They say you never forget your first time. First love, first car, first job - perfected in our memories for sure but if we’re honest, a little nerve-racking too. Likewise, it can feel like a big leap when you make the foray from saving to investing.

But it doesn’t need to.

Your first step as an investor can seem daunting if you don’t know where to start. If you’re reading this right now, you've already made the right call by beginning the learning journey into the world of investments for beginners.

This guide is to give you the confidence to start investing. That includes gaining investment knowledge from how to decide the right stock trading platform for you, to understanding the different types of investments available for beginners. Without further ado, let's begin.

What to keep in mind when you start investing as a beginner

A good place to start is to ask yourself who you are as an investor.

That question isn't supposed to evoke looming feelings of existential dread. It’s just meant to clarify what your investment goals are in the first place and what sort of journey you want to take towards them.

Every investor has their own objectives and unique financial circumstances. Often, you're investing with the hopes of meeting specific financial goals.

These could be shorter-term like buying a new car or taking a vacation. In that case, it could be that investing isn’t a sensible way to get there. If that dealership or Airbnb needs a cash deposit soon, the last thing you want is to find your stocks are more down than up just when you need the money.

Five years tends to be the guidance when it comes to the lower limit on how long you should invest for. It’s about giving your investments the time they need to grow and the longer you give them, the less spiky it all tends to look.

Or, you might already be thinking about the long run, like how you can better financially prepare for retirement.

Pinpointing these goals, determining your tolerance for investment risk, and establishing your time horizon should inform the types of investments you make.

How much money do you need to start investing?

A logical next question would be to ask how much you need to start investing.

While you're more likely to reach your investment goals with a larger initial investment, that shouldn't be your main concern.

Firstly, it’s important to make sure you’ve cleared off any unsecured debt. You should also have enough cash set aside in a rainy day fund for unexpected expenses that could arise.

If you’ve got those boxes ticked, then you might be ready to consider investing.

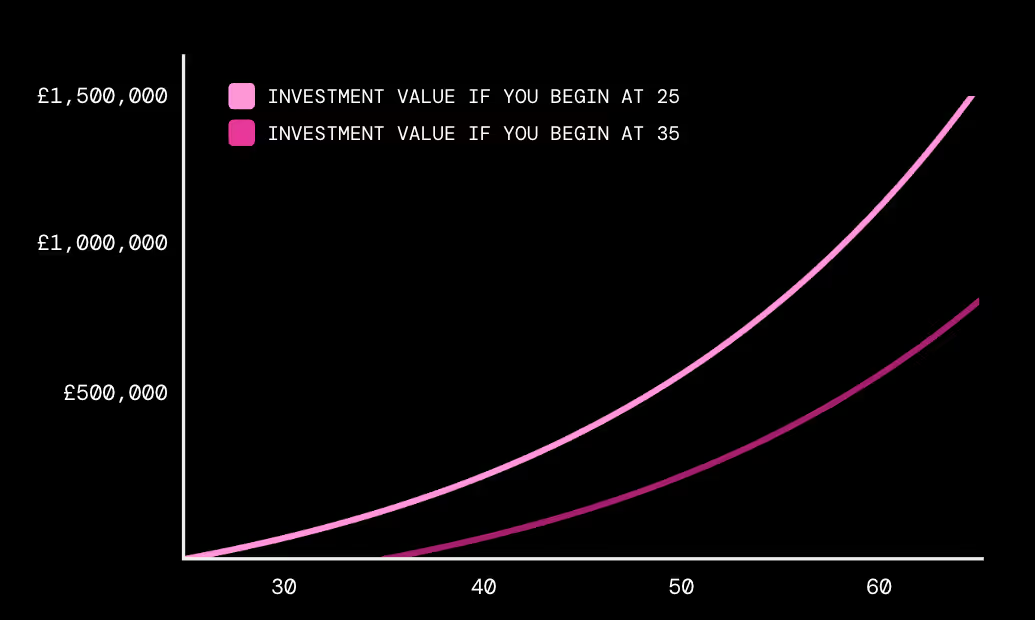

As you'll see, it's about getting started as soon as you can so your returns can accumulate over time. It's not about waiting until you have cash coming out of your ears.

Given you should assume that the money you’re investing will be invested for five years, figure out how much you can invest regularly with that timeline in mind.

The minimum investment you actually need to open a stocks and shares account with a broker usually depends on the provider. With Freetrade, the investment minimum is £2.

Should I begin investing with small amounts?

You can start buying shares with small amounts of money, but some shares cost hundreds or thousands of pounds each. The good news is, even if you don’t have much to start with, the magical powers of compounding can lend your investments a big helping hand.

When you keep your money invested for the long run, over time, compounding happens. Cast your mind back to second-period maths and you might remember it being described as ‘interest on interest’.

It means you’re not only earning a return on your initial investment. You're also getting an additional return on those accumulating investment returns from prior years. So your earnings don’t just grow, the rate at which they grow accelerates too.

Even if you’re investing small amounts at the start, compounding can make a massive impact.

The power of dividends would further that affect even more. If you’re stroking your chin pondering “how do dividends work?”, rest assured, we'll get to those soon.

Fractional shares

If you're only interested in starting with small amounts, you can still invest in US companies with bigger share prices through fractional shares.

They are literally that, a fraction of a share. They allow you to invest in a company without having to buy a whole share. If an XL ham and pineapple pizza is a whole company, and a share is a slice, a fractional share is just one delicious bite. And yes, pineapple deserves to be there, don’t @ me.

Sometimes, you’re just not hungry enough for the whole pizza. Or, you’ve not got enough cash for the whole thing. So fractional shares solve the problem of wanting to invest in a company but being unable to buy an entire share because the price is higher than you’d like to spend.

Start investing with a lump sum

Lump-sum investing means taking your cash and getting in the market now, as opposed to doing so in smaller increments over time.

As we’ve already seen, there’s tremendous value in investing early if you have a long time horizon. So if you can afford to invest more, it's usually a good idea to do so.

That said, pound-cost averaging is a method of investing where you buy stocks gradually, rather than all at once. You're essentially buying into a share in small amounts over time, with the hopes of averaging out fluctuations in its share price.

The pros and cons of both are pretty simple. Whereas early lump-sum investing kicks off that compounding with a bigger engine, if the share price falls tomorrow, all of your money will go with it.

Investing over time gives you less of an initial pot to start compounding but you can actually take advantage of a dip in share price by picking up shares in the company you like at a lower price, like shopping in the sales.

In the end, the choice can be more about sheer practicality though. Most people get paid monthly and choose to invest after each paycheque.

Whatever regularity suits you, the point to hammer home here is even if you’re starting small, it’s best to start soon.

Investment ideas for beginners

There are other asset types a beginner investor can consider too.

Investment trusts are funds that allow you to gain exposure to a bunch of assets. They can help you build a diversified portfolio, without you having to select numerous stocks in one go all by yourself. In this sense, they're sort of similar to ETFs. Freetrade has a wide range of different types of investment funds available on our platform.

Usually, the biggest difference between an investment trust and ETF is how it's managed. Generally, a fund can be active or passive - but it's got nothing to do with how many steps the fund manager is logging on their Apple watch.

Investment trusts are typically led by human fund managers who actively pick a mix of stocks they believe will grow faster than others. They're trying to find companies that can provide an above-average return. So these are expertly-managed pooled investments, which can even provide retail investors with access to private companies.

Many investment trusts also pay steady dividends thanks to their ability to hold back up to 15% of the income they generate annually. That means in some not-so-hot years, they can often still pay out dividends.

On the other hand, most ETFs are passive investments because they're simply tracking the performance of an index of assets like the S&P 500. So ETFs are trying to deliver the return of the index, they’re not trying to beat it. Since they're not usually actively managed, they can cost less in fees than investment trusts. Active ETFs are on the rise though, as are their fees, so make sure to check how your fund is managed and what you’re paying.

If you feel like you don't have the investment experience to get started with individual investments, remember there are plenty of ways to start investing. Funds can offer a more diversified, and less labour-intensive way to start investing.

Five investment tips for beginners

We’ve already got a simple guide on how to invest in stocks for beginners. But here are a few ways you can start thinking about what might be some good investment strategies. And it's not just about individual companies, it's also about where you decide to house these investments too.

1. ETFs

But if sifting through thousands of stocks feels a little more daunting than exciting, exchange-traded funds (ETFs) can be a simpler way to invest. ETFs track the performance of a market index or a group of stocks, so you spread your money across many individual shares in one go.

Two popular examples of ETFs among Freetrade users are Vanguard's S&P 500 trackers (VUSA and VUAG). Of course, that doesn’t mean that these investments will be right for you and it’s certainly not financial advice.

Both of these track the S&P 500, which includes the 500 largest companies in the US according to their market capitalisation.

ETFs provide exposure to a broad number of companies. That’s why they're sometimes seen as an easy investment for beginners since they don’t require you to carefully select each and every stock. The ETF has already loaded up the basket for you.

Still, it’s important to read the recipe so that you know the ingredients you’re combining for the dish. Because even though ETFs tend to include a large number of companies, that doesn't guarantee you a diversified portfolio. A cannabis ETF tracking a collection of weed stocks will still be exposed to anything affecting the whole sector like law changes, so complete diversification isn’t a given. And diversification is like the armour to your portfolio when it sets out to battle. It's there to guard us against stock-specific risk as much as possible.

Back to those S&P tracking ETFs. While the ETFs track hundreds of stocks, there are a lot of commonalities among them. So despite the volume of the stocks, sector-specific risks exist. Tech companies made up 32% of the VUAG ETF as of 30 October 2024.

That means your investment would be heavily weighted in that industry. And if you're already invested in tech companies through individual stocks and shares, you're really risking doubling down on the same sector, or even the same stock. So just remember that ETFs don't guarantee portfolio diversification.

2. Individual stocks

A top-down view of looking at an industry or theme to decide which stocks to invest in can be a good way to see the big picture.

But there are winners and losers in every group, so you have to be able to sift out the gems from the dust.

This is one way of approaching investing in individual stocks. When you’re looking at an entire industry, you can then search for the bottom-up stock stories to bolster your research.

Consider technology. The word as a whole encompasses practically anything nowadays. To just be a company in tech certainly won't guarantee you success. Likewise, as an investor, you need to look at a sector under a microscope if you really want to understand what you're investing in.

The PE ratio can serve as a good tool in your investor's toolbox to compare firms across an industry or sector. It compares a firm's share price (what you pay as an investor) to its earnings (what it's making as a business). So a lower PE might indicate you're paying less now to get a bit of a firm’s future earnings than a higher PE would. But bear in mind a low PE doesn’t mean good value. It can also be a reflection of an out of favour business, losing some of its lustre.

All this to say, looking at a theme can be a great way to learn about businesses offering goods and services within it. Then using tools like the PE ratio can help compare these businesses to decipher which investments are right for you.

3. Dividend paying stocks

A dividend is a distribution of a company’s profits to its shareholders. Meaning when you invest in a firm, when they earn a profit, they can dole out a proportion of that as a dividend to you, the investor.

Let your mind wander back to the VUAG and VUSA ETFs. The difference between the two is the way that dividends are distributed. Investors in VUSA will have dividends distributed to them. These can be used as an additional income stream, or if you have regular expenses you need help with.

The main thing to understand is that when you get dividends, these can either accumulate in your account or get distributed back to you.

VUSA puts the cash in your pocket while VUAG plugs the cash back into your investments.

As your dividend payments go back into your dividend-generating assets, chances are, those payments will get even bigger next time. Enter: the snowball effect.

For an example of just how powerful those dividends can be, consider the UK’s top 100 firms. Between 1999 to 2020, the share price value of the UK’s biggest companies barely moved, price-wise. But if you were invested in those firms and re-invested all of the dividends earned during that period, the index returned 122% or 4% a year according to Schroders data1.

Past performance is not a reliable indicator of future returns.

Annual total returns

Freetrade does not give investment advice and you are responsible for making your own investment decisions. If you are unsure about what is right for you, you should seek independent advice. Source: Morningstar, as at 30 Oct 2024.

4. ISA

It’s not just about the investments you make, it’s about where you keep those investments too.

If you choose an investment app to buy and trade shares, there are a few factors to bear in mind when shopping around. This isn't a one-size-fits-all decision, which is why it's important to know exactly what you’re looking for before you start perusing.

A few account options are a stocks and shares ISA account (ISA), a general investment account (GIA) and a self-invested pension plan (SIPP).

A stocks and shares ISA lets you invest in a tax-efficient way. That means you can put up to £20,000 each tax year into a wide range of assets (including individual shares, funds, government bonds and ETFs) without paying UK capital gains tax or income tax on any gains you make from those investments.

That’s a major distinction between an ISA and GIA. With a GIA, you won’t get those tax efficiency benefits. That can mean a little more number crunching for you as an investor when it comes time to report any taxes on dividends or capital gains.

Our flexible ISA is included in all plans. As a new investor that means you don’t have to worry about costly platform fees every time you trade.

Trading costs quickly eat away at any of your potential gains, and can be particularly damaging when you’re trading smaller amounts.

5. SIPP

A SIPP is another potential home for your investments. Similarly to an ISA, it provides you with a tax-efficient wrapper for your investments. But a SIPP is about your pension, which means you can also take advantage of tax benefits from your contributions. For instance, you can contribute up to 100% of your salary and receive tax relief on contributions up to £60,000 per tax year.

Just remember that when you put your money in a SIPP, that money’s intended for your pension, so it’s locked up until you turn 55 (or 57 from 2028 onwards).

It also puts the control in your hands. You get to decide exactly how you want your pension invested, in a way that reflects your risk tolerance and outlook on how the market (and world, for that matter) might change in the future too.

You can open a SIPP for free, with any Freetrade plan.

Long-term investments for beginners

If you're a commitment-phobe shaking in your boots at the thought of marrying your investments, fear not. Long-term investing doesn’t mean you’re locked into the same investments for years to come. So don’t get spooked that your first needs to be your best.

When we talk about long-term investing, it's about having a long-term view instead. That's because the length of time you’re in the market usually matters more than each and every investment pick.

That's why the answer to "when should I start investing?" is usually the sooner the better.

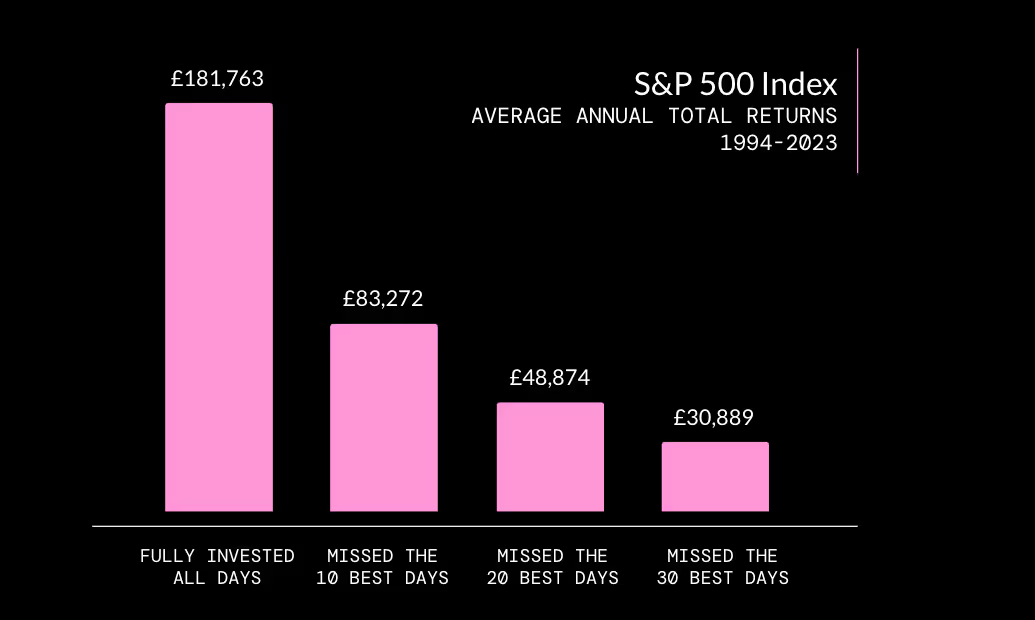

The first reason is that timing the market perfectly is about as likely as a pig flying by your window. It’s natural to want to jump on the dips but the reality is few can do it well consistently.

The fact of the matter is, timing the market is nigh-on impossible. Not only that, but attempting to time it can actually be a very expensive mistake.

The above chart shows the average return you’d have earned if you'd invested $10,000 in the S&P in 1990. If you’d missed the 30 best performing days in the market, your return would clearly be much lower than if you’d been invested during those days too.

A lot of those ‘best’ days will have followed some not-so-great ones too. Meaning, many investors who sold on the dips (sub-prime mortgage crisis and global financial crisis, anyone?) then waited for ‘the right time’ to get back in probably just suffered a double whammy. They might have not only sold low, but missed out on any subsequent recovery periods too. Ouch.

Had you just stayed invested in the S&P during the entire period, you would have walked away with a lot more than your initial $10,000.

Depending on your mindset, it will probably always feel like there was a better time to buy or sell your shares. But if you have a long-term outlook, that really shouldn’t be your main concern. History shows us those ups and downs iron themselves out if you’ve got your skin in the game for long enough.

No one investment journey is similar to the next. Don't get bogged down comparing what you know to what the pros know. It's about getting started, focusing on the long-term, and keeping your personal goals front of mind all the while. Investing isn’t about sharing an IQ with Einstein, it’s about patience and discipline. And couldn’t we all use a little bit more of those in our lives?

Past performance is not a reliable indicator of future returns.

Annual total returns

Freetrade does not give investment advice and you are responsible for making your own investment decisions. If you are unsure about what is right for you, you should seek independent advice. Source: Morningstar, as at 30 Oct 2024.

[1] Schroders, 2023, How the FTSE 100 returned 122% in 20 years but barely moved

[2] Hartford Funds, 2024, Timing the Market Is Impossible

When you invest, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you invest.

Freetrade does not give investment advice and you are responsible for making your own investment decisions. If you are unsure about what is right for you, you should seek independent advice.ISA and SIPP eligibility rules apply. Tax treatment depends on personal circumstances and current rules may change.

A SIPP is a pension designed for you to save until your retirement and is for people who want to make their own investment decisions. You can normally only draw your pension from age 55 (57 from 2028), except in special circumstances.

At present, Freetrade only supports Uncrystallised Fund Pension Lump Sums (UFPLS) for customers who wish to withdraw funds from their SIPP after their 55th birthday. We strongly encourage you to seek financial advice before making any withdrawals from your SIPP.