Finding out how to invest in US stocks from the UK can help you to diversify your portfolio and back some of the world’s biggest companies.

The first thing to note is that UK investors CAN buy US stocks.

Some of the biggest and most recognisable companies on the planet are listed on US indexes. UK investors can get their piece of the pie, but you need to know how to get started before you can add the likes of Nvidia and Tesla to your portfolio.

Check out our step-by-step guide to find out how.

Invest in US stocks in the UK

1. Open a trading account

To invest in stocks, you need a share dealing or brokerage account. These accounts generally serve as platforms for you to deposit money, which you can then use to invest in stocks, ETFs, funds, and more.

Opening a new account can be accomplished in just a few minutes in some cases. You will usually need some form of ID (passport or driving licence) and proof of address (such as a bank statement or council tax letter).

A Freetrade account can enable you to invest in a huge range of US stocks through a stocks and shares ISA, SIPP or a General Investment Account. Sign up now to start your investing journey.

2. Fill out a W-8BEN

If you’re a UK investor, you’ll need to fill out a W-8BEN form. This form confirms your status as a non-US person for tax purposes.

When you complete the form it’s valid for three years from the date you signed.

As standard, the Internal Revenue Service (IRS) slaps a 30% withholding tax on dividend income foreign investors receive from US equities. However, thanks to a tax treaty between the US and the UK, UK investors usually pay a reduced 15% rate once they have signed the W-8BEN.

This might all sound intimidating, but filling in the form is quick, simple and easy to do through the Freetrade app.

3. Choose the US stocks you want to buy

There are many ways to decide what stocks you want to invest in. You might be looking to back big tech, to secure regular income from dividend stocks, or just to get behind a company you believe in.

If you’re not sure where to start, read our guide to picking stocks and shares.

4. Understand fees and taxes

Before making your first trades, ensure you understand all potential costs.

When buying US stocks from the UK, these costs will likely be:

- Foreign exchange (FX) conversion fees: American stocks can only be purchased in US dollars, so any transaction to buy them with GBP will include a fee for currency conversion.

- Dealing commission: Many providers (although not Freetrade) charge dealing commission on stock purchases. These vary considerably among different providers, but commission costs can be higher when purchasing US stocks.

Depending on the type of account you are using to buy, hold and sell your US stocks, you may also be subject to tax on any gains or dividends you receive.

The tax you pay on your investments depends on your personal circumstance and current rules may change.

5. Buy US stocks

With all the paperwork done, your choices made, and the risks understood, it's finally time to get investing.

Most modern brokerage accounts allow you to execute share purchases in just a few clicks on a mobile device or web browser. You might have a choice for how you want to buy your chosen stock. For example, you may have the option to buy in the following ways:

- Instant order: An immediate purchase, in which you buy at the best price available now. This may also be called a “market order”.

- Basic order: An instruction to purchase at a specific time, such as when the market reopens.

- Limit order: An instruction to buy stocks at a specific price (or lower). The price your purchase executes at won’t be guaranteed though if the price jumps quickly.

- Trigger order: An instruction to buy stocks when the price reaches a certain level.

Once your order is executed, your new stocks should be visible in your portfolio.

Congratulations, you have invested in US stocks! But that’s only the start of your investing journey.

Why invest in US stocks?

The advantages of investing in US stocks include:

- Shop at the largest market: The US has an enormous variety of stocks on offer. This is demonstrated by its NASDAQ and NYSE being the two biggest stock exchanges in the world based on market capitalisation.

- Diversify your portfolio: Branching out across the Atlantic could protect your portfolio from events that adversely impact the UK economy.

- Access more sectors: US indexes are weighted towards different sectors to the London market, featuring the big tech powerhouses of Silicon Valley and major healthcare stocks.

- The dollar factor: With the US dollar considered something of a safe haven for investors, investing in US stocks might protect you against global currency fluctuations. But remember you’ll usually have to convert dollars back to pounds to withdraw money, and currency movements can impact your returns.

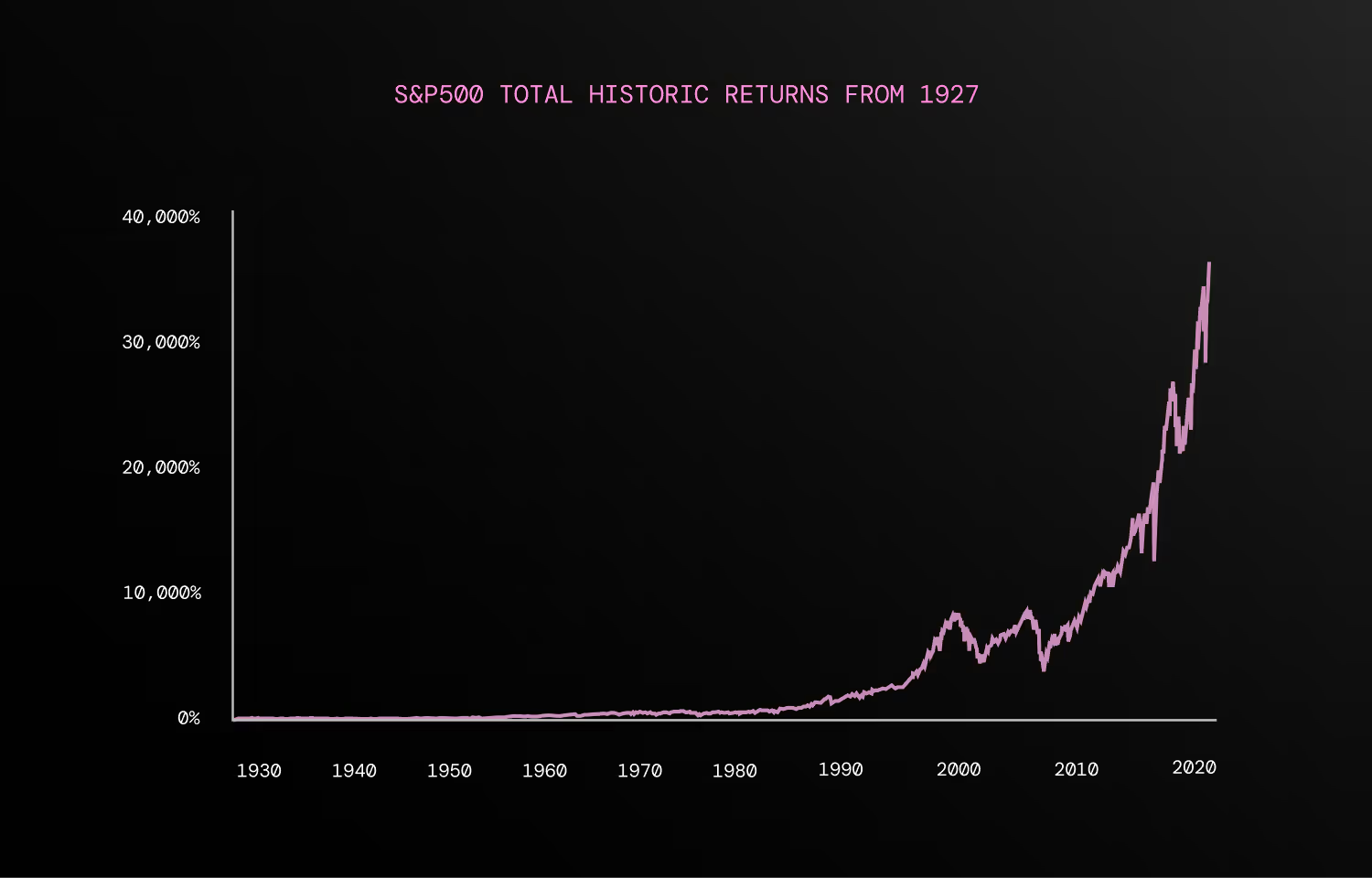

- Historical performance: As you can see from the graph below, US equities have historically performed very strongly.

That’s not to say that there are no potential disadvantages to investing in US stocks. Consider the following:

- Exposure to US economy: Just as a downturn in the UK’s economic fortunes may impact the value of your UK-listed stocks, trouble for the US economy and the USD will impact the value of your portfolio if it features US stocks.

- Higher initial cost: Due to currency conversion fees, the initial cost of investing in US stocks will usually be higher than that of an equivalent investment in GBP.

- Taxes: Any dividend income you receive from your US stocks will normally be subjected to a 15% withholding tax.

Do you pay tax on US stocks in the UK?

You may be subject to taxes on your US stocks if you receive dividend income or dispose of the stocks profitably.

Your dividends will be subject to a 15% withholding tax (or 30% if you have not signed a W-8BEN form) from the IRS. If your annual dividend income exceeds the UK dividend allowance (£500 for 2025/26), you will be taxed between 8.75% and 39.35% depending on your income tax bracket.

The good news is if you are a UK investor you do not pay US taxes when you sell or otherwise dispose of your US stocks. However, you will have to pay UK capital gains tax on any profits beyond the capital gains allowance (£3,000 for 2025/26).

You should always consider the type of account you use for your investments. That’s because investments held within tax-efficient wrapper accounts like ISAs and SIPPs are not subject to capital gains tax or UK dividend tax. Foreign withholding tax may still apply in certain cases.

Tax treatment depends on your personal circumstances and current rules may change. Seek professional advice if you need help with your investments.

Alternatives to US stocks

You might decide that US stocks are not the right investment for you. Fortunately, there are many alternatives you can consider for your portfolio.

US ETFs

Like stocks, ETFs (or exchange-traded funds) are traded on stock exchanges. They are funds that can comprise a variety of stocks, bonds, commodities and other financial products.

ETFs on Freetrade will all trade on the London Stock Exchange, even those tracking foreign markets like the US stock market.

You can find out more with Freetrade’s guide to investing in ETFs.

Other international shares

If you are investing in US shares to diversify your portfolio away from the UK, you could also consider investing in other geographies. For example, Freetrade allows users to invest in stocks from Germany, France, Italy and beyond.

Buying US stocks from the UK - FAQs

Can I hold US stocks in my ISA?

Yes, you can invest in US stocks through an ISA as long as your provider includes access to US markets as part of its offering. Most stocks listed on NYSE and NASDAQ meet the ISA eligibility requirements set out by HMRC, but in some cases you won’t be able to hold US stocks in your ISA.

What time can I buy US stocks?

The two primary US stock exchanges (NYSE and NASDAQ) are open from 9:30AM to 4:00 PM Eastern Standard Time (EST) on weekdays. That’s equivalent to 2:30 PM to 9:00 PM Greenwich Mean Time (GMT).

Pre-market and after-hours trading can happen in the hours ahead of market open and after the close, though these time periods can feature significantly more price volatility due to a lower volume of trading.

What happens if exchange rates move?

Because US stocks must be purchased in US dollars, changes in exchange rates can affect the value of your investments.

For example, if the GBP weakens against the USD, the value of your US stocks will have increased in terms of GBP even if the share price has not changed. Of course, the same is true in reverse if exchange rates move in favour of the pound.

Do I need a US bank account to buy US stocks?

No, you do not need a US bank account to buy American stocks. You just need to open an account with a UK-based brokerage firm that allows you to invest in US shares from the UK.

Important information:

The value of your investments can go down as well as up, and you may get back less than you invest. Always do your own research, this is not investment advice. Fluctuations in foreign exchange rates may affect investments denominated in currencies other than GBP and the amount you receive back.ISA and SIPP rules apply. Tax treatment depends on your personal circumstances and current rules may change.A SIPP is a pension designed for people who want to make their own investment decisions. You can normally only access your money from age 55 (57 from 2028). Seek professional advice if you need help with your pension.

.avif)