these companies are usually pretty small or fairly new to the stock market.

Many cannabis stocks have share prices that fall into penny stock territory, but they often have a larger market capitalisation (calculated by a company’s outstanding shares multiplied by its current share price). Given a lot of these firms have low share prices but relatively high market caps, they might have an above-average number of outstanding shares.

When a company issues more shares, it can help finance additional growth. But those shares can become diluted very quickly if a company issues a lot in one go - especially when they’re a small company with little, if any, profitability to show.

Sundial Growers’ share price is currently below $1, but its market cap is $1.1bn. Technically then, it isn’t quite a penny stock. With 2.1bn shares outstanding as at its most recent quarterly report, it has a lot of investors to pool any profit with. That isn’t inherently bad, but given the firm’s latest quarter reported an $18m loss, there’s not much to go around.

A company’s share price is not a crystal clear reflection of the business underneath. Just because a stock is cheap doesn’t mean it’s good value. And when companies have a lot of cheaply priced shares, they need to prove themselves even more than companies with fewer investors.

Past performance is not a reliable indicator of future returns.

Source: Koyfin, as at 28 Feb 2022. Basis: bid-bid in local currency terms with income reinvested. Data only available for performance since NASDAQ listing. *Performance data commences Aug 2 2019.

UK cannabis stocks (small-cap stocks)

In the UK, medical cannabis was legalised in 2018 but recreational use remains illegal. Today, the UK is the world’s biggest medical cannabis producer.

So most UK cannabis stocks either specialise in CBD consumer goods, medical marijuana, or both. LSE-listed Kanabo only offers CBD products for the time being, but hopes to soon have a medical marijuana segment as well. In its most recent half-year earnings, the firm grew revenue by 7.1% to £15,000. But during that same period, Kanobo widened its loss by 113% to £1.2m.

It’s not unusual for growth-mode companies to outspend now with hopes of higher revenue in the future. But £888,000 of Kanobo’s expenses were classified as general and administrative, while its research costs were a relatively smaller £116,000. Day-to-day costs to operate a business are necessary to keep the lights on. But rent and salaries don’t necessarily promise growth.

And given the firm is supposedly looking to enter the UK medical cannabis market, investors would probably like to see more of the company’s expenses going towards developing that product and market. Especially given the firm labels itself as a ‘Research & Development’ company first.

Similarly, Cellular Goods is a CBD product manufacturer, though it hasn’t expressed intent to create medical marijuana products yet. Unlike some of its competitors, Cellular Goods also makes CBG (cannabigerol) products, which tend to be used in products like face serums and after-shave.

When the firm first IPO’d, it made waves for being backed by David Beckham. Cellular Goods even noted his ability to conjure up “instant recognition and credibility” in the firm’s annual report.

But plenty of eyeballs on the firm isn’t very useful if they don’t translate to plenty of demand.

In the year to August 2021, Cellular Goods generated no revenue. In the same period, it spent £1m on wages and salaries, and £3.3m on other expenses. The firm's share price has taken a massive hit since its IPO in 2021, and it’s now less than fifth of its initial value.

With not much to show aside from £57,178 of inventory, it’s easy to see why shareholders have become increasingly uncertain about the firm’s ability to make a good product, let alone sell it or turn a profit.

Past performance is not a reliable indicator of future returns.

Source: FE, as at 23 Mar 2022. Basis: bid-bid in local currency terms with income reinvested. Data only available for performance since LSE listing.

Marijuana ETFs

Marijuana ETFs offer exposure to the industry through a basket of cannabis-related stocks. They might have operations spanning multiple regions and an array of revenue streams.

While diversification is a vital tool in any investor’s portfolio, not all diversification is created equal. For instance, a portfolio with the diversification of several firms within a given industry doesn’t guarantee your investing strategy is less risky.

That’s because you’re putting all of your eggs in one industry’s basket. And when it comes to cannabis, the industry is very much in its infancy, and it’s no less risky to just spread your investment across a ton of relatively young firms throughout the sector.

Specificity is king here. It’s the only way to distinguish between cannabis firms with proven operations and those still trying to prove themselves - let alone those banking on impending legislative change (which they mostly have no control over).

Another important factor to keep in mind is an ETF’s outward investment claims might not clearly align with what it actually holds. Rize’s Medical Cannabis & Life Sciences ETF says it’s focused on medical cannabis and CBD. But its top 10 holdings could surprise an investor who’s exclusively seeking cannabis stocks.

Source: Rize ETF top 10 fund holdings and fund sector weights as at 31/01/2022. Percentages may not add to 100% due to decimal place rounding.

Rize’s holdings are mostly firms with a relatively small proportion of cannabis-related operations. While these firms span a big part of the cannabis supply chain, most wouldn’t ever see a plant themselves. That might be a good thing for those who don’t want to invest in individual, riskier marijuana stocks. These firms are comparatively larger, and so could have easier paths from research to distribution.

For instance, Novartis already had decent logistics, networks and cash flow to produce medical cannabis products once they received approval. Cannabis startups on the other hand are much more strapped with resources, and if something goes wrong, there’s a lot more on the line.

While this is just one example of a cannabis ETF, it proves the value of knowing an ETF’s top holdings. It’s vital information for any investor who might think their ETF is investing in a certain industry or business model when the reality might be starkly different.

This ETF is not heavily reliant on the cannabis industry’s ongoing legalisation given most of the stocks have operations outside of the industry. Theoretically, that could make it lower-risk than investing in firms with cannabis operations only. But if you want direct access to cannabis firms, this ETF won’t offer you a clear entry into the market.

Cannabis REITs

Cannabis REITs are another indirect way to invest in the industry.

A REIT is a real estate investment trust which can provide a steady stream of income for investors since they have to pay out 90% of profits as dividends.

Some REITs directly invest in property, and so depending on your portfolio, they can provide access to another industry that might benefit your diversification. They can offer you exposure to the real estate market without having to take on the burdens of property management yourself.

Cannabis REITs supply cannabis companies with farms, greenhouses, processing plants, dispensaries or other industrial facilities for operations. When state-by-state legalisation first began in the US, cannabis REITs became a popular choice for companies needing property as they entered the cannabis market. Given commercial banks were unwilling (and mostly legally unable) to provide loans and property rentals, REITs stepped in.

Their leases require extensive scrutiny and negotiation, and the insurance is costly. If a tenant leasing from a cannabis REIT is forced to shut down, there’s high potential for a negative consequence on the REIT’s ability to keep earning rent.

All this to say, cannabis REITs are by no means inherently less risky than cannabis pureplay stocks. They just come with their own unique set of potential pros and cons.

And the tides may soon be a bit stormier for the industry too. In February, the US passed the SAFE Banking Act, protecting financial institutions from the government taking punitive measures against them if they decide to work with cannabis firms.

The likely impact of the legislation will be commercial banks becoming much more involved in funding real estate loans and other forms of debt for the cannabis industries. Given their larger asset base and broader proliferation, these institutions will likely chip away at cannabis REITs’ current advantage in the market.

Advantages and disadvantages of investing in cannabis stocks

Canada isn’t a perfect reflection of what could be to come if newly legalised markets emerge. But it’s the best case study of the industry for now, and it highlights the potential advantages and disadvantages of investing in cannabis stocks.

Many of Canada’s cannabis firms first struggled to meet demand when legalisation began. As massive backlogs for orders burdened producers, supply chains struggled to keep up.

Underground players haven’t necessarily moved their operations into legal circles. They’ve stayed on the sidelines and continued to operate in the dark. Until they do legitimise and consumers follow suit, much of the demand will remain underground and publicly traded firms will struggle to prove the value of their pricier products.

Another concern with cannabis stocks is their politically cyclical nature. It makes their share prices and potential share price growth especially challenging to predict.

And given the industry is still in growth stages, cannabis firms’ share prices are likely to decline during periods of high inflation.

When inflation’s running hot, as it is right now, central banks turn to interest rates to turn down the heat. This makes a challenge for growth stocks, like marijuana stocks, because more of their profits will come from the future. They’re in spending mode now to grow profitability in the future.

When interest rates rise, companies will need to prove even higher future profits. That’s because its intrinsic value is determined by converting future profits into a value today, based on a discount rate. A big component of that rate is the prevailing interest rate. And so, a higher rate means higher stakes for growth companies trying to prove their current valuations.

So with many national inflation rates at above-average highs, the volatility of growth stocks can make them particularly vulnerable to any upcoming changes to interest rates.

What does the future hold for cannabis stocks?

And in the near future, many governments have indicated or warned that those rates are soon to rise. That can bring about unfavourable conditions for stocks in a growth industry.

In the longer term, if the US were to legalise, American cannabis firms could then list on an American stock exchange like the NASDAQ or NYSE. It might increase the likelihood they’d gain American institutional investment. These institutional investment flows would provide much-needed liquidity to the cannabis market, as well as an overall improved perception of its legitimacy.

In Canada, there could be an opportunity for increased medical benefit plan coverage. This could be a revenue-generating opportunity for firms if they capitalised on employers covering the cost of cannabis products for employees. 37% of employers currently cover it, while 64% of employees believe it should be covered (Sanofi Pasteur 2020 Canadian Healthcare Survey). If coverage expands, firms could benefit from heightened demand for what are already higher-margin products.

But both of these are big ‘if’s. Investing charts are inherently backwards-looking but, as investors, we have to think about the future, and changes in political legislation can be very challenging to accurately foresee. So staying focused on what cannabis firms are doing in the present is your best bet of capitalising on any future changes in the industry.

Are marijuana stocks a buy right now?

Many cannabis firms are reporting higher revenues than at their peak share prices years ago. Even so, taking Canada as an indication, demand has been weaker than the yay-sayers hoped and expected.

The revenue growth which has ensued simply hasn’t translated to share price performance. That doesn’t mean these companies are undervalued. Likely, it just means the stock market is adjusting expectations as the industry is at a lull in its turbulent cycle. Maybe people just got a bit too excited too.

An investment’s worthiness has to do with the business beneath it. It shouldn’t rely on outside forces like massive political changes to prop it up. While cannabis stocks may reflect a growth opportunity within a slowly-progressing industry, changes have been a lot slower than expected.

Strong returns are no guarantee. Regardless of what the lines on your screen do, investors need to remember it’s about assessing the actual business, industry and environment underneath it all.

And remember, every investor has their own financial goals and individual circumstances. These, along with your personal level of investment risk and investment horizon should be responsible for determining the combination of assets in your portfolio.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

.avif)

.avif)

.avif)