Starting today, we’re rolling out another new feature to help you get a better idea of how your portfolio has performed.

It’s time for your Insights tab to come out of beta, with the brand new time-weighted rate of return (TWRR) joining the money-weighted rate of return (MWRR).

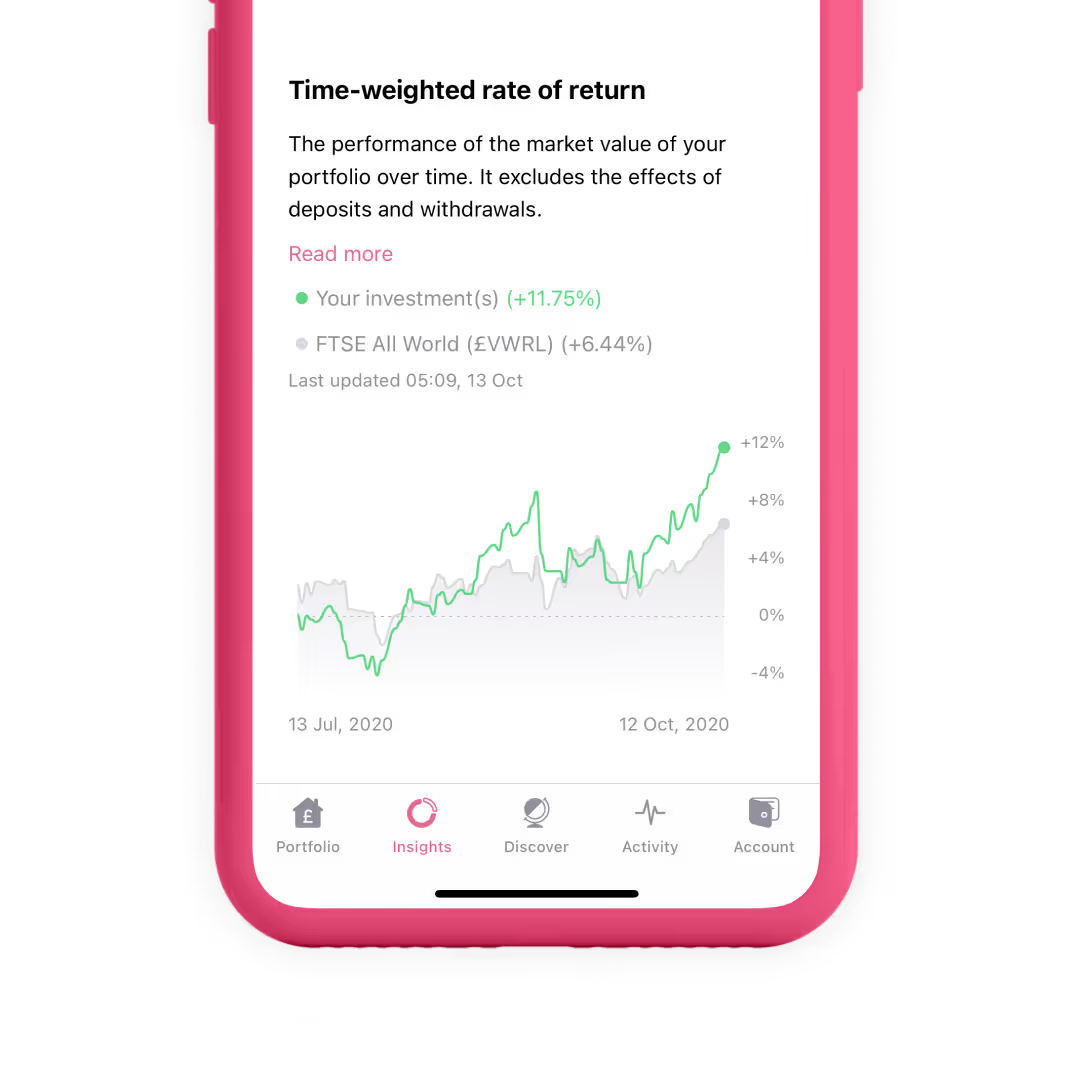

The TWRR tells you how well the stocks you’ve invested in have performed during the time that you’ve held them. It’s often seen as the best figure to use when comparing your results to benchmark figures.

Unlike the MWRR, the TWRR doesn’t take into account any deposits or withdrawals you make.

This is why it’s used by fund managers. They don’t control these cash flows, they only pick what to invest in.

The TWRR lets them show other people how well the assets they’ve chosen have performed, without the detrimental effects that poorly timed cash flows may have made.

That’s also why you need to be careful!

The TWRR shows the percentage gains your investments have made, not the monetary ones.

As such, you can have a situation in which you’ve lost money but still have a positive TWRR.

What can I use the TWRR for?

See how your investment decisions are affecting your bottom line

Having both the TWRR and MWRR on your app means that you can see how both the timing and volume of your investments is affecting your portfolio.

The TWRR will tell you how well the stocks you have picked have performed. But the MWRR will tell you how well the money you’ve invested in those stocks has performed.

That means you could be a great stock picker but make poor decisions when it comes to the timing and cash volume of your buying and selling. Comparing between your TWRR and MWRR can give you a better idea of how you’re doing on this front.

Compare your performance against a global benchmark

To help you get an idea of how your performance looks in a wider context, you’ll also be able to compare your performance against the Vanguard FTSE All-World UCITS ETF, an ETF tracking a stock market index that covers over 3,100 companies in 47 countries.

Choose your timescale

You can use the new toggle on the top-right of your Insights tab to view your performance on either a 1 week, 1 month, 3 month or Max timescale.

Where can I see the time weighted rate of return on Freetrade?

You’ll find your TWRR on the Insights tab of your app.

We’re starting a phased roll out of the feature today, so it may be a couple of days before you can see it.

Remember to keep an eye on your Insights tab moving forward as we’ll be adding more features to it in the future.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).