With no ecommerce platform to speak of, Primark lines were around the block once stores re-opened in April.

And who really needs a digital offering when shops are boasting queues 100 shoppers strong?

Retail sales were up 207% in the third quarter, reaching £1.6bn. Which goes to show it might be all about big brands and flashing the cash on social media but, back in real life, UK shoppers are all about the Primarkisation, not premiumisation.

Because for all the recent brouhaha over fast fashion’s questionable supply chains (at best) and seeming lack of regard for sustainability, the industry isn’t really floundering.

With Primark’s revenues zooming past analyst expectations and setting two-year record highs, clearly, discount leggings are as alluring as ever.

No digital? No dilemma

One of the advantages of having no online operations is that Primark’s been able to nail its inventory management.

Most fast-fashion retailers had to rely on heavy discounting to push the going-out styles in low demand since lockdowns hit.

But the timeliness of its stores reopening boded well with restrictions lifting. And Primark’s been able to mix its old inventory in with the new.

So it’s been less pressured to cut costs. That’s good, since it’s hard to imagine them getting any leaner.

Plus, as one of the few remaining members on the UK’s dwindling high-street, Primark’s likely going to benefit from the thinned out physical retail scene. The fat’s been trimmed, now that many former kingpins from Debenhams to Topshop have boarded up shop.

Get that bread

Reflecting a whopping 44% of group revenue, Primark is clearly ABF’s crown jewel.

But ABF’s grocery division was a decent buffer during the few months when shops were still closed.

Although the segment saw some high highs during last year’s banana bread and sourdough lockdown fanfare, it’s since fallen by 3% to £871m for the third quarter.

Makes sense, given those crazes have now lost some appeal up against a pint at the pub.

But when you compare the numbers against pre-pandemic levels, grocery was actually up 6%. All things considered, that’s some pretty tasty growth.

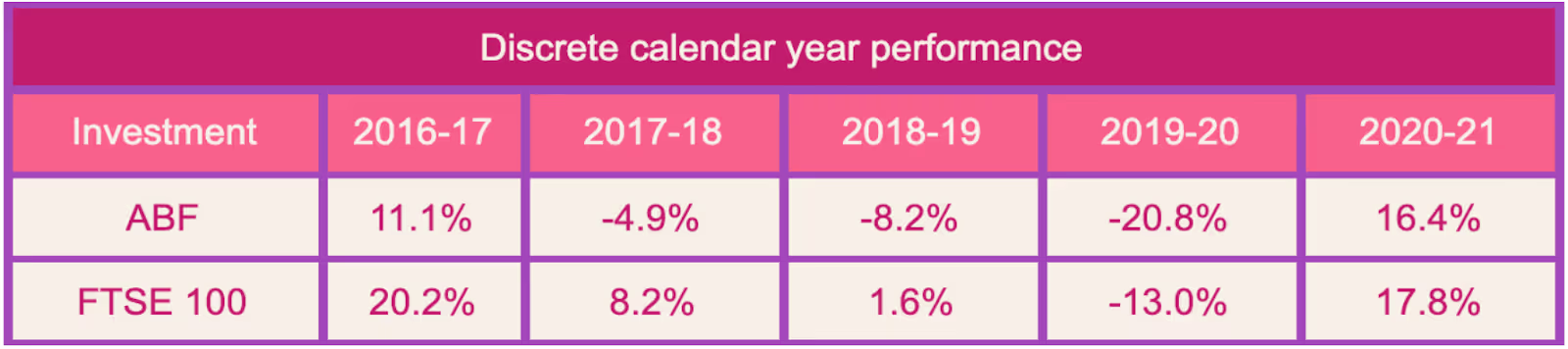

Past performance is not a reliable indicator of future returns.

What are your thoughts on the investment case for ABF and Primark? Let us know on the community forum.

At Freetrade, we want to make it easy and accessible for everyone to invest in the stock market. That’s why we built our stock trading app from the ground up and focussed on helping customers achieve better, long-term financial outcomes. Start with an investment account or a tax-efficient account like an investment ISA or a SIPP pension.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

.avif)

.avif)