Your £20,000 ISA annual allowance will reset come April so it's a good time to find the best stocks and shares ISA account out there.

Whether you're on the lookout for an investment ISA (also known as a stocks and shares ISA) to complement your cash ISA, or you're just scouring the web for the cheapest investment platform out there, we've got you.

So, grab a coffee, sit back and find out which ISA is best for your individual circumstances.

Read more:

Stocks and shares ISA rules

15 common ISA myths busted

The (more realistic) ISA millionaire

How to compare stocks and shares ISA providers

Minimum ISA investment amounts

The ISA allowance for the 2023/24 tax year is £20,000. That doesn’t mean you have to invest that amount, it’s just the upper limit to what you can put in your stocks and shares ISA. Remember, any of your investments made within that allowance are protected from capital gains tax and dividend tax.

Beyond the maximum tax year allowance, there might be a minimum investment you have to invest with certain fund platforms too. So it’s worth checking if the level of platform charges is right for you and your personal financial circumstances.

That lower requirement is more common when you’re dealing with cash ISAs but that doesn’t mean it can’t be a requirement for their stocks and shares cousins.

There's also the possibility that a firm doesn't advertise in flashing lights that they have a minimum, but there are other ways you might pay the price for a smaller account size. For instance, are heavy fees for small account sizes might be a platform’s sneaky way of telling you who they really want on board. And who they don’t. An expensive platform might be expensive for a reason.

Read more: how do stocks and shares ISAs work?

What makes a good stocks and shares ISA account?

The best stocks and shares ISA for your investment portfolio is the one that suits you. It sounds trite but it's true.

And the answer isn't always going to be the cheapest provider. You need to look at both the investment ISA account itself, as well as what the investment platform behind it is offering.

That's because the secret sauce behind the best performing stocks and shares ISA is what actually goes in it and how much is taken out in platform fees.

And you want to make sure the wide range of investments you want to make (be it shares, exchange-traded funds (ETFs) or investment trusts) are actually available with your chosen investment ISA provider.

The last thing you want is to fall in love with a slick investment platform, only to find that you can't fill your ISA with the wide range of stocks you actually want to invest in.

But, away from the stocks to invest in and how the investments inside your stocks and shares ISA perform, there are a few other things to think about when it comes to choosing the best share trading platform and ISA.

Accessibility, investment tools, guidance and education, customer support, and, as we've said - ISA investment charges, all matter. Here's what to keep in mind when you're weighing up the best UK platform for your long-term investments in an ISA.

ISA account fees and charges

That's actually a neat segue into a very important aspect of ISA shopping we've alluded to: fees and charges from investment providers.

Lining up all the traditional UK investment ISA platforms, newcomers, and robo-advisers beside each other seems like a good way to compare ISA fees. But it can turn into a huge headache when you realise they all offer different things and charge in different ways - percentage fees against fixed ones, for example. There isn't one, single 'basic plan' that remains the same across all platforms either. And then there's the fact that certain features might actually seem like reasonable additional charges to you, while they might not to others, all depending on whether they align with your individual circumstances.

As if by magic, here's a quick ISA fee pricing table to put it all in context. While that comparison table can help shine a light on the differences among certain UK platforms, more broadly, you should keep a few of these extra charges in mind:

- The ISA account fee - this might be a flat fee or percentage of your ISA pot. That means if your cumulative performance improves, for example, this charge could go up. That also means larger portfolios might get dinged more than smaller ones.

- Trading fees - often a flat fee, this is how much you’ll pay each time you place a trade. This could also very depending on how often you trade per month. And that can really add up if you have regular investing habits.

- Foreign exchange (FX) fees - how much (normally a percentage) the platform will charge you to buy assets listed in foreign stock markets in foreign currencies.

- Fund fees - these usually apply to ETFs, OEICs, unit trusts and investment trusts. The company running the fund will normally charge a percentage fee (often dubbed the 'management fee',) as a monthly fee. Sometimes, this could be an 'annual management fee', or a 'fund management charge'. The fee rears its head under plenty of names, but it represents the same cost underneath.

So, while it may be tempting to look for the cheapest stocks and shares ISA out there, stopping your search at the headline charges means you won’t get the full picture.

Factor in what your investing habits are and what assets you’re likely to invest in - if you want to buy shares, it’s not much use to you if low fund dealing charges are an ISA platform’s selling point, while you pay a fixed fee for every share trade you make.

How often you plan to invest is important to consider too. Racking up transaction fees on multiple shares, investment trusts and ETFs each month can end up making the cheapest ISA provider look a lot more expensive.

Have a play around with our ISA calculator to see how the Freetrade ISA fees stack up against the other stocks and shares ISA platforms in the UK.

Transfer in existing ISAs

If you’ve built up a few ISAs over the years with different investment platforms, building societies or banks, it might make sense to bring them all together.

It can be much easier to manage them all in one place and makes working out things like ISA fees less of a struggle.

It could be that you’ve spotted a cheaper ISA option for your needs or you want to buy assets that your current ISA provider doesn’t offer.

Whatever your reason, it’s important to make sure an ISA transfer is right for you before you make the move. Be aware of any potential transfer fees and transfer charges you could incur in the process. Our guide to ISA transfers could help here.

ISA account management

Think about what you actually need from your ISA platform. Are you looking for the best trading app or would you prefer a website?

What do you want to see displayed when you log in? Is it useful if you can see your self-invested personal pension (SIPP) or general investment account (GIA) in the same place?

Thinking about how you plan to interact with the services on offer will help decide if it’s the right ISA platform for you but it’ll also help determine if it really is providing value.

Are there any services you’ll be paying for but won’t actually use? If you just want the gym membership, there’s no point paying for the pool and fitness classes too.

Have a look at a few options - do you like the way the investment platform displays your account details? If it’s all a bit confusing that’s just another barrier you can do without, especially if another ISA provider can do all the same things but make it all clearer.

Customer service

We've all had times when customer service either makes or breaks the experience. And the likelihood is that when we need to talk to someone it’s not for a casual chat - it’s to get something done.

That’s why it’s important to have an ISA platform that offers assistance in the way you want it. If you’re a fan of in-app chat or phoning up, make sure that’s what’s on offer.

There’s a lot to be said for a dependable service with knowledgeable staff and decent response times. That might even form part of how you assess whether you’d get value for money or not from your overall ISA account.

Tools

It’s important to have the tools you need when you invest but more doesn’t always mean better. That’s why it’s worth looking at the resources on offer through a very personal lens.

Do you value charting graphs and tools? Are the calculators up to scratch and, importantly, are they all intuitive and easy to use?

If it’s not useful to you or looks confusing enough to put you off using the platform, then no matter how attractive the annual charge seems or how broad the fund supermarket looks, this could be a red flag that the platform's whole proposition is being pitched at a different type of investor.

If you aren’t really that bothered about building a chart full of your Bollinger bands and Fibonacci numbers for your stocks & shares portfolio, there isn’t much point in looking for a platform that offers them.

ISA stocks to invest in

As we’ve said, the ISA is just the tax wrapper which can offer a buffer against income tax and dividend tax. But the ISA doesn't choose your investments for you - that part is entirely up to you.

If you already make regular investments in stocks, investment trusts and ETFs, make sure they’re there when you’re comparing ISA accounts. If the stock list is looking a bit stale, you might find the ones you want to hold just aren’t there or the company might not be equipped to bring new companies and funds into the stock universe.

Investment guidance and education

It’s one thing to want the cheapest ISA out there with the fanciest tools on offer but it’s more important that you do your best to become a better investor at the same time.

Have a look to see if your investment platform has an ISA guide or a suite of content that will keep you up to date with the stock market and give guidance on how to choose the right assets for your portfolio.

Granted, they won’t know your personal situation so you’re unlikely to find a site that tells you exactly what to do. That’s what financial advisers are for, although a lot of people find they can get everything they need with a bit of research and guidance from articles on ISAs and investing.

That said, if you are having trouble and aren’t comfortable choosing your own investments, a financial adviser could help.

Alternatively, our Learn hub is full of handy articles on how to start investing, ways to make sure your portfolio stays in line with your investment personality, and investment strategies for beginners and experienced ISA investors too.

Our free investing newsletter Honey explors everything from how to (realistically) become an ISA millionaire to whether crypto is right for your ISA or not.

DIY or ready-made ISA portfolio?

When we get into investing, a lot of investors fall into one of three buckets:

- Do it for me (likely involving a financial adviser or robo-advice platform for financial advice, and limited personal involvement on your behalf)

- Do it with me (using guidance and research to learn, then investing through execution-only platforms yourself)

- Just let me do it (having enough experience to want to take control and looking for the necessary assets and tools yourself)

And the same applies to the assets we put in our ISA accounts. Some of us would rather outsource it all to a professional and some of us can think of nothing better than doing it all ourselves. The good thing is there’s a way to invest for everyone.

Robo-advisers often have a wide range of ready-made portfolios to choose from, based on the level of investment risk you want to take. Generally, these portfolios are full of exchange-traded funds (ETFs) tracking global markets.

If you still fancy some ready-made options but would like a bit more choice between investment styles and the overall mix of assets, a bigger range of collective investments like ETFs and investment trusts might be attractive.

As a reminder of the difference between the two, an investment trust (or investment company) is a basket of shares chosen by a manager, and listed on the stock exchange for you to buy and sell. They're the person at the helm calling the shots and making the investment decisions on behalf of the trust.

The trust’s manager aims to beat their chosen benchmark index by selectively choosing stocks, as opposed to an ETF which aims to match the market’s performance.

If you already have an idea of the stocks to buy for your ISA and don’t want an adviser or external fund manager on board, chances are you’re just looking for a handy, low-cost investment platform with a selection of assets to meet your needs.

Best stocks & shares ISA providers for beginners

When it comes to initial investment options and tools, less can really be more.

If you’re a beginner investor, a huge range of charts and bizarrely-named funds can be daunting and paralysing. Like wandering aimlessly down the cereal aisle, often it’s better if someone helps whittle down that choice with you or gives you the building blocks (muesli and cornflakes obviously) and lets you develop your tastes from there.

Back in the investment world, that means keeping it simple. If you’re going for an ISA provider with all the bells and whistles, ask yourself if you know what they are, how they’d aid your learning and if they’re worth paying for.

There seems to be the perception that, as you get better at investing you suddenly need more complicated analytic tools and charts. Ironically, often the best investors keep it as simple and repeatable a process as possible.

Whatever level you’re at, being confused is never a positive. So look for an ISA platform that doesn’t make you feel stupid, offers the investment universe you need, and the guidance to help you become a better investor.

Everyone has their own goals and unique financial circumstances so you really need to make sure your ISA providers suit you when you also factor in your tolerance for investment risk and time horizon.

Our resource hub for investing in the stock market might be able to help make that blend a bit clearer for you and our guide on how to invest in stocks is a great start for first-time investors. As we’ve said, if you are still unsure of how to make your own investment decisions, speak to a qualified financial adviser. And remember, whenever you invest, you're putting your capital at risk.

How to choose the best stocks for your stocks & shares ISA

The best stocks for your stocks & shares ISA are the ones that truly match your appetite for your own level of risk, investment goals and time horizon.

If you start relying on hunches or stock tips from excited friends down the battlecruiser you’re not factoring in your own financial situation - the vital element in all of this. Don’t put the horse before the cart.

What might suit your personal situation might be completely wrong for someone else, so try to run your own race and make sure your portfolio lets you sleep at night. That last thing you want is to be fretting over a volatile mix of assets when you could have got the right blend by putting yourself first.

Read more:

Top 10 stocks and shares ISA investments on Freetrade

Another consideration: UK tax allowance changed in April 2023

The UK changed capital gains allowances and dividend allowances as of April 2023.

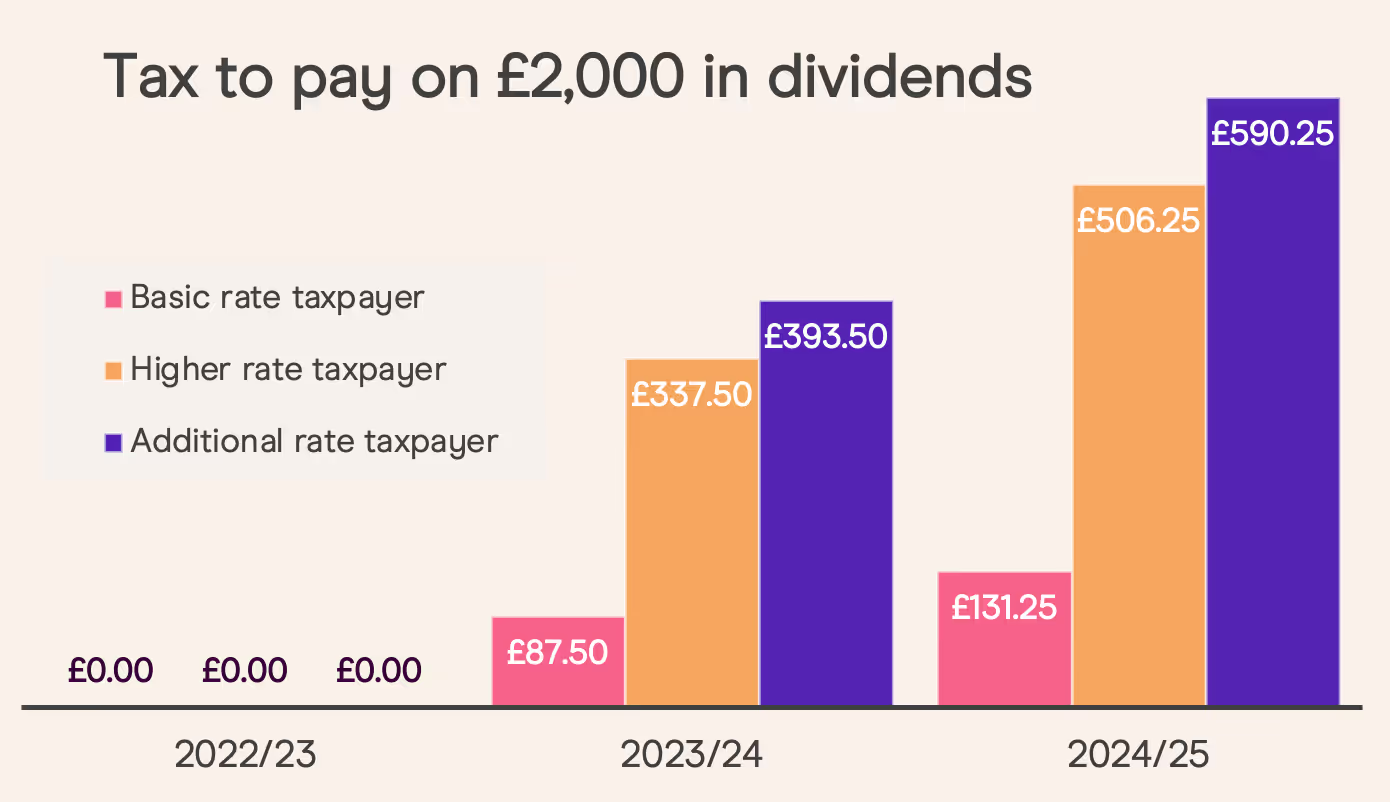

First, the changes to dividend allowances. A basic rate taxpayer earning £2,000 in dividends in the 2022/23 tax year, and earning the same dividend income for the next two years, would suddenly have to pay £87.50 in 2023/24, then £131.25 in 2024/2025.

The rise in dividend tax is even more pronounced for higher rate taxpayers, who would pay £506.25 in 2024/25, and additional rate taxpayers, who’d owe £590.25.

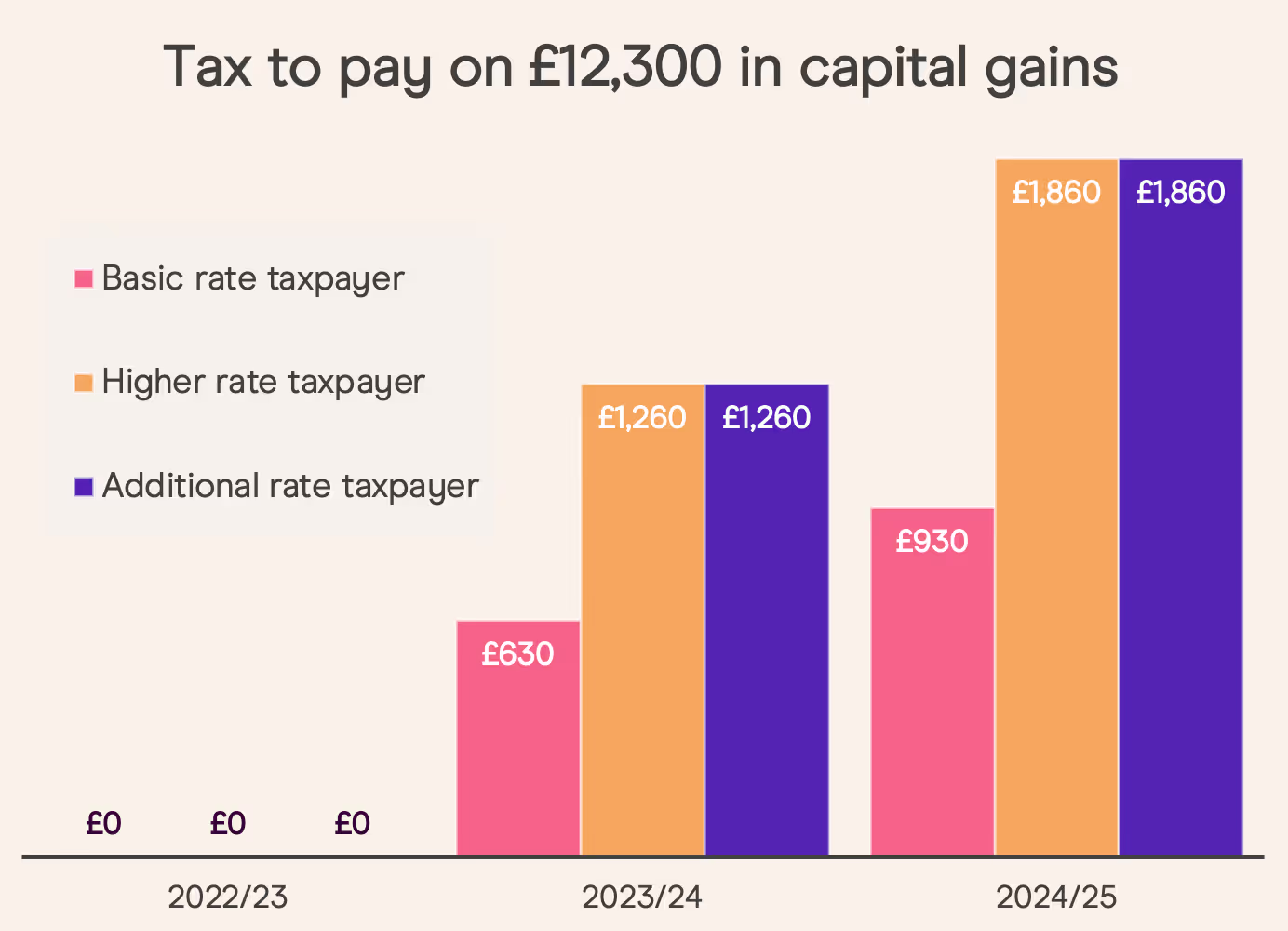

Dividend allowances aren’t the only limits that got the chop in the 2023/24 tax year. The amount you are taxed on capital gains also increased. That's because your capital gains allowance is fell from £12,300. First, to £6,000, then to £3,000 next year.

Of course, if you don’t sell any stocks then it won't matter all that much right now. But eventually, in the long run, the goal is to sell your investments and actually put that money to use. The point here is that you'll potentially have to pay tax on any gains you've made.

The main point here is that you're best equipped to protect yourself from these changes by starting your investments in a tax-efficient account from the start. And that might be long before you actually sell up and move on. But If (and hopefully, when) you do get to that stage, the last thing you want is to be kicking yourself just because you didn’t use a tax-efficient account, like an ISA, to begin with.

Which is the best ISA platform for me?

The best investment ISA providers offer clear and straightforward tools, guides and investment journeys. And they don't cost the earth. For instance, they let you invest in a wide range of ETFs in a way that suits you - without hidden fees.

The last thing you want is to get the bill and see a host of platform fees like annual charges, hidden investment fund charges or trading fees that you simply didn't expect.

Which stocks and shares ISA is best for you depends entirely on what you need from it, whether it will encourage you to be a better investor or will scare you off, and how seamlessly it fits into your everyday life.

If investing in your ISA feels like a huge chore, best saved for a rainy afternoon, there's something wrong. It's not lining up with your investment style or personal circumstances - and that means it's time to get back to the drawing board. The platform might be intended for more active investors or experienced investors rather than beginner investors - but don't panic.

Your stocks & shares ISA shouldn't feel like an extreme sport and it shouldn't be something you resent either. The platform itself is a big part of that - it can either fill your head full of jargon or be your go-to source of investment guidance and building up a diversified portfolio.

Concentrate on the important aspects and match your ISA provider to your money goals as much as you can.

We've created one of the UK's leading stock trading apps to help everyone build their wealth over the long term. Join over 1 million users that have chosen Freetrade for their general investment account, investment ISA or personal pension.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

.jpg)

.avif)

.avif)

.jpg)