I’m still getting my feet under the table at Freetrade.

It’s been brilliant getting to know the community and talking to some of you - a huge positive that I wasn’t expecting, and miles away from what I had got used to as an investment writer.

In my previous life writing on the markets at a big fund platform, part of my job was to speak to fund managers around the City (seeing their houses on Zoom was... depressing).

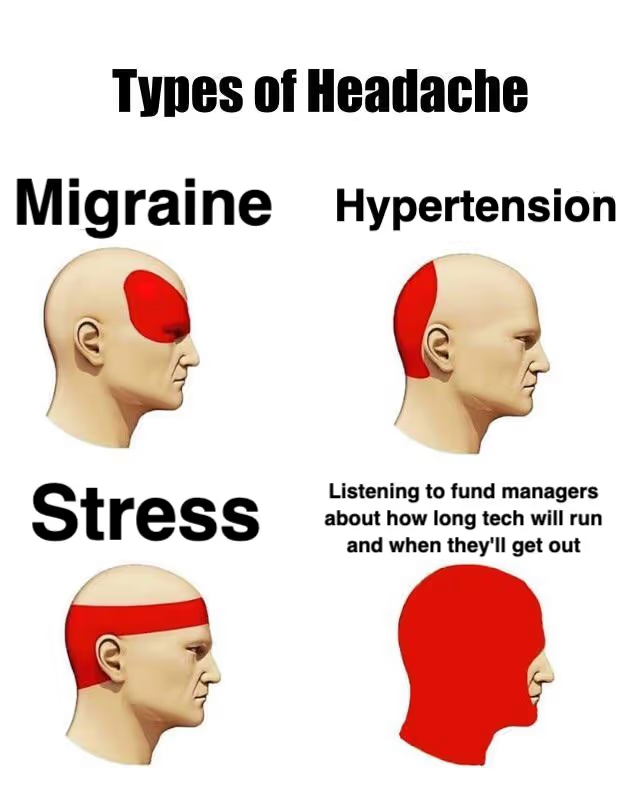

Over the past year I’ve asked them all the same question, “How high can this tech run go and when are you getting out?”

As you might expect, a lot of their responses were long and expertly crafted to avoid an actual answer.

So let’s look at it now.

How did we get here?

So far in this mad fever-dream of a year, it feels like the tide has lifted quite a few US tech boats - not quite matching the levels of mania that we saw 20 years ago, but indiscriminate in its own way.

Tech and pharma have separated themselves from most other sectors since March, with tech accelerating the trends we had all seen developing for years.

It’s this acceleration from novelty to absolute necessity in online learning, workplace digital adoption, captive audiences needing entertainment and vastly reduced physical footfall in all sectors that’s behind most justifications for the tech rally.

But the prospect of a second lockdown and the third quarter earnings season throwing up some curveballs both bring the conversation back to the one I posed to London’s many money-runners.

Has the rally fizzled out?

Let’s start with what we learnt last week from some of the sector’s rockstars.

Snap blew expectations apart on Tuesday as it reported a 52% hike in sales thanks to advertisers coming back to the platform. Good news, especially against a 17% rise the previous quarter.

User numbers hit 249m, nearly exactly a third of the population of Europe.

But incredibly, Snap still isn’t profitable.

Tesla racked up a record 139,300 vehicle deliveries, and reported its fifth consecutive profitable quarter.

Revenues bypassed expectations of $8.4bn, reaching nearly $8.8bn. And it’s full steam ahead with new factories planned in Germany and Texas, as well as the tentative launch of the Cybertruck at the end of 2021. The vehicle design is a bit divisive, but there are Elon fans at Freetrade who’d buy it in a heartbeat.

By contrast, Netflix missed its target of adding 2.5m subscribers, managing 2.2m in the third quarter.

Analysts were way off in expecting 3.6m new users, hence the share price losing ground this week. For reference, the firm added around 16m, then 10m in the first two quarters.

And investors in Intel weren’t impressed either, sending the stock lower despite the firm beating revenue expectations.

It’s the non-chip side of the business that had investors concerned. Revenues at Intel’s data centre business came in at just under $6bn, missing expectations of $6.2bn.

The internet of things division and memory operation disappointed too - revenues fell 33% and 11% on this time last year.

A mixed bag but what does it tell us?

Well, this is where I have a bit of sympathy for my interviewees.

If anything the threat of another lockdown, or at least a lockdown-lite in the UK, means a lot of investors (pros included) will be wondering whether it’s a case of rinse and repeat for the stocks they bought last time, and a chance for the dominant names to show their worth again.

But, judging by this week’s numbers, I’m not sure there’s the same opportunity on the table for all the companies that owned the first lockdown.

You don’t tend to sign up to Netflix twice and your spare room is probably already kitted out with hardware for working from home. But, is that a reason to sell?

In situations like this, one thing I did learn from my interviews was to look at the business case well before the share price.

If we’re selling we’re telling ourselves the narrative we bought into has run its course or has changed. We’re deciding it no longer offers the same opportunities to justify the current valuation or, importantly, it doesn’t fit with our personal financial goals or investment personality.

For the long-term investor, that means reassessing our original thesis on the company from the ground up.

If you’ve set yourself up for the long haul and take the view that these companies will be essential in our inevitable evolution of a WiFi-enabled extra limb, then arguably the next quarter shouldn’t matter.

What this divergent earnings week does suggest is that, if we’re given another inflection point in the form of a lockdown, it will be key to be even more selective among the current winners.

Treating the sector as one homogenous blob feels less sensible the more results start to split the pack.

If not here, where?

One final thought.

Investing in quality growth companies is normally about identifying the global leaders with significant pricing power and who kind of have their market sewn up.

It’s hard to imagine a future without some of the world-leading companies reporting this week and next.

But if you decided that growth in the sector was dead in general, where would you put your money?

The value stocks that contrarian investors have flocked to over the past decade tend to include companies that would love an uptick in the economy. Banks, airlines and real estate developers fit the bill.

And maybe a painless Brexit and the next US president opening the government coffers could kick that off but value has had a few false dawns, most notably in 2016 when the style rotation ran out of steam fast.

If you’re sensing that I’m sitting on the fence, it’s because I know my limits as an investor and as a fortune teller.

I can’t predict what the next quarter will bring and that’s why a diversified exposure to a range of sectors, styles and geographies is so important. Taking a short-term punt with part of your life savings is a mug’s game.

It’s becoming more important than ever to be selective, look to the long term and make sure the company you bought into continues to align with your personal risk appetite and investment goals.

Only then will you start to see what the right course of action is for you.

Freetrade is on a mission to get everyone investing. Our stock trading app makes it easy to buy and sell a wide range of investments, including stocks, ETFs, investment trusts, REITs, SPACs and even newly launched IPOs. Take a look at the most traded shares on the platform to see what retail investors buy and sell weekly.

Important information

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

.avif)