Time-weighted rate of return (TWRR) is a figure that tells you the percentage gains that your investments have made over a particular period of time. It’s generally considered the best figure to use when comparing your returns to benchmark figures or other investors’ results.

The TWRR is calculated by breaking up the period of time over which you’ve been investing into smaller chunks. Each time you deposit or withdraw cash from your account, it marks the end of one period and the start of another.

When you calculate TWRR, you’ll look at how your investments performed in each of these time periods and then combine the results together.

The percentage figure you are left with gives you an indication of how the assets you’ve invested in have performed in the time frames that you held them.

Why is the time-weighted rate of return important for me?

Investors like to compare their returns to benchmark figures or to other investors’ results.

There are many reasons for this but the main one is to get a sense of how well their investments have performed.

This is like almost any other area of human activity. If you have nothing to compare your performance to, it’s hard to gauge how well or how badly you have done.

The TWRR is a useful figure for comparing the performance of your investments with benchmark figures or other investors’ results.

The reason for this is that, unlike the money-weighted rate of return, the TWRR does not take into account the impact that any deposits or withdrawals into your investment account have on your investments.

TWRR gains don’t mean you’ve gained

That TWRR doesn’t look at the impact of deposits or withdrawals into your account makes it useful for comparisons. But it also means it can mislead you into thinking you’ve made gains that you have not.

This is because the way in which TWRR is calculated means that it looks at the percentage gains the assets you’ve invested in have made, as opposed to the monetary gains that you’ve made.

As a simple example of this, imagine that…

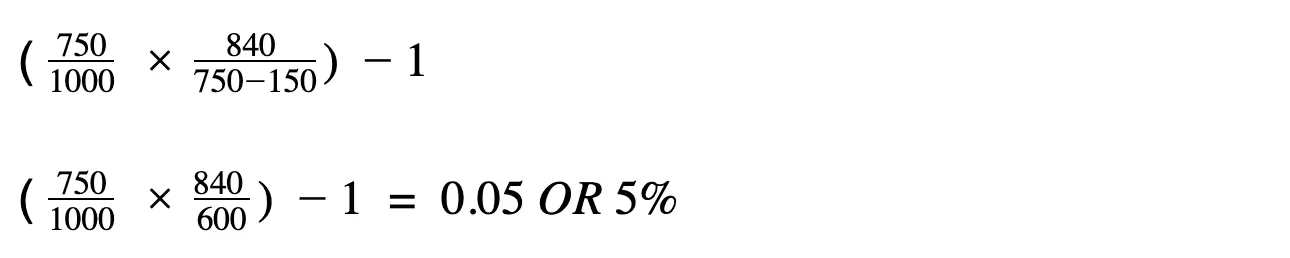

- You invested £1,000 in Greggs shares at the start of 2021. At the end of the year those shares are worth £750.

- You sell £150 of Greggs shares at the start of 2022, leaving you with £600. At the end of 2022, you sell your remaining Greggs shares for £840.

If you do some quick maths, you’ll see that you started with £1,000 and sold off shares worth a total of £990. That means you lost £10 in real terms.

But if you worked out the TWRR of these same results, you’d end up with a 5 per cent gain.

If that seems totally illogical then remember that the TWRR is looking at the percentage gains your investments have made and not the monetary ones.

On that basis, the example above makes sense. True you saw a 25 per cent loss in the first year. But in the second year you saw a 40 per cent gain, which is how you end up with a TWRR of 5 per cent.

Calculating the TWRR

Working out the TWRR of your investments isn’t tricky.

First, just remember that we have to break up the period of time you’ve been investing over into chunks.

These different chunks of time will be determined by the cash flows into and out of your account. When you deposit or withdraw cash, that will mark the end of one chunk of time and the start of another.

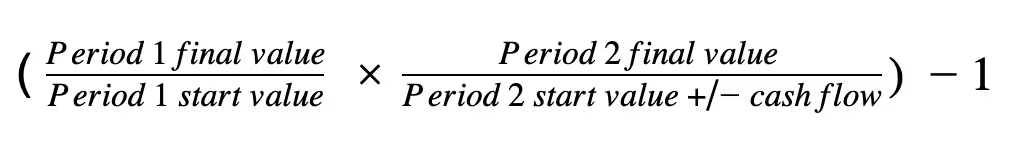

You can then use the following formula to work out the TWRR. In this example, we’re only using 2 time periods but, depending on your cash flows, there could be many more time periods to consider than this.

This equation may look a little confusing but if we insert the Greggs example from the section above, it will start to make sense.

We think investing should be open to everyone. It shouldn’t be complicated, and it shouldn’t cost the earth. Our stock trading app makes it simple for both beginners and experienced investors. And costs are low. You can buy and sell shares commission-free and take advantage of fractional shares (buy just a part of a share).

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

.avif)

.avif)