Clickbaity listicle behemoth BuzzFeed looks set to hit the stock market.

The digital media company is merging with SPAC 890 Fifth Avenue Partners en route to a Nasdaq listing in the final quarter of 2021.

The firm is targeting a $1.5bn valuation and has announced plans to acquire digital publisher Complex Networks for $300m, made up of a blend of cash and BZFD stock.

Complex focuses on streetwear, music and culture and will “immediately accelerate BuzzFeed’s revenue growth” according to the buyer.

Having more cash on hand could go towards snapping up even more media titles.

BuzzFeed took news site HuffPost off Verizon’s hands last year and co-founder Jonah Peretti added weight to the strategy by saying “I’ve been talking to founders of companies, management teams of companies, I think there’s a lot of excitement to join up with us.”

But if you think that means even more “Which type of garlic bread are you?” quizzes, guess again. The BuzzFeed brand range has been growing and now includes titles like food network Tasty, homeware channel Nifty, beauty site As/is and travel site Bring Me.

That diversification has meant the firm now gets more eyeballs on a monthly basis in the US than any of its big competitors.

BuzzFeed draws in 38m unique visitors per month, ahead of the 31m garnered by Vox Media, and the 12m people browsing Vice.

And users clearly like the content they’re getting served up. They spend just over 21 minutes on the site, more than three times as long as users on Vox (6.9 minutes) and miles ahead of users on Vice (2.6 minutes).

Is BuzzFeed making money?

All this makes for great window dressing for investors but how does the attention feed into the balance sheet?

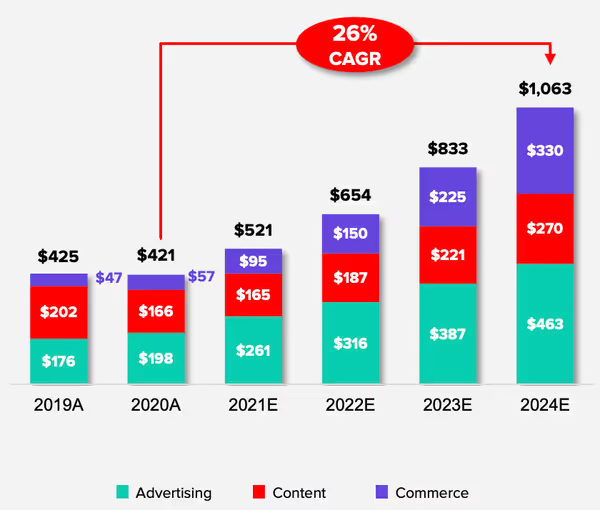

The company generated revenues of $321m in 2020, $421m when you factor in Complex.

This year, Buzzfeed is expecting the combined group to have a turnover of $521m (including $119m from Complex) and is aiming to reach $654m next year, $833m in 2023 and $1.1bn in 2024.

And after having been a loss-maker for much of its 15-year history, BuzzFeed finally managed to turn a profit in 2020.

Last year’s earnings before interest, tax, depreciation and amortisation (EBITDA) hit $31m, or $17m when Complex’s $14m loss is included. That signalled progress from 2019’s $14m loss overall. But it’s a big difference from projected profits of $263m in 2024.

If that’s where it’s hoping to get, ecommerce will definitely need to become a bigger slice of the profit pie.

Is BuzzFeed a good investment?

Last year Buzzfeed partnered with commerce platform Bonsai to launch an experience that cuts out the middleman, and helps drive revenue.

Adding a Quick View button to articles lets readers pop products they see on screen into their shopping baskets and doesn’t take them away from the site at any point during the transaction.

This allows BuzzFeed to own the entire consumer journey and take larger commissions - around 25%, which is a 15% increase over affiliate links that take shoppers to another retailer’s site.

Despite the big projections and diversified revenue streams though, investors just need to look at last year to see how tough it can get in the digital media space.

After years of trying to generate consistent profits, last year took the wind out of the sector’s sails as Facebook and Google hoovered up the lion’s share of internet advertising revenue.

The result was furlough arrangements and lay-offs across the industry but, with revenues getting back into the black this year, things could be looking up.

Digital ad spending increased by 10% in 2020, while linear formats like traditional pay TV fell by 16%, according to research from IPG Mediabrands’ Magna.

If BuzzFeed can use their listing as a chance to expand sensibly and capture more ad spend from Facebook-weary marketers, there could be a chance to extend their lead over their rivals.

What’s your investment personality? Take our quick quiz

It’s only right we mark the listing news in classic Buzzfeed style. But rather than finding out which Hogwarts house you belong to, take our quick quiz to find out what sort of investor you are.

1. You’re out shopping for new clothes. You:

- A. Go straight to TK Maxx. It’s worth flicking through the rails because there’s a cracking cheap find in there sometimes.

- B. Head to Levi’s for your jeans, Nike for your trainers and Calvin Klein for your undies - you can’t go wrong with the staples.

- C. Have a few tabs open online. Big brands are great and everything but so is sticking to a budget.

2. It’s Friday night, you’re finally having friends round again and it’s your turn to choose the takeaway. You:

- A. Go for the two-for-one pizza place. Even if it’s not quite as good, more pizza is the best pizza.

- B. Immediately order in the dishes you all had last time. Everyone loved it then so why mess with what works?

- C. Scour the Chinese options on Just Eat, using your trusty chicken ball price index to see which place offers the best value.

3. One of your portfolio companies is in the news today. Which headline is most likely?

- A. New management team aims for big changes as turnaround begins.

- B. Dividend gets a lift, revenues from new markets start to roll in.

- C. Earnings growth comes in bang on expectations, long-term growth rate intact.

4. You're in the shampoo aisle. Which one is going straight in your basket?

- A. Hang on, is that expensive brand 50% cheaper than normal? Why has no-one noticed this? I’ll take two, thank you very much.

- B. The trusty favourite. It gives a lovely lather and that coconut scent is worth paying up for.

- C. Coconut’s great, and so is the bargain bin, but I’ve got my eye on the one that gives me the best bang for my buck.

5. Volatility strikes. Which sounds like your immediate reaction?

- A. It’s time to go shopping. Big falls can mean big recoveries… eventually.

- B. Sometimes even the steady compounders get brought down by the broader market, I’m focusing on the long term so I’m not worried.

- C. Let’s see what good assets have suddenly become cheap. I’ll consider a buy if the price is right.

Mostly As

Value contrarian

You like unearthing new investment opportunities before anyone else and you aren’t afraid to swim against the tide to find them. That might mean looking into a struggling firm to see how they’re turning things around or companies the wider market hasn’t managed to analyse yet.

One thing’s for sure - you have nerves of steel. It can take a long time for those turnaround stories to bear fruit or that overlooked gem to really get motoring (if either of them ever manage it).

Mostly Bs

Quality growth

You’re a big fan of dominant firms with the ability to stave off the competition and keep customers coming back for more. These companies probably won’t shoot the lights out (elephants don’t gallop, after all) but steady growth and a good dividend policy are just what you’re after.

Mostly Cs

Growth at a reasonable price (GARP).

You can see yourself in both of the descriptions above. You look for growth-oriented companies with relatively low price-to-earnings multiples but diving head first into the value world would keep you awake at night.

Cheap stocks get your attention but you need to satisfy yourself that the business behind them is solid before you commit to investing in them. You aren’t afraid to look at small and mid cap names for growth but you don’t chop off those gains and go looking for value elsewhere if you can help it.

What's your take on BuzzFeed coming to the stock market? Let us know on the community forum:

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

-min.avif)