The recovery won’t be equal.

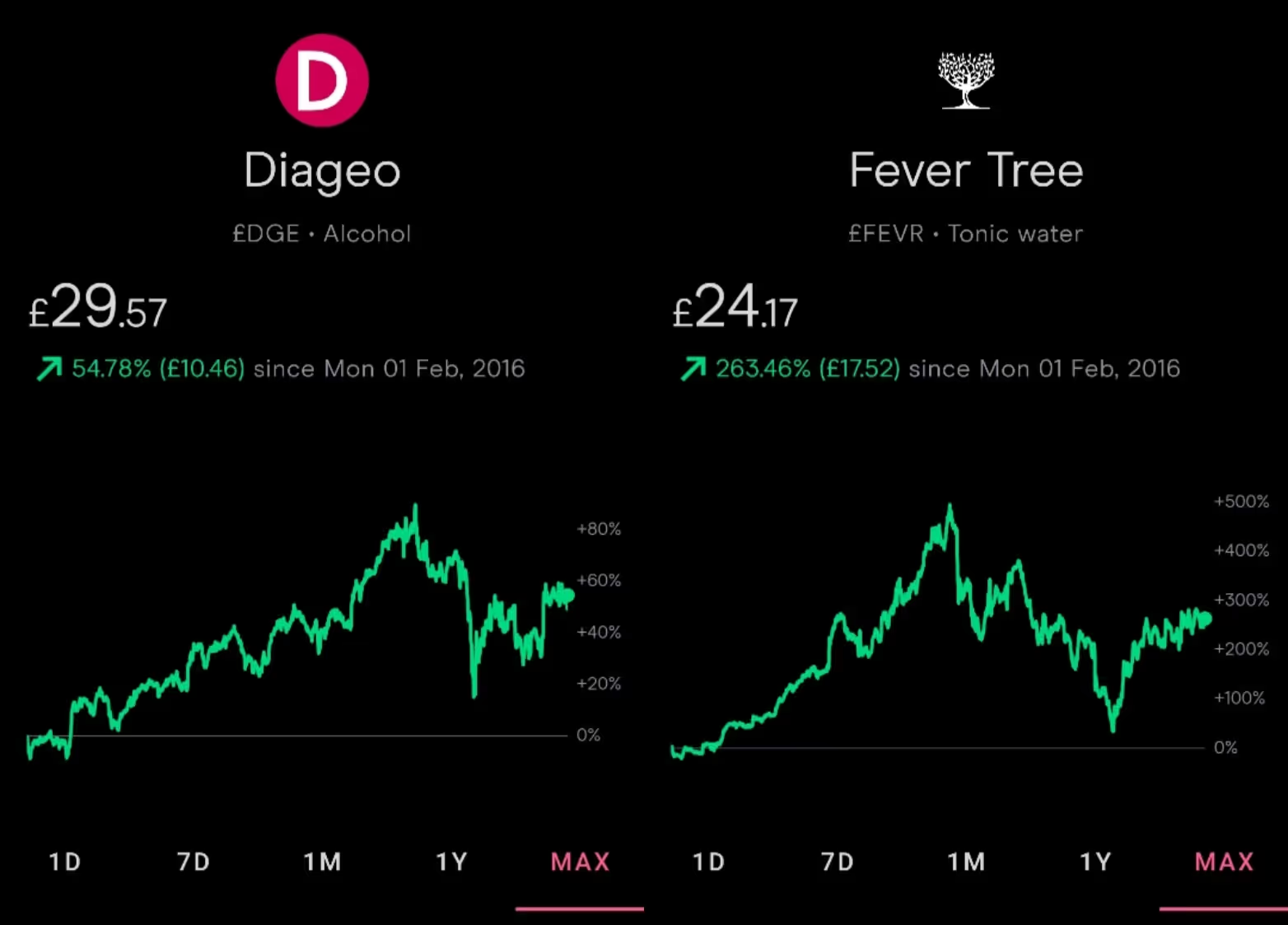

That was the takeaway from this morning’s results from drinks giant Diageo and posh tonic firm Fever-Tree.

Both have been hit by lockdown losses to business and today showed us how uneven their journey back to normality looks.

It’s not all to do with pubs and restaurants being off-limits at the moment (although that is a huge factor).

A particular concern is how consumers around the world are adapting to a midweek tipple at home and how the pandemic is affecting buying power across the globe.

For Diageo, it’s the US that’s keeping them afloat.

The group’s organic net sales grew 12.3% in the segment, enough to offset falls elsewhere except Africa, which stayed level. Nigeria is a huge market for Guinness and is home to the first brewery built outside of the UK and Ireland.

And it was a similar story for Fever-Tree. The mixer maker saw a 23% increase in overall revenue in the US compared to a fall of 22% in the UK division.

Even with supermarket sales rising by 20% on this side of the pond, the premium brand’s overall figures were hit by a 60% fall in on-trade revenues (bars and restaurants).

So, with lockdowns still biting sporadically around the world, the US is currently the big source of growth for drinks, but why are Diageo and Fever-Tree gaining momentum over there?

Spirits in high demand

Guinness might be the face of Diageo but the firm has worked hard to be all things to all people.

Fancy a gin? It has Gordon’s and Tanqueray. What about a vodka? It owns Smirnoff and Ciroc. How about a Captain Morgan’s or a Bailey’s at Christmas?

A stable of market leaders is designed to be able to tap into the next taste trend before it happens. In this case, it has meant helping Americans stock up on spirits like Johnnie Walker.

Chief exec Ivan Menezes called this out specifically today. He said, “North America, our largest market, performed particularly strongly and ahead of our expectations. Consumer demand has been resilient and the spirits category continues to gain share of total beverage alcohol.”

And what do you mix with your measure? Well, broadly, the US still likes its spirits and sodas dark like Coca-Cola, so Fever-Tree’s tonics haven’t been a natural winner.

But pushing their own cola and ginger fizzes seems to be working, finally. They managed to unseat coke-owned Schweppes from the tonic top spot in the UK; Coke is a different beast altogether but they are making in-roads.

The firm has managed to support the rise in at-home spirit consumption, with a full-year off-trade sales increase of 57%.

Many Britons and Americans alike have seen their savings rise as they simply can’t get out to spend what they would normally.

With after work drinks and weekend outings a thing of the past and future, premium products are attracting our newfound ability to spend a bit more in the shopping.

And it’s this capacity to maintain and grow a consumer base that has long attracted fund manager Nick Train to Diageo and, more recently, Fever-Tree.

The investor holds both companies in his Finsbury Growth and Income investment trust.

On adding the tonic maker to the portfolio he said, “If I had to pinpoint the trigger that convinced me we needed exposure to Fever-Tree, it was seeing the brand featured in Diageo’s marketing materials. That persuaded us that the Fever-Tree brand is truly valuable and has a long way to go.”

Train prefers companies with pricing power, who can attract consumers even with a higher price tag.

But it’s important for the manager that there’s a loyalty there too. If consumers drop a product as soon as they need to rein in the spending it can hit things like drinks, which we don’t really need to spend any money on at all.

When there are companies with proactive management who can pivot between on and off-trade effectively and still engage consumers at a profit-making price point, they can become even more dominant.

For the manager, this is what portfolio stalwart Diageo has offered for a long time and what Fever-Tree will hopefully deliver too.

Smaller players risk running out of money during the pandemic and could well be acquisition targets once lockdowns subside. Diageo strengthening its balance sheet is as important as its revenues today and is something it has done well.

It’s used to paying the big bucks for additions to its portfolio. Buying up Aviation gin, co-owned by actor Ryan Reynolds, and George Clooney’s Casamigos tequila gave it the premium spirits it needed to complement Gordon’s, Tanqueray and Don Julio.

But post-corona acquisitions will have to be even more thoughtful. This could be one reason there’s such a strong focus on keeping cash ready at the company.

Tell us what you think about the case for Diageo and Fever-Tree on the community forum:

Learn how to make better investment decisions with our collection of guides. They explain in simple language how to start investing if you are a beginner, how to buy and sell shares and how dividends work. We’ve covered investment accounts too, and how an ISA or a SIPP could be good places to grow your investments over the long term.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. Past performance is not a reliable indicator of future results.If you are unsure whether a product is right for you, you should contact a qualified financial advisor.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

.avif)