Hey Powell, kick us while we’re down, why don’t you?

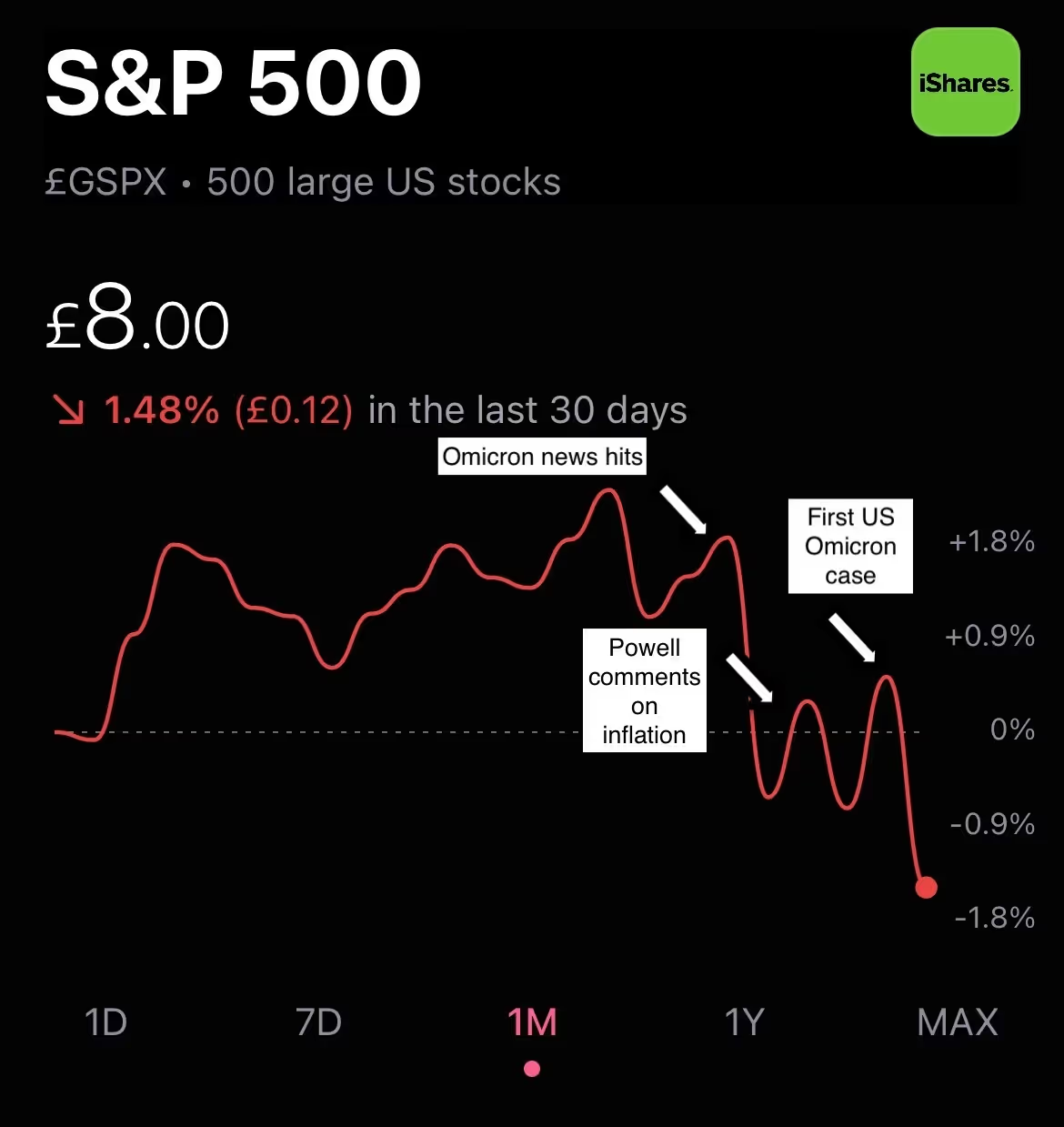

Last week, the market took a bit of a hit after Omicron worries ramped up and the US chair of the Federal Reserve hinted he’d like to tighten up the country’s monetary policy.

Those wouldn’t be ideal headlines in and of themselves. And coupled up, they’ve felt like a one-two jab.

Talk about speedbumps. A new variant in town doesn’t strike as ideal timing for Powell to be amping up his support of raising interest rates.

Yes, US inflation hit a 30-year high last month, but some might argue that another Covid wave could naturally taper that down a bit if lockdowns come into effect.

On the other hand, it could just usher in a new round of stimulus cheques for Americans - which would only further exacerbate those inflationary pressures.

As for what would really be the “appropriate” means of course correction is but a calculated guessing game. And the market didn’t seem to quite know what to do with all this newfound knowledge, but without any crystal clear decision attached.

Wednesday 8 December

- GameStop - Q3 earnings

- Stagecoach - Q3 earnings

- Berkeley Group - Q2 earnings

Thursday 9 December

- Costco - Q1 earnings

- Lululemon - Q3 earnings

- On The Beach - Q4 earnings

- Doc Martens - Q2 earnings

It’s important to highlight that this is just a look ahead, not a suggestion or recommendation that you buy or sell any of the securities mentioned.

Remember that everyone has their own goals and unique financial circumstances. These, along with your tolerance for investment risk and time horizon, should inform the mix of assets in your portfolio.

Our resource hub for investing in the stock market might make that blend a bit clearer for you and our guide on how to invest in stocks is a great start for first-time investors. If you are still unsure of how to pick investments, speak to a qualified financial advisor.

Stocks to watch this week:

Costco

Costco’s share price has been off to the races for some time now. It’s one of only a few stocks that hardly took a tumble in the March 2020 sell-off. Perhaps because no sooner did Covid become a household name than canned goods and loo roll hoarding became popular pastimes.

So Costco and all its bulk-sized glory was a big pandemic winner. But its successes have continued on long past lockdowns, and its first-quarter earnings this week could paint a similarly rosy picture.

The retailer already revealed sales figures for the 13 weeks to the end of November, and they’re looking lofty.

Total revenue grew 16.8% to $54.1bn, with e-commerce sales revving up by 12.8%. Impressive, given this period last year would have actually had many of its markets in lockdown. Assumedly then, with restaurants off the table, Costco was an easy choice.

Online sales would have also been naturally quite attractive for those preferring to shop from the comfort of home rather than navigating those daunting warehouse aisles.

Yet even as we’ve reopened, Costco’s increased revenue across all channels and markets. It’s one firm that, frankly, doesn’t really mind what happens next with this whole Omicron thing. The evidence so far suggests It’ll probably be just fine either way.

Read more:

Sign up to Honey, our free daily investment newsletter

Top 10 stocks and shares on Freetrade in November

Hope for the best, prepare for the worst

GameStop

In all honesty, it’s more than likely most investors who bought shares in GameStop this year weren’t hopping aboard for the financials. Neglected as they may be, they deserve a good look.

GameStop’s third-quarter earnings come out this week, and what the retailer’s managed to pull off with its over $1bn from investors stands to be seen.

For three years, the firm has failed to be profitable, though it isn’t for lack of trying. Last quarter revenue jumped 27% to $1.2bn. Not bad, and decent growth too, though for the $13.9bn market cap, one might expect a bit more.

It’s a bit ironic the firm which couldn’t be where it is today without plenty of internet hype has somewhat failed to digitally adapt its business.

GameStop sells physical copies of games, which are increasingly unpopular to their digital copy counterparts. The unappeal isn’t surprising - when was the last time you saw a colossal DVD collection without an instant lump in your throat for the poor owner’s buyer’s remorse?

While GameStop doesn’t seem to have made much progress on this front yet, it has been leaning out its retail footprint and cutting down on liabilities. Those are two good calls for the firm, and it’s sitting with $425m less debt than this time last year around.

Many of Chairman Ryan Cohen’s turnaround plans are still in the mix. This quarter’s earnings certainly won’t tell the full story, but they’ll hopefully shed some light on what all that money’s doing behind the scenes.

Make your investments work a little bit harder with one of the UK’s leading commission-free trading apps. Freetrade has transparent charges, no hidden fees and is one of the only brokers to offer fractional shares in the UK. Download our iOS stock trading app or if you’re an Android user, download our Android stock trading app to get started investing.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

.avif)

.avif)

.avif)