Freetrade’s mission is to get everyone investing, and so far over 1.3m people have signed up to the app in the UK alone.

Our freemium business model has helped make this happen, removing confusing fee structures and instead offering you the investment accounts and benefits you want for a simple monthly cost.

These subscriptions are a cornerstone of our mission to get everyone investing and will form the foundations of a sustainable business far into the future.

That’s why today we’re announcing a new evolution of our freemium model with the launch of three redesigned, value-packed subscription plans.

Introducing our new subscription plans:

- Basic. A great place to start, with a free general investment account, commission-free trades*, and access to over 4,800 global stocks and ETFs.

- Standard. Brand new for 2022. Access the full range of over 6,000 stocks, invest tax-efficiently with an ISA and get features like limit orders and stop losses to give you even more control of your investments. You’ll also get 1% interest on up to £2,000 of uninvested cash in between investments.

- Plus. The ultimate Freetrade plan just got even better. We’ve added a self-invested personal pension (SIPP) into Plus so you have all three accounts in one plan: GIA, ISA and SIPP, plus all other Freetrade benefits, including 3% interest on up to £4,000 uninvested cash, access to the Freetrade Web beta, and analyst ratings.

*other charges apply

What happens to my ISA or SIPP?

All ISA and SIPP customers will receive communications about their accounts.

In short, both ISA and SIPP will be included in Freetrade Plus while the ISA will be included as part of Standard, alongside a host of other great features.

If you’re an ISA customer, you’ll also have 60 days to try Standard.

I’m a Plus member, what happens now?

Your Plus membership remains £9.99 per month, and you now also have the option to open a self-invested personal pension (SIPP) as part of our plan. You’ll receive a message with more information on how to do this.

You’ll also get access to new benefits like the Freetrade Web beta, our expanded stock fundamentals, and of course all the existing benefits of Plus.

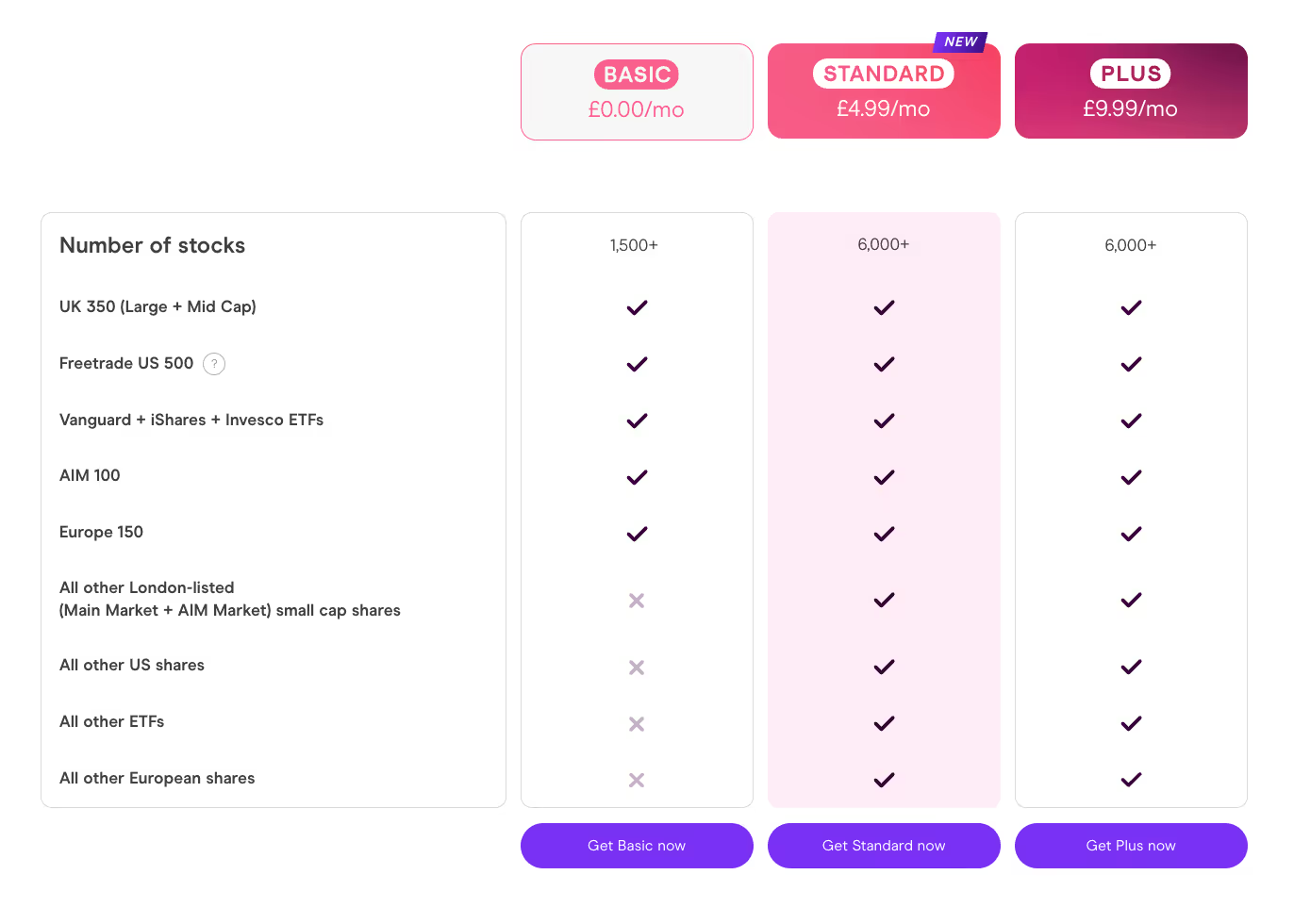

How about the range of stocks?

Access to more stocks has always been one of the most highly-requested features from users.

We’re introducing the full range of stocks into Freetrade Standard as well as Plus. That’s over 6,000 stocks and ETFs from the US, UK and Europe.

The level of access to US stocks for Basic customers will be changing.

Basic customers will have access to over 1,500 stocks, including the Freetrade US 500, a curated list of the most popular Large Cap US companies with valuations over $1bn. This means that some US stocks will be moving from the Basic plan to Standard and Plus, effective on 26 September 2022.

If you hold one of these stocks that will move to Standard and Plus, you will be able to continue to hold the stock or sell it after this date. You will need to upgrade to Standard or Plus if you want to buy more of the stock.

Explore each plan in more detail here, and let us know what you think of them on the community forum.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Tax rules for ISAs and pensions can change and their benefits depend on your circumstances.SIPP is a pension product designed for people who want to make their own investment decisions. You can normally only access the money from age 55 (57 from 2028). Current rules can change. Freetrade does not currently offer drawdown products for our SIPP.Before transferring a pension you should ensure that this is the right thing for you to do and in particular you will not lose valuable guarantees or incur excessive transfer penalties. Pensions are usually transferred as cash so your savings will be out of the market for a period and therefore there is a risk you may lose out on investment gains during this period.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).