Black taxis, buses, tubes. If it moves around the end of the tax year, it’s probably screaming ISA at you.

But even with all that advertising, what a lot of the financial industry fails to do is actually explain the full extent of what those three letters represent.

Unfortunately, that means ISA myths are always rife at this time of year too. And if we’re all a bit hazy on the benefits of an ISA, it means we’re less likely to engage with them and find out if they’re a good fit for us, let alone chart a course to become an ISA millionaire.

Luckily, misconceptions about ISAs are often easily explained. So, let’s clear up 15 of the most common ISA myths that have sprung up, and replace them with what you need to know instead.

Read more:

The (more realistic) ISA millionaire

ISA investors, keep your coffee

Is crypto right for your ISA?

1. You need a lot of money to get started

You can open a stocks and shares ISA (Individual Savings Account - there’s a misunderstood acronym cleared up already) for free with a Freetrade Basic plan.

Everyone has a £20,000 annual allowance across their ISAs for the tax year but there’s nothing to say you have to hit that upper limit. Some people will, some won’t, and it’ll reset come the next tax year.

The current tax year started on 6 April 2024 and runs until 5 April 2025.

You can find more information in our full guide to individual savings accounts.

2. ISAs are just for cash savings

You can opt for a cash ISA, normally offered by banks and building societies. But ISAs aren’t just for cash. There are four types of ISA:

- Cash ISAs

- Stocks and shares ISAs

- Innovative finance ISAs

- Lifetime ISAs

In a stocks and shares ISA you can hold a wide array of assets, including company shares, exchange-traded funds (ETFs), investment trusts and SPACs as well as cash. So, while you can hold cash in a stocks and shares ISA, you can also hold a whole suite of other investments too.

You can have multiple ISAs at once. You can have a combination of ISA types (e.g. a cash ISA and a stocks and shares ISA), or you can have multiple of the same ISA (e.g. two stocks and shares ISAs with different providers).

Be mindful of fees though - having multiple ISAs with different providers could be more expensive. And, don’t exceed your annual £20,000 ISA allowance.

Cash ISAs might be useful for people who couldn’t stomach the risk of the stock market.

One of the most common misconceptions about cash is that, because you can see and hold it, its value stays the same.

What a tenner can buy you next year or the year after is likely to reduce over time due to inflation. It’s often a hidden risk but it’s there all the same. And the past two years sure have shown it.

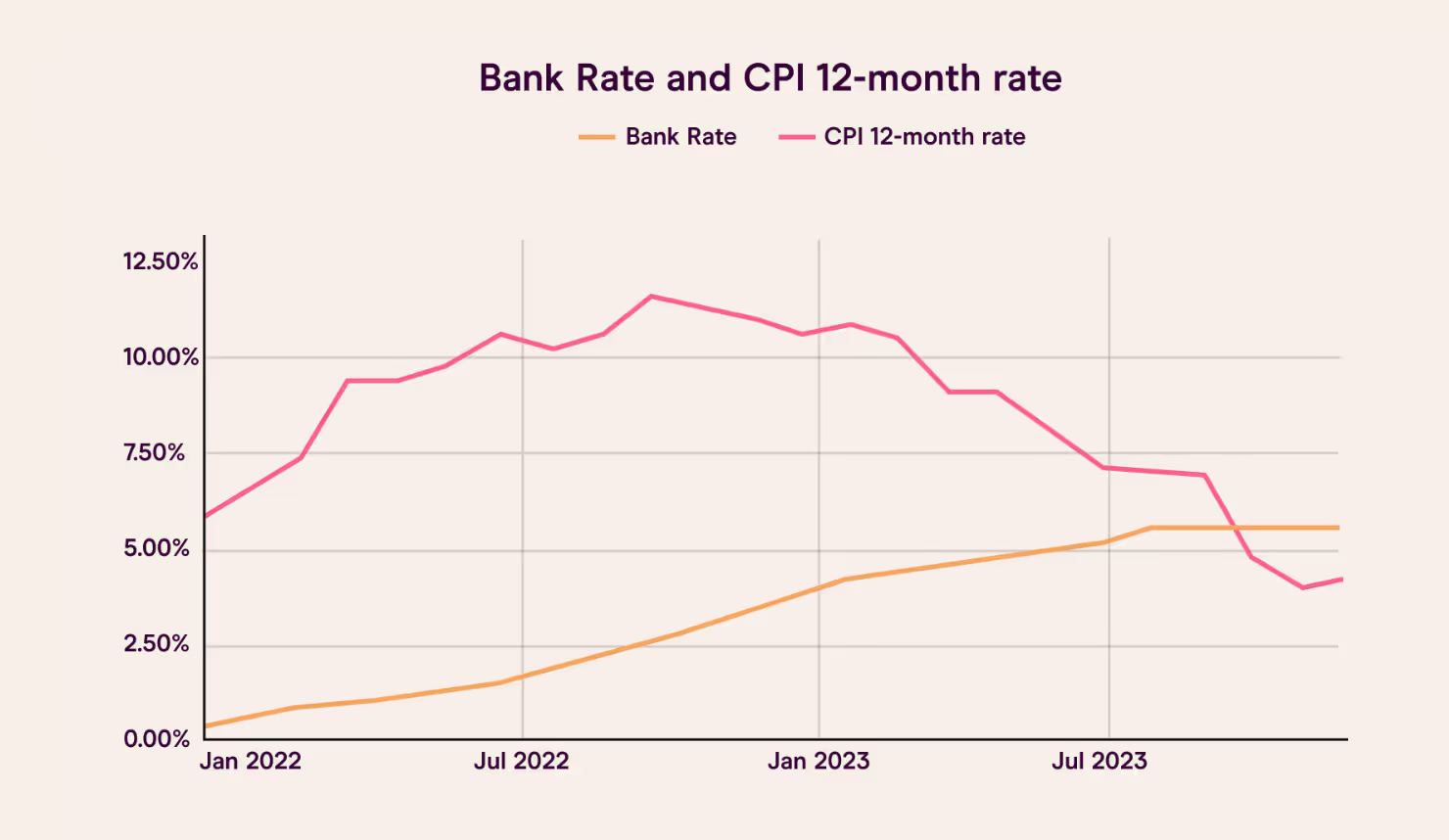

The UK’s Consumer Prices Index (CPI) was up by 10.4% in February 2023 (CPI 12-month rate, ONS), making the average shopping trip a lot pricier (we needn’t remind you, do we?). At the same time interest rates were just 4% meaning the value of cash savings was eroding in real terms.

The good news is that inflation has steadily dropped over the past 12 months, landing on a more comfortable 3.2% in March 2024. Interest rates are 5.25% as of March 2024, so cash savers are seeing their cash savings truly appreciate in value.

So, while cash is less volatile than investments, it doesn’t always beat current inflation rates. Oftentimes, as demonstrated over the past two years, cash savings actually lose value..

This isn’t to say that investments in your stocks and shares ISA come without risk. Whenever you invest, your capital is at risk. That means the value of your investments can go down as well as up. There is a risk that you lose all of the capital that you invest in the market. And this would be much less likely in the case of a cash ISA.

So, why invest?

Investing is also a way to diversify your wealth. Cash is one type of asset, but you can diversify into stocks, ETFs, investment trusts, and Treasury Bills, too. You can invest in different geographic regions, like the UK, US, Europe, APAC and LATAM, and different industries. These different assets have different levels of risk, and consequently, potentially bigger returns.

In the unlikely event your ISA provider went under, your ISA would be covered by the Financial Services Compensation Scheme (FSCS) up to a maximum value of £85,000. This is the case for both cash ISAs and stocks and shares ISAs too.

3. Opening an ISA is complicated

It’s really not. Just keep your national insurance number handy and the rest should be relatively straightforward.

Before you click anything though, here’s a bit more information on who can open an ISA.

You have to be:

- 16 or over for a cash ISA

- 18 or over for a stocks and shares or innovative finance ISA

- 18 or over but under 40 for a Lifetime ISA

And you also have to be either:

- A UK resident

- a Crown servant (working overseas in the civil service, for example) or their spouse/civil partner if you do not live in the UK

You can’t open or hold an ISA on behalf of someone else. Some providers offer Junior ISAs (JISA) that you can open for your children but they’ll eventually take ownership of that. They can start managing it when they turn 16 and actually withdraw from it when they turn 18.

While the opening process isn’t complicated, remember that the ISA is just the wrapper. Once you have an account, it’s up to you what investments you put in it.

Everyone has their own goals and unique financial circumstances. These, along with your tolerance for investment risk and time horizon, should inform the mix of investments you choose for your ISA, if the decision to open one seems right for you.

Our resource hub for investing in the stock market and guides like those on how to start investing and the best investments for beginners might help make that blend a bit clearer for you. But if you are still unsure of how to pick investments, speak to a qualified financial advisor to develop your own investment strategy.

4. The best time to open an ISA is at the end of the tax year

It’s probably when you’ll hear most about ISAs because the 5 April deadline is looming but it’s not necessarily the best time to open one.

Despite how many people leave it to the last second to open their ISA, or squeeze in their final contributions to make the most of their allowance, you can open an ISA at any time.

If you’re planning on contributing to an ISA regularly, maybe monthly right after you get paid, it could be a good idea to start your account sooner in the tax year rather than later.

It’ll also give you more time to make your savings and investments tax efficient.

The last thing you want is to not use your allowance in the best way that you could have for your own financial situation, just because of a bit of disorganisation.

There are also no time limits on how long you need to keep your money invested in a stocks and shares ISA. That said, it’s good practice to have a long-term time horizon when investing, of at least five years to give your investments time to grow and hopefully iron out any short-term volatility.

5. Once your investments in a stocks and shares ISA hit the annual allowance, you start paying tax

This one blurs a couple of important concepts around ISAs, so let’s first separate them.

Your £20,000 allowance refers to how much you are allowed to put into your ISA each tax year. It has no bearing on tax thresholds, it’s just the upper limit to the amount of cash you can add to your account from 6 April to 5 April of a given tax year.

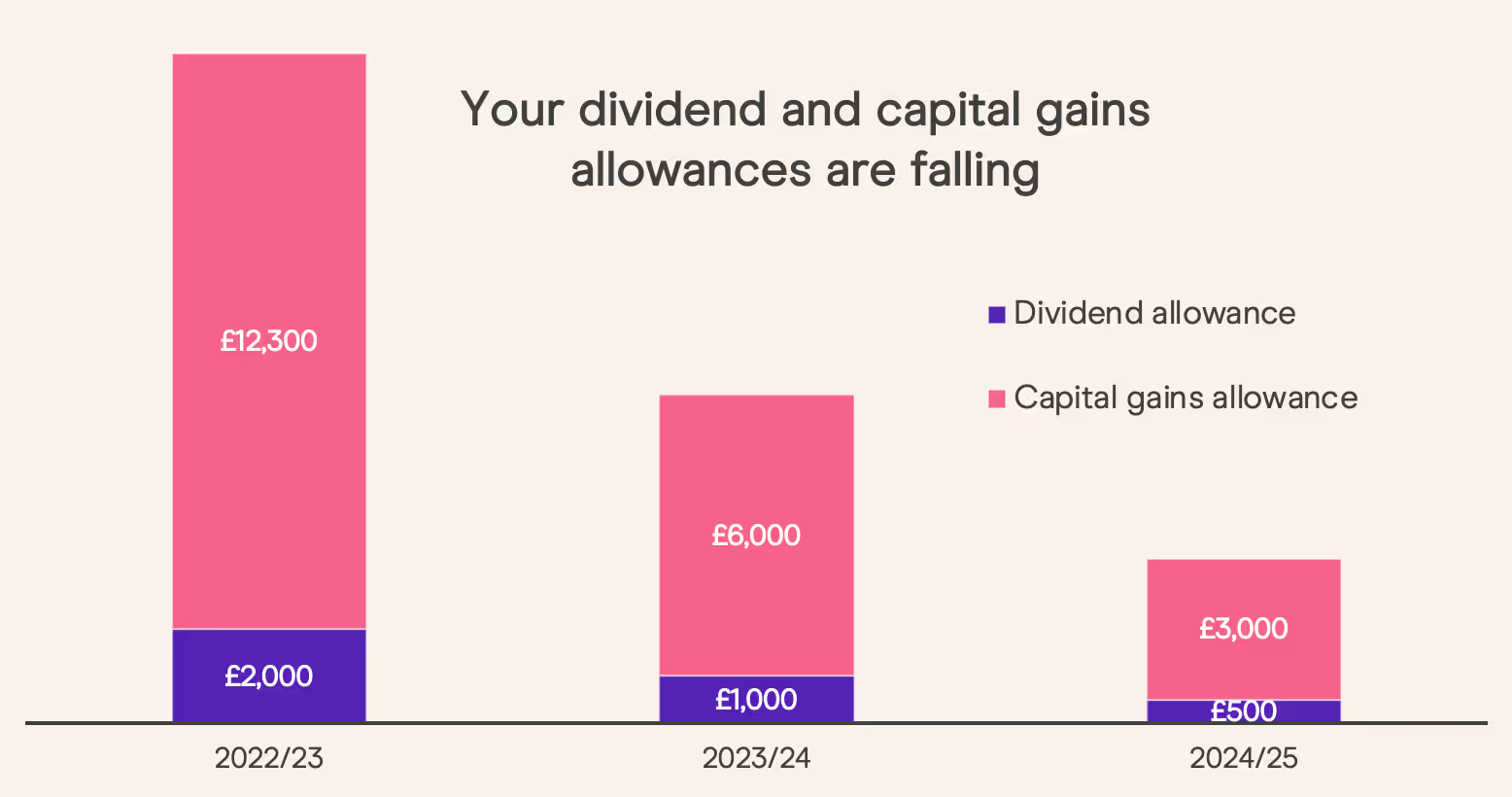

The second part here risks missing the point of stocks and shares ISAs entirely. They offer a way to invest so that you can keep your gains instead of worrying about exceeding the £3,000 CGT (capital gains tax) limit for 2024/25..

If you’re not investing in an ISA, you may end up with a lot of extra maths come year-end, and potentially, much more tax to pay.

The dividend and capital gains allowances that we’ve been used to have been dramatically slashed over the past two years.

6. Stocks and shares ISAs are for seasoned investors

There’s something of a mental barrier behind this myth. Investing can conjure up images of old city traders chatting in code about financial products, but the reality is we can all get involved in taking control of our financial futures with help from a stocks and shares ISA.

In fact, stocks and shares ISAs can be particularly helpful the longer you have them. If your investments begin to grow over time, the benefit is being able to hang onto those gains in an ISA without having to pay CGT.

Whether you’re maxing out your allowance every year or just contributing smaller sums over the years, there’s no need to put on your red braces and Savile Row suit to get started.

And if you’re on a mission to choose the best trading app, it might be worth looking at which providers are set up to help new investors as well as old hands to figure out the best platform for your specific financial goals and needs.

7. An ISA won’t help me, I don’t pay taxes on my savings anyway

We’ve touched on this above but it’s worth laying out what purpose ISAs serve in helping us take responsibility for our own financial futures.

While a lot of us stockpile cash in general savings accounts (or GIAs), record-high inflation has meant the benefit of doing so has faded a lot as of late.

However, we’ve seen interest rates steadily increase over the past year, to the current 5.25% (as of March 2024). If you earn 5% interest on cash savings in an ISA, it may not be as hard as you think to exceed your personal savings allowance.

Personal savings allowance bands

Put it this way. If you have £20,000 in a cash ISA (or across multiple ISAs that you have saved into over the years) earning 5% interest, you’ll earn £1,023 in interest in a year.

- Basic rate taxpayers will pay 20% tax on the £23 that exceeded their £1,000 personal savings allowance

- Higher rate taxpayers will pay 40% tax on the £523 that exceeded their £500 personal savings allowance

- Additional rate taxpayers will pay 45% tax on the entire amount as they have no personal savings allowance

In summary, the current high interest rates may not save you from the taxman.

As we mentioned earlier on, for those making the step from cash into investing, there has to be an acknowledgement that risk becomes a factor here. Those who are ready to accept the risks and volatility that come with the stock market could begin to go beyond a cash ISA, opting for a stocks and shares ISA instead.

If you already have investments in a GIA, be aware that if your gains exceed the 2024/25 tax year’s £3,000 CGT allowance, you’ll be liable for tax on any gains above the threshold.

So, while you might not be currently paying tax on any savings or investments in your GIA, if there is the possibility that you might have to in the future, it’s worth considering how to make your money tax efficient now.

And if the goal of long-term investing is to build up the snowball effect of compound interest over time, the last thing you’ll want is to penalise your gains later on because you chose a different account to begin with.

It all depends on your individual circumstances and sometimes it helps to think about your goals and work backwards. Will the way you currently save or invest hit that nest egg goal or do you need to revisit how you plan to get there?

If tax becomes the hurdle to you reaching your financial ambitions it’ll be too late to turn back the clock, so a smart investor will consider all their options from the get-go and be open to change as their life goes on.

If you want to know more about it, have a read on paying tax on investments in the UK.

8. If I get a stocks and shares ISA, I’ll have to do a tax return

Tax seems to be a word that strikes fear into savers and investors, or just turns us off completely. But if that’s a reason you’re unsure of ISAs, remember the goal here is to be tax-efficient.

That means you don’t have to get involved with any investment-related tax calculations later on, because your gains inside a stocks and shares ISA won’t attract CGT.

There is no explicit need to fill in a tax return for your investments when you invest in a stocks and shares ISA.

9. You have no control over what you invest in within your stocks and shares ISA

It’s never been easier to decide exactly what goes into your stocks and shares ISA. There are a ton of options, including UK, European and US stocks and shares, ETFs and investment trusts to pore over and use for portfolio diversification.

10. ISAs are a better way to save for your retirement than pensions

Workplace pensions and self-invested personal pensions (SIPPs) benefit from tax relief, as well as a host of other unique characteristics that don’t apply to other investment accounts.

And while ISAs and SIPPs are both tax efficient in their own ways, ultimately how you plan to use them can be the key differentiator in which is a better choice for you.

You can currently only access your pension savings and investments from the age of 55 (rising to 57 in 2028). If you have goals that require money before then, and you want to invest tax efficiently, a stocks and shares ISA could come in handy too.

Where the two can complement each other is if you plan to retire before you can actually access your pension. ISAs might help bridge the gap between your working life and your retirement savings kicking in.

It also may be that an ISA could provide tax-efficient dividend income for you as you ease off the pedal at work and edge into retirement. In general though, most people will use pensions to build up their investments for their third age, while they’ll use ISAs for savings goals before then. As we’ve seen though, it doesn’t have to be a case of ISA or SIPP, both can work together.

11. Stocks and shares ISAs are risky

It’s not the ISA itself that carries risk, it’s the stocks and shares you put inside it.

We’ve said it before and we’ll say it again. You can think of a stocks and shares ISA like a sweet wrapper. All it does is house the goodies, it has no taste of its own.

That’s why you’ll often hear it referred to as a ‘tax wrapper’. It’s up to you what you want to put inside.

You get to select the assets and determine your own level of risk. If you’ve never done that before or would like a refresher, have a look at our beginner’s guide to investing in the stock market.

12. You need to decide where to invest straight away

You don’t. The good thing about being able to hold cash in a stocks and shares ISA is that you can add money while you are deciding on what to invest in. Or, if you’ve just sold one asset and you need some time to figure out what to do next, there’s no reason that money can’t await its next destination in your ISA.

While, as we’ve said, the longer you can keep your money in the market, the better, it’s important to be confident in your investments and to feel good about your research before you make any decisions. Cash drag is a real thing and ultimately, stocks and shares ISAs are for investing, not for hoarding cash.

But, you can keep your cash in your tax-efficient ISA while you build up your stock market knowledge in the meantime of making investments.

This feature of an ISA can be useful at the end of the tax year, if you know you want to secure your £20,000 annual allowance but haven’t decided what to invest in yet.

13. You can’t take your money out

There may be different types of ISAs with lock-in periods or terms that penalise savers for taking money out early.

Thankfully, a stocks and shares ISA doesn’t have these rules. You are free to buy and sell assets in your ISA, and withdraw your money when you need it. It should be said, though, that good investing is about letting time do the work. Having a long-term view from the beginning is a key part of developing strong investment principles.

Be aware that withdrawal charges may apply, depending on your ISA provider.

You should also note that withdrawing any amount from your Freetrade ISA will not increase your subscription limit for that tax year, and you may not be able to pay any withdrawn amount back into your Freetrade ISA in that same tax year if you have already reached your limit. For more information, you can check out our Freetrade ISA Terms which outline transfers in, out, and withdrawals.

14. You can’t take money out and pay it back in later

This can be a tricky one because individual ISA providers will approach this differently.

Some providers offer flexible stocks and shares ISAs. This means you can deposit and withdraw money in the same tax year and your allowance will be adjusted accordingly.

It is worth noting this will often also apply to any cash you’ve added but haven’t actually invested.

Other ISAs are not flexible. This means any money you deposit contributes to your allowance. Take the money out and your allowance will not be adjusted.

As an example of the difference between the two, imagine you have your 2024/25 allowance of £20,000.

You deposit £20,000 in cash and then decide you only want to invest £10,000, so you withdraw £10,000.

In a flexible ISA, that means you still have an allowance of £10,000.

But if your ISA is not flexible, then your initial £20,000 deposit means you’ve used up all of your allowance for the tax year. You can’t invest any additional amount.

If in doubt, be sure to check with your provider before you take action.

15. You need to keep your ISA in the same place forever

If you’ve spotted another ISA provider with a better range of investments for you, or you’ve calculated your annual ISA fees only to realise a different app seems more up your alley, then you have the option to transfer an ISA over to your new provider.

You can move your existing ISA to another provider, or just change your existing ISA to another type of ISA with the same provider.

For example, you could move your stocks and shares ISA from your bank to a stockbroker. The account type remains the same but the provider has changed.

Alternatively, you could transfer from a cash ISA into a stocks and shares ISA. You could do this with the same provider or move to a different one.

An ISA transfer should be handled by the provider you’re moving to, so check with them to see how you can start the process.

The first thing to be aware of is a possible exit fee. This is a fee you may have to pay for moving your ISA from one provider to another. It will be charged to you by your existing provider.

Make sure you know if you’ll have to pay one before you do anything, or if your new provider will help cover it.

The actual ISA transfer process can take two routes:

'In specie' ISA transfers

This type of ISA transfer will keep your existing investment portfolio intact and move it to another company.

So if you were wondering, “Can I transfer my shares into one ISA from another ISA?”, the answer is ‘yes’, if you do an ‘in specie’ transfer.

In specie transfers can take around six to eight weeks, whereas cash transfers usually take about four weeks. You can check with either your current or future ISA provider for more information on how to transfer an ISA.

Cash ISA transfers

This is where your existing holdings are sold and the resulting cash is transferred to an ISA with another provider. You might already be holding cash in a cash ISA. So in this case, your cash would be transferred and added to that balance. In general, cash transfers are faster than in specie transfers.

And with that, this myth-busting meeting is adjourned!

Protect your investments from UK tax with tax-efficient investing accounts like a stocks and shares ISA or a self-invested person pension (SIPP). Check out the ins and outs of both accounts before opening one. Take a look at our ISAs Explained guide and our SIPP guide. We summed up the key differences in our SIPP vs ISA guide.

ISA eligibility rules apply. Tax treatment depends on personal circumstances and current rules may change.A SIPP is a pension designed for you to save until your retirement and is for people who want to make their own investment decisions. You can normally only draw your pension from age 55 (57 from 2028), except in special circumstances.At present, Freetrade only supports Uncrystallised Fund Pension Lump Sums (UFPLS) for customers who wish to withdraw funds from their SIPP after their 55th birthday. We strongly encourage you to seek financial advice before making any withdrawals from your SIPP.

.avif)

.avif)

.jpg)