Cost averaging is one of the first investing strategies you’ll encounter as a beginner. It’s a well-worn investing technique with the classic combo of jargon-y name, simple reality.

So we think it’s high time to dive in with some clear info.

First, what is cost averaging?

Pound (or dollar, or rupee) cost averaging is when you purposely buy into a share in small amounts over time. The overall price you pay for the shares — your buy-in price — averages out across the fluctuations in the share price.

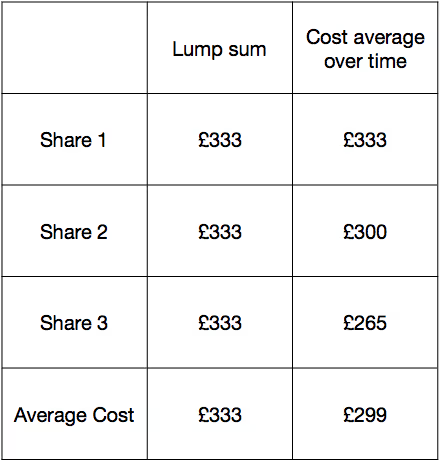

For example, let’s say you have £1000 saved up and want to buy some Tesla shares. Rather than making a single purchase of 3 shares at £333, you wait and buy 1 at £333, another a month later at £300 and the third a week later at £265.

Although you might get a similar end result, note that cost averaging is strategically different than repeatedly investing more as you earn more money. When you use cost averaging, you’re actively choosing to hold money you already have in reserve.

Does it work?

Sometimes! Pound cost averaging is a tricky character. If a share or market is going down over time, averaging does indeed lower your purchase price. Whether you should actually buy into a declining asset depends on whether you really believe in it and think it’s only undervalued in the short-term.

Alternatively, if a share is fluctuating around a similar level — £102, £100, £98 — the strategy also guards against the bad luck of putting in all your money at the highest point. 😬

However, there are potential downsides.

Historically the market has gone up more often than down. 60% of months since 1987 saw the UK stock market as a whole rise higher than the month before.

This won’t necessarily be true for all markets, all the time. However, where it is, cost averaging, on average, is more likely to increase your purchase price than reduce it.

This is another aspect of the famous adage that ‘time in the market beats timing the market’. The huge investment company and ETF provider Vanguard have also been sceptical of cost averaging strategies, after research showing that investing a lump sum usually outperforms averaging.

With most brokers, there’s also the problem of paying multiple high commissions on all those small purchases. With us, of course, that’s not an issue!

Learn more: How to invest in stocks - guide

An interesting nuance

On this evidence, as a strategy cost averaging is a bit of a mixed bag. However, where it does really excel is in the psychological aspect of investing.

Psychologically, averaging can be a much more comfortable way to start than making large purchases all at once. Ultimately, the best investing strategy is the one that lets you progress without anxiety and procrastination. Thousands of people learnt this during 2017’s crypto rush!

It also helps you avoid unpleasant experiences like investing a whole nest egg just before a big drop. No-one wants their nest egg to smash.

So what to do?

Purely as a strategy, cost averaging may not be the best way to maximise your gains, unless you plan to invest mainly during down markets. However, any approach that helps you invest with less anxiety is worth considering. 🤔

Will cost averaging improve your investment performance? Not necessarily. Could it improve your relationship with investing? Quite possibly. 👌

We’ve created one of the UK’s leading stock trading apps to help everyone build their wealth over the long term. Join over 1 million users that have chosen Freetrade for their general investment account, investment ISA or personal pension.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

.avif)