Contrarian thinkers live a hard life.

Swimming against the tide can be a real slog, it’s unlikely to win you many friends and it can feel like an eternity before your ideas are accepted, if they ever are.

In the past you’d run the risk of being branded a heretic and promptly disposed of, just ask Socrates. In 2022 you’re more likely to be labelled an arrogant edgelord and mocked mercilessly on TikTok.

So why on earth go down that path in the first place?

For some, the status quo is boring or unconvincing enough to look for something else. For others it’s more a question of why on earth everyone else is missing what you can see.

When the latter group stumbles upon a stock market almanac and decides to invest, the value-contrarian is born.

Hold your nose, we’re going value hunting

I once heard former Temple Bar manager Alastair Mundy describe value investing as “rummaging around in other investors’ dustbins”.

I’d never heard it put so beautifully.

If it’s new to you, value investing is about buying shares in unfairly unloved or overlooked companies, or firms falling on hard times but with a turnaround strategy in place to get them back to winning ways.

Rather than focusing solely on the market’s shiny headline companies with big plans for growth, value investing tends to revolve around the businesses everyone has forgotten about, written off as basket cases or just never looked at in the first place.

The theory here is that companies with super cheap share prices and, importantly, still decent businesses behind them have more to gain than to lose.

Think classic underdog but with a real chance at the title. Like Quasimodo with a beautiful balance sheet in hand.

If they turn it all around or come back into fashion there’s a huge opportunity for the shares to reflect that.

If they don’t, a lot of the bad news has already been factored into the current position.

Over the last 100 years or so, investing this way - in companies whose share prices are arguably too low, and selling when the market eventually pushes the price up - has served investors well.

Is growth so 2021?

But, in the years since the financial crisis, this style has fallen far behind growth investing.

That’s an approach which focuses on companies growing solidly and earning more than their peers along the way.

The tech sector is a good example of the latter here.

The start of 2022 tells a different story though.

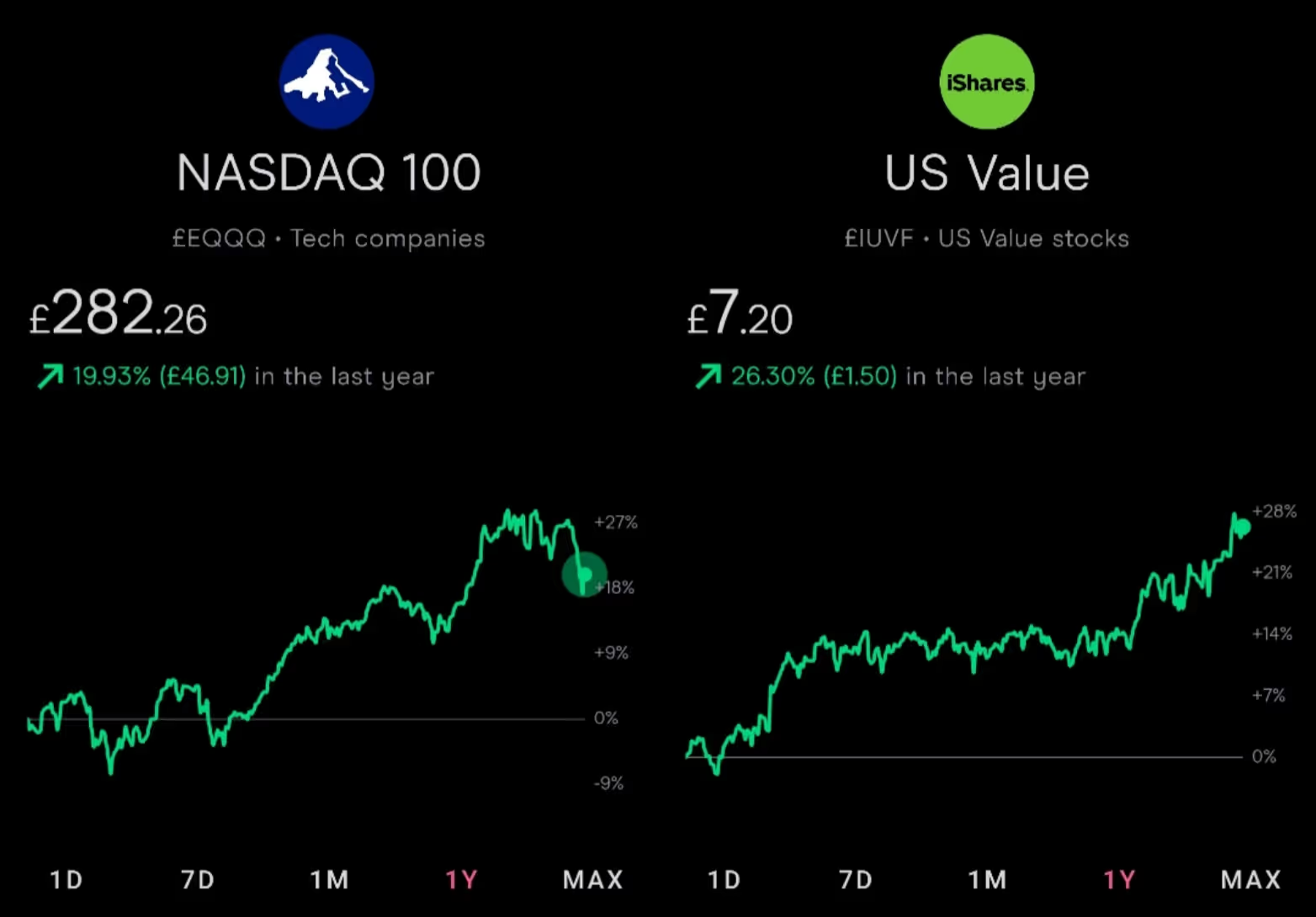

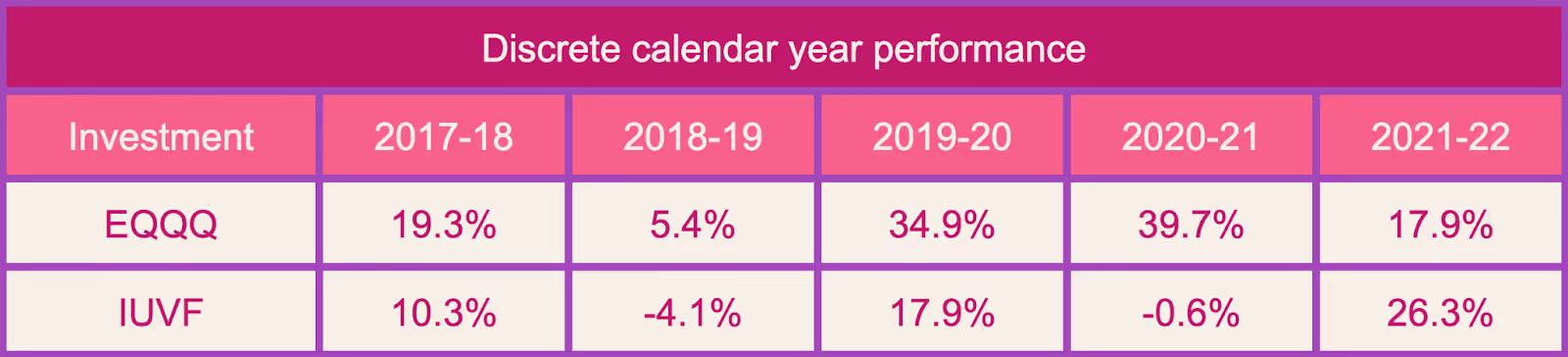

Funds tracking tech-heavy indices like the Invesco Nasdaq 100 UCITS ETF (EQQQ) took a dive heading into the new year, just as value-focused funds like the iShares Edge MSCI USA Value Factor UCITS ETF (IUVF) took off.

Past performance is not a reliable indicator of future returns.

Here’s where the contrarian crowd needs to exercise caution though. A similar thing happened from November 2020 to February 2021 when the vaccine rollout accelerated and the once-hated travel and financial stocks fought back.

It was one of a number of false dawns value investors have had to put up with over the years and this one might just be another one.

But there is an interesting difference this time.

The name’s bond, slightly higher-yielding bond

Interest rates are on the rise, with both the UK and US firmly set on raising them on both sides of the pond over 2022.

That has been music to the ears of banks (which value investors have warmed to) as they make money on the difference between the interest rate they pay us on our savings, and the one they charge us on the loans we take out.

Higher rates in general means a higher net interest margin for them.

The plan to raise rates has also boosted yields in the bond market - something an entire generation of investors might not even be aware of.

If those higher yields stick around that could be good for some of the biggest bond buyers out there - insurance companies (also a current fan favourite among value investors due to their perceived worth and low valuation).

Have a read of my colleague Gemma Boothroyd’s plunge into the insurance sector here.

Don’t call it a comeback

We could opine on the case for a comeback in the likes of the travel and hospitality sectors too but, pragmatically, by now we know it’s fairly pointless guessing the next chapter in the Covid saga. While restrictions persist, those sectors will remain under pressure.

The trick for real value investors is to work out which ones’ share prices are falling because they’re unimpressive businesses to start off with, and which have been punished a bit too much.

That means it’s time to roll up the sleeves and delve into the accounts. Which ones are haemorrhaging cash and which ones have enough firepower to spring back when all this is over?

And that raises a good point that value-seekers always need to remember - no amount of perceived cheapness will suddenly make a bad business good. If there’s no prince underneath, you’re just kissing frogs pointlessly.

Diversify, diversify, diversify

Whether you’re a hardline value contrarian or you much prefer sticking to companies with quality growth characteristics, the past week has shown us that we really should have elements of both in our portfolios.

As private investors, we don’t need to staunchly support or denounce either approach and can take advantage of both so that the styles can pass the baton pack and forth in our accounts on our behalf.

But rather than suddenly trying to swim against the tide yourself and seek out opportunities, there are readymade portfolios on hand, listed on the UK market in the form of investment trusts.

Here are three investment trusts, headed up by value-minded investors with broad portfolios designed to take advantage of an uptick in the economy and welcome investors back to value shares.

These are just a few examples of ways you can quickly and easily diversify your portfolio by adding another strategy that might have been missing.

Fidelity Special Values (FSV)

Manager Alex Wright and his trusty team of analysts aim to swoop in on companies going through a tough time but on the cusp of recovery, then sell when normal service resumes.

Insurance firms Legal & General and Aviva are some of the trust’s top holdings, as the manager thinks they are “cheaply valued, despite strong balance sheets, positive earnings outlooks and attractive dividends.”

Aberforth Smaller Companies (ASL)

Managed by Aberforth’s seven-strong investment team, the strategy here is to look for value others have missed among small UK companies.

A lot of investment firms don’t have the capacity to research every single company on the stock exchange and quite often, it’s the smaller ones they are happier to ignore.

Enter Aberforth.

The further you go down the size scale in the UK, the more those companies tend to serve the domestic UK economy rather than sending products or services abroad.

This means most of the companies Aberforth looks at, like vehicle rental firm Redde Northgate and asset manager Rathbones, have become less popular among investors, who are trying to weigh up how damaging or beneficial Brexit and Covid will be to the UK economy over the long term.

Lowland Investment Company (LWI)

Management duo James Henderson and Laura Foll spend their days looking under rocks among UK companies of all sizes until they find the winners no-one else saw or were too impatient for growth to hold.

Ideally, they aim to put half of the portfolio in the UK 100 companies and mix it up by allocating money to firms further down the cap scale.

Short of walking around town wearing a sandwich board advertising these undervalued companies, it’s been difficult to lure investors away from the growth on offer in the big tech names over the past few years.

It’s no use buying them when you start to feel warm and fuzzy again though, the managers would argue. You have to trust in your convictions and research, and ignore the naysayers in order to really profit from times like these.

The pair hold GlaxoSmithKline in high regard and feature the likes of HSBC, BP and Direct Line among the trust’s top 10 names.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

.avif)

.avif)