A few weeks ago we invited our investors to our new office for a mixer. We gave them an update on what we worked on in 2017, and what our priorities are for the next year.

We are now sharing the highlights and some stats below. 👇

2017: Smashing our fundraising target and securing regulatory approval

- We graduated from Octopus Labs’ accelerator.

- We blew past our £300,000 target on Crowdcube to well over £1,000,000. 💰 This overwhelming support changed our plans. We became more ambitious: we’ve decided to double down, and build a full-stack, independent stockbroker.

- A key pillar of our new plan was to earn direct authorisation from the Financial Conduct Authority: the same stockbroker permissions as legacy platforms e.g. Hargreaves Lansdown have. We are proud that our authorisation was granted in October.

- The HMRC approved us to be an ISA Manager, so we’ll be able to roll out with ISAs.

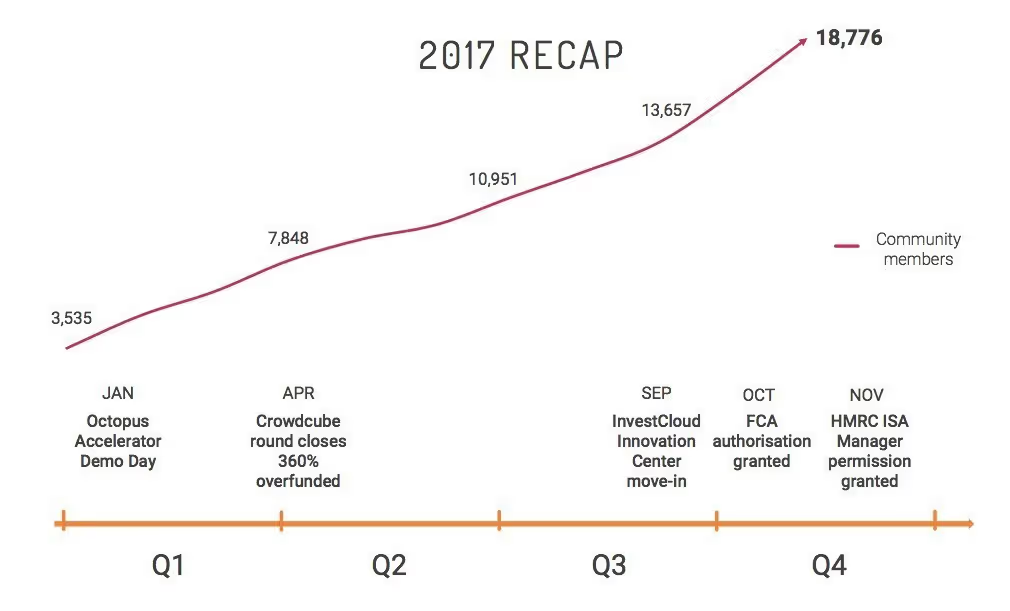

- Our waitlist grew 5x to nearly 20,000 people (our chart above is already outdated 😎). Our story is spreading fast, and we are seeing over 100 signups per day, with an upward trend. And we have just barely started.

- We moved into a new office located in InvestCloud’s Innovation Center. We use the firm’s accounting solution for our books of records (BOR).

- We added 4 senior team members to head up Growth, Design, Finance, and Compliance.

- Last but very far from least, we’ve been hard at work building and assembling the various modules of our tech stack.

2018: Product roll-out and growth

- We’ll do a complete system and control testing, which the Board will sign off as fit for purpose before onboarding our first customers.

- When that happens, we’ll start gradually rolling out the iOS app, and we’ll keep you posted as we go. Initially, we’ll add users in small groups starting with our investors and top ranking community members. We look to onboard everyone as soon as possible.

- On average, 39.5% of our waitlist have Android as their primary mobile device. When we break down our community into age groups, we see that younger members tend to have Android with higher likelihood. The share of Google’s operating system among 18–24 year olds is 46.02%. So, Android is a big priority for us in 2018!

- We’ll join organisations we as stockbrokers need to be members of. At the moment, we’re just waiting for the final approval to join the London Stock Exchange — which we expect any day now.

- We’ll continue to scale our engineering team. We are a small team in central London, and we look to remain lean through our growth, so if you want to work with us, the time to apply is now. We strongly believe everyone should own part of the company we are building, but our thinking is similar to that of Netflix. You choose the mix of salary, equity and benefits that suits you, as well as the working arrangements. If you are interested to work on big problems that will dramatically improve how millions of young people invest, apply!

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Eligibility to invest into an ISA and the value of tax savings depends on personal circumstances and all tax rules may change.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).