Diversifying income sources matters.

With the lion’s share of equity income funds in the UK holding the same big income-payers, if you don’t look under the bonnet you might unknowingly have the same company in three or four of your holdings.

Oil producers, banks, tobacco, metal miners - our portfolios can be full of them without us even realising.

The result is that, while you thought you were diversifying, you were actually concentrating your money in just a few stocks.

Avoid the clump

Dividend clumping is a real problem, so we need to make sure we are spreading our money over different assets and geographies. If a particular market takes a hit, you don’t want your whole portfolio going down with it.

With a big bunch of Finnish stocks landing on Freetrade recently, it’s a good time to see if there’s anything Helsinki-way which could provide that income diversification for what is otherwise likely to be a UK & US-heavy portfolio.

Read more:

Five stocks for 2022

Do I need to get every stock pick right?

Sign up to Honey, our free weekday investing newsletter

Before we get stuck in, it’s important to highlight that this is a wrap-up, not a suggestion or recommendation that you buy or sell any of the securities mentioned.

Remember that everyone has their own goals and unique financial circumstances. These, along with your tolerance for investment risk and time horizon, should inform the mix of assets in your portfolio.

Our resource hub for investing in the stock market might be able to help make that blend a bit clearer for you and our guide on how to invest in stocks is a great start for first-time investors. And if you are still unsure of how to pick investments, speak to a qualified financial advisor.

Hello Europe, Helsinki calling

So what’s big on the Helsinki exchange? Maybe the most recognisable name is 3310 hero Nokia, representing a chunky IT cohort.

Industrials: Kone

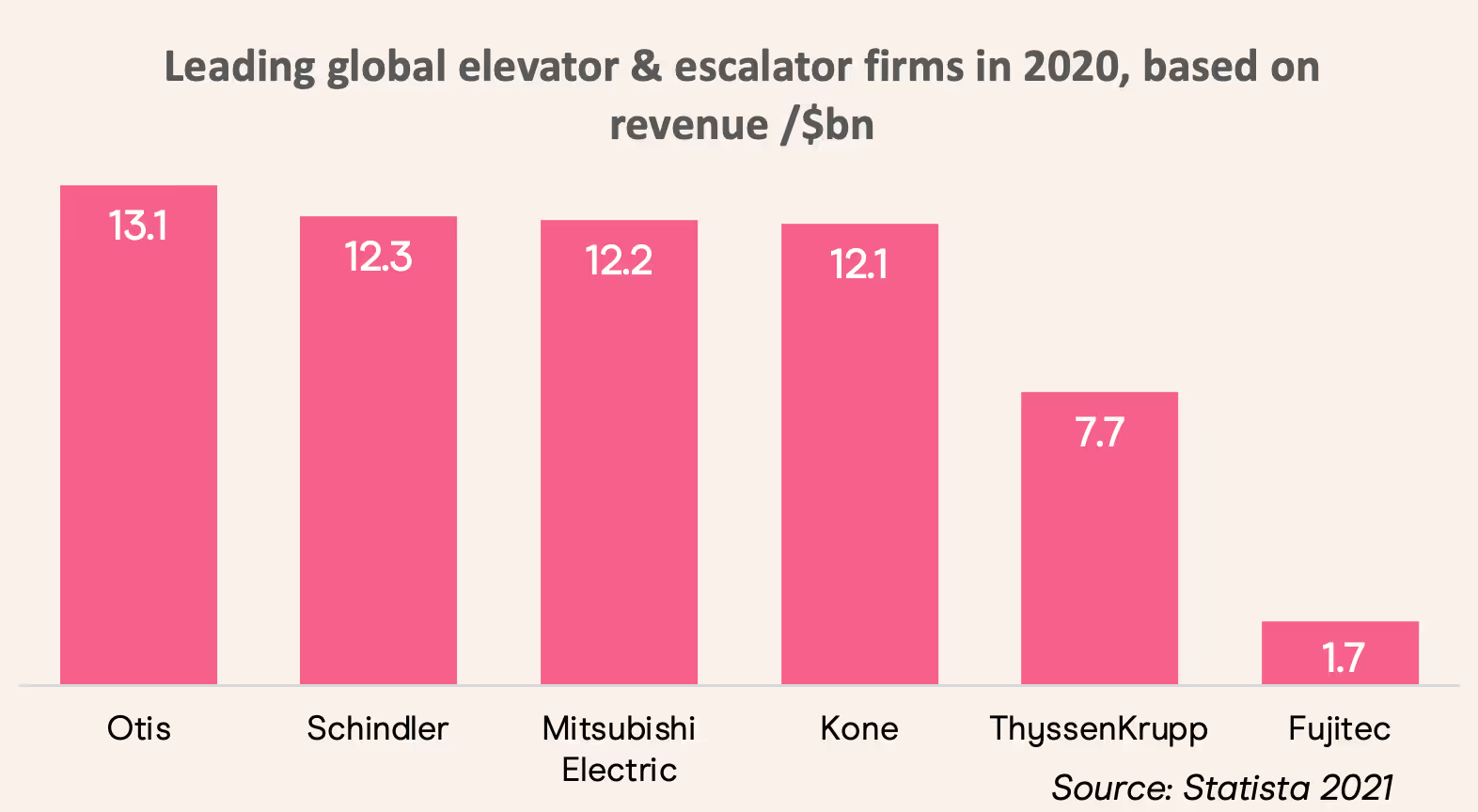

But, away from indestructible phones, industrials make up around a quarter of the Finnish index, with names like elevator firm Kone.

It’s one of only a few big players in the space, along with Otis, ThyssenKrupp and Schindler.

And while the lift-maker’s shares will inevitably go up and down (nope, not even sorry) the draw here is in the after-sales model.

Lifts are chunky pieces of kit and companies don’t tend to change them very often.

So, when Kone offers installation and maintenance services they pretty much have customers for life. Throw in a clause that says no-one else is allowed to service the product and suddenly there’s a real recurring revenue opportunity.

Fundsmith’s Terry Smith has raved about the company’s maintenance offering in the past and income investors might be attracted to the opportunity for capital growth as well as a 3.6% yield.

Financials: Sampo

Financial firms have been largely out of favour since the crisis in 2008.

Overnight, record low interest rates pretty much guillotined the profits banks made on the difference between what they charged us on loans and awarded us on our savings.

But, with interest rates starting to begin their upward trajectory around the world that narrative could be changing.

It’s particularly interesting when we bring in the insurance sector. Insurers are some of the biggest investors in bonds (read Gemma Boothroyd’s cracking deepdive into that here) so a rise in bond yields could really benefit the investment side of these businesses.

Investors in Sampo get access to a bit of all of the above. The insurer has subsidiaries including the UK’s Hastings, and has its own investments in Nordic bank Nordea, as well as Nordax, another bank in Northern Europe.

CRUX Asset Management seems to like the strategy and certainly won’t turn its nose up at a 4% dividend.

The firm appears in the top 10 names of the CRUX European Special Situations fund, whose managers Richard Pease and James Milne scour the continent for overlooked or underappreciated stocks.

Forestry & paper: UPM-Kymmene

You’ll often see ‘Materials’ pop up as a sector when looking through the Helsinki index. What that doesn’t reveal is just how big the country is in paper.

UPM-Kymmene is the biggest firm in the space and has 13 paper mills in Finland, Germany, the UK, France, Austria, China and the United States.

Over the years it has expanded into recycling and energy but still maintains a huge focus on forestry and paper products, employing 18,000 people globally.

And despite the world’s steady move into digital media, those other profit centres have helped shares run up the page over recent years.

Shareholders also get the benefit of a 4% dividend yield to boot - one of the highest yields on the Finnish market and one that offers a distinct difference to what a lot of UK investors will already be exposed to.

Diversify, diversify diversify

Whether your interest is piqued by these firms or not, the point is that we need to be thinking about where our income is coming from and what would happen if that country or sector took a hit.

When the regulator told UK banks to stop paying dividends during the height of the pandemic, that completely shut off an income stream for a vast swathe of British investors.

Failing to prepare for that unlikeliest of scenarios by introducing different sectors and geographies would have been catastrophic. Don’t become part of that group - know where the money’s coming from and what would happen if it suddenly stopped.

Make your investments work a little bit harder with one of the UK’s leading commission-free trading apps. Freetrade has transparent charges, no hidden fees and is one of the only brokers to offer fractional shares in the UK.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

.avif)

.avif)