Three-letter acronyms are always a fan favourite. Think about it. They cover everything from major broadcasters like the BBC or ITV, to the highly-trained SAS special forces. Even financial regulators like the FCA and countries like the USA can’t get enough. But none are as important to savers and investors as the mighty ISA (individual savings account).

Although spelling it out involves just three letters, there’s a lot to unpack with an ISA. Most importantly, there are various forms of accounts available. This includes cash ISAs for, you guessed it, cash savings. Then, you have investments ISAs such as the stocks and shares ISA and innovative finance ISA. And then there’s the lifetime ISA, which is a bit of a blend of everything.

Although you get an overarching annual allowance for all of these ISAs, which we’ll explain later, each ISA can come with its own rules, limits, and tax advantages. You should be aware of these to make the most of the full range of ISAs available for your best shot at building long-term wealth.

What is an ISA and how does it work?

An ISA is a type of account, sometimes referred to as a ‘wrapper’ (not the type that rhymes), which can shield your money from certain tax burdens when saving or investing. An ISA is also unique to people based in the UK.

Everyone gets an annual allowance too. As it stands, the current annual limit is £20,000 for the 2023/24 tax year. But this figure isn’t set in stone, and it can change.

An ISA allows you to save or invest in a tax-efficient way. This happens because the tax treatment of this type of account is more favourable than an ordinary savings account or general investment account (GIA).

An ISA’s tax-efficient advantages will depend on your account type. For example, using cash ISAs for cash savings means you won’t pay tax on interest earned over time. Whereas with investment ISAs, you can avoid paying taxes on UK dividends or any capital gains tax (CGT) obligations.

Why would you have an ISA?

The most straightforward reason is that ISAs can allow you to pay less tax and keep more of your potential investing profits or money earned on cash through interest received.

No one wants to (and nor should have to) pay more tax than is necessary. ISAs provide some welcome respite and breathing room in the world of taxes.

Not only do ISAs offer favourable tax treatment for your hard-earned money, they’re also beneficial for your peace of mind. Savings and UK investments held in ISAs don’t need to be included in your tax return, which is one less piece of admin for you to worry about.

What’s the ISA allowance for 2023/24?

Your total annual allowance for this tax year is £20,000. This could be used in entirety for either a cash ISA, stocks and shares ISA, or an Innovative Finance SA. Alternatively, you can split the total allowance across them like a three-piece combo. It’s up to you how to distribute your cash into your ISA accounts. Money put into a lifetime ISA also counts towards this annual limit, but it’s somewhat of an outlier because you can only save a maximum of £4,000 each year.

As mentioned, these limits can adjust over time. For example, the initial annual allowances for ISAs when they launched back in 1999 was £7,000. This annual limit gradually increased until it hit £20,000 in 2017, remaining at this level ever since.

In the future, the government could increase your annual ISA allowance, decrease it, or remove it altogether. This is why, no matter your financial goals, it’s worth making the most of the range of ISAs to rack up as much favourable tax treatment while you can.

What are the four types of ISA?

Here are the currently-available ISA accounts you can open.

- Cash ISA

- Stocks and shares ISA

- Innovative Finance ISA

- Lifetime ISA

1. Cash ISA

This type of individual savings account is for your cash savings. You can use the whole of your yearly allowance for a cash ISA if you like. Or, you might choose to put your allowance to work in all of the other ISAs instead.

Cash ISAs work similarly to most ordinary savings accounts (apart from the key advantage of tax-free interest). So, the different types of cash ISAs on offer would include accounts like:

- Easy-access

- Regular savers

- Limited access

- Fixed-rate no-access (for a period of months or years)

- Variable rate

Although the bones of all cash ISAs are essentially the same, the options and rules for accessing your cash savings will depend on your particular provider and the flexibility the scheme administrator allows.

Read more:

Cash ISA vs stocks and shares ISA

ISA guides

Types of ISA

2. Stocks and shares ISA

The stocks and shares ISA is your primary investment option for money outside of your ordinary savings that you want to invest in hopes of it growing over a more extended period. This could involve stock trading, looking for the best long-term stocks, or if you’re starting out, finding the best investments for beginners.

Again, you can use your total yearly allowance towards investments in this type of ISA if you want. The favourable tax treatment means that over the long run, your money can grow without UK dividend or capital gains tax eating away at your potential profits.

Also, when you decide to start withdrawing money from your stocks and shares ISA, it won’t count towards your total income for that year, which means no income tax applies.

Remember that just because you’ve withdrawn money from your ISA doesn’t mean you can put it back in whenever you please. If you’ll exceed your allowance by re-adding that money to your ISA, then you can’t deposit it back.

Be sure to check our full guide of stocks and shares ISA rules if you’re still not clear on how ISA allowances work.

Although there are tax advantages to ISAs, it’s best to think of the account as a tax-efficient way to invest rather than as a tax-free wrapper that completely protects you from all taxes.

There are some instances in which you would still pay some tax on investments, such as with US stocks and shares, where you’d still have to pay a withholding tax (WHT) of 15% on ISA dividends or income. Read this to find out more about buying US shares in the UK.

Also, for a better general understanding of investing, you can check out this guide explaining how to invest in stocks.

3. Innovative Finance ISA

Another shade of investment ISA, this option is a little more complex.

A limited number of investment brokers and platforms provide this type of account, largely because your investment options are narrower and come with less protection.

With an innovative finance ISA (IFISA), the main difference from a cash ISA or stocks and shares ISA is that it allows peer-to-peer (P2P) lending. In practice, this means pairing up investors (like yourself) with borrowers (individuals, property developers, businesses etc.).

Lending directly means that you can sometimes access a better ‘target return’ than if you were to keep your cash in a bank. And these third parties can access more favourable lending terms than if they were to borrow money from a large financial institution. So it can be a win-win situation for you and the borrower, and a good source of alternative income.

But the critical point to be aware of is that this flexible lending comes with a higher investment risk than most other forms of investing. There can be a higher risk of defaulting because there are lower levels of regulation and your eligible deposits are not protected by the FSCS (Financial Services Compensation Scheme).

The annual limit for this ISA is also £20,000 (your total allowance).

Remember, your right blend of ISAs will depend on your situation and financial goals. It’s worth seeking independent financial advice if you’re unsure of the right ISA mix to reach those future goals.

4. Lifetime ISA

This final option is somewhat of an outlier, mostly because it comes with different rules and a unique annual allowance.

The lifetime ISA (LISA) has an annual limit of £4,000 each year (that’s still part of your overall £20,000 annual allowance). A key benefit of this account is that a 25% top-up will be added to your savings, like a government bonus if you will. But there’s a catch.

You must be over 18 and under 40 to open an account, and the funds can only be used for buying your first home or saving for retirement. Once you turn 50, you can’t put any more money in, and then you have to turn 60 before you gain access to money held in the LISA.

The LISA rules and stipulations don’t stop there. Should you need to access your savings before you’re 60, or for something other than buying your first home, you’ll be hit with a withdrawal charge. That means you lose your top-up bonus, and then some.

As a penalty, you’d pay a 25% withdrawal charge, leaving you with less money than you initially put in. So this is worth bearing in mind if you think you need the flexibility to access your money.

One benefit that some people aren’t aware of is that you don’t have to just hold cash in a LISA. If you like, you can also use this type of ISA to invest. But, depending on your investment broker, your investment options may be limited. For example, some may only let you invest in investment trusts, whereas other platforms may restrict you to funds, or just provide stock market trackers like an ETF (exchange-traded fund).

How many ISAs can I have?

There’s no limit to the number of individual savings accounts you can hold, but you may find that the rules and eligibility criteria for each type of account limit your actual options.

You can have more than one ISA, but you can only open and pay into one of each type of ISA every tax year.

Also, it’s not worth having loads of ISA accounts scattered about in most cases, because it can make your finances more difficult to manage and your gains might be getting eaten away by fees.

Finding a great provider, then filling out the transfer application form for carrying out your ISA transfer and consolidating your holdings, could be a more straightforward way to save and invest. Just make sure you know all the potential mistakes to avoid when transferring your ISA before you start the process.

What are my investment allowances for 2023/24?

The times they are a-changin’. Recent announcements from the UK government have laid out a less desirable landscape for savers and investors.

Changes introduced to investment tax allowances mean it’s more important than ever to make the most of your annual ISA allowance to give yourself the best shot at reaching your financial goals.

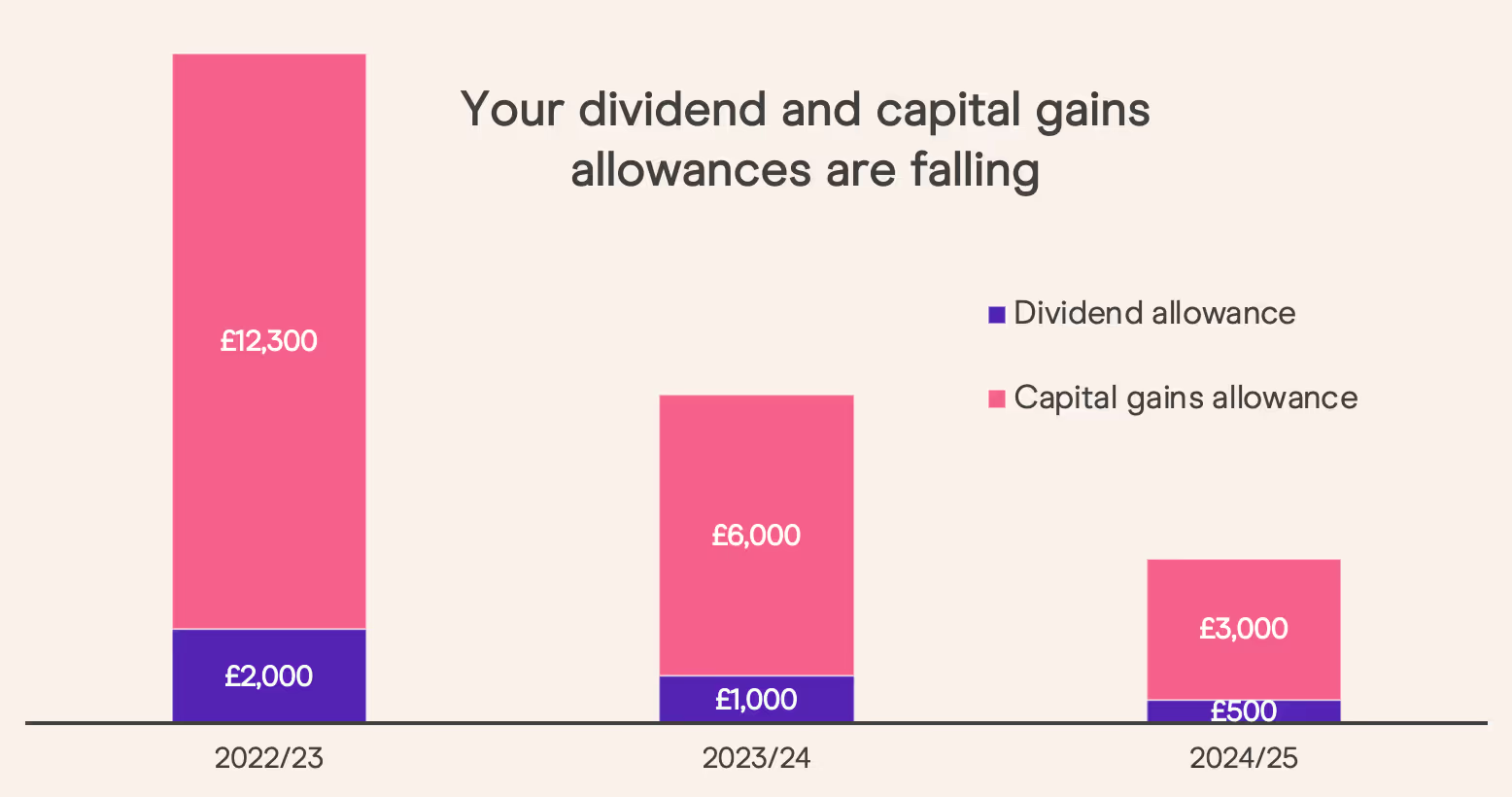

Failure to use all of the tools at your disposal could leave you with money on the table for the government to scoop up. Here’s a table to show how your investment allowances are being reduced over the coming years:

For this 2023/24 tax year, you have a dividend tax allowance of £1,000 and a capital gains tax allowance of £6,000. That means anything within these thresholds is tax-sheltered. Going over these levels is when your tax-efficient investment ISA will shine.

The new changes mean your allowances are going down, so you have less wiggle room for potential profits to turn into tax-free gains. For basic, higher, and additional-rate taxpayers - your tax liability for investments will be even further exacerbated without protection.

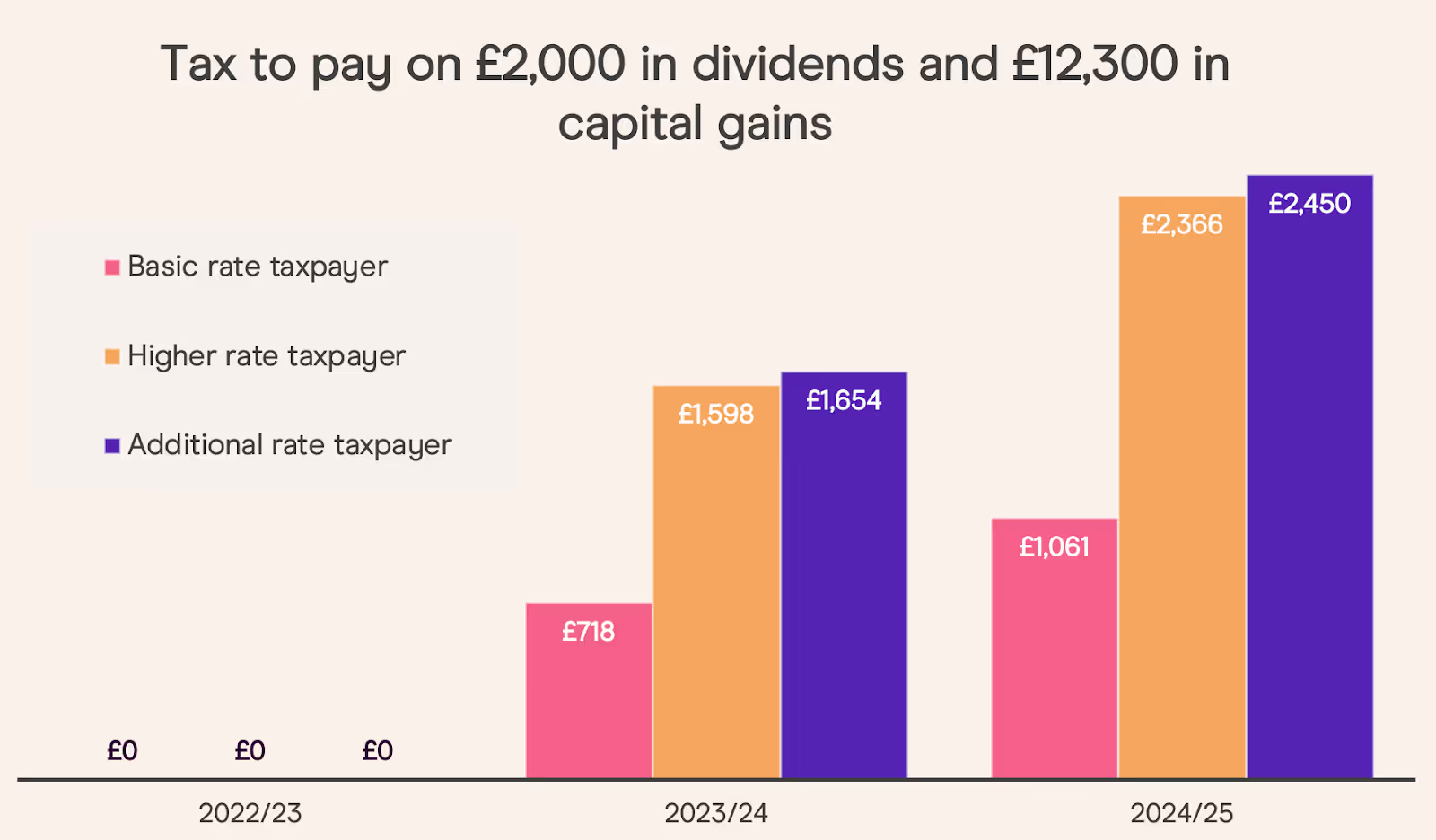

Here’s what your possible tax burden will look like for the 2023/24 and 2024/25 tax years, for different levels of income tax brackets:

What’s important to keep in mind is that making the most of your ISA allowances will allow you to not worry about these incoming reductions to your tax-free investment allowances.

There’s no point paying more tax than you need to. In order to do so, you may need to take action to ensure you’re fully protected from these winds of change with a weatherproof tax-wrapper like a stocks and shares investment ISA.

ISA Q&A

1. Is an ISA better than a savings account?

This depends on your needs, but in most cases, yes. The majority of features available with an ordinary savings account can also be found with a cash ISA. This means you can still access your cash in something like a fixed rate or variable rate cash ISA if you’d prefer, it doesn’t have to be locked away.

But the final blow to a savings account in the ISA vs savings account debate is the ISA’s tax efficiencies. In the 2023/24 tax year, you have a personal savings allowance (PSA) of £1,000 for basic-rate taxpayers, £500 for higher-rate taxpayers, and £0 if you’re in the additional-rate band.

With a standard savings account, you’ll have to pay tax on any interest above these thresholds.

The tax advantage of holding your cash in a cash ISA instead means you can avoid this entirely, paying no tax on the interest earned in your total savings pot.

2. What are the advantages of an ISA?

The specific benefits will depend on which type of ISA you’re using. Here’s a rundown of the notable advantages across the range of ISAs:

1. Cash ISA: eligible deposits in this tax-free wrapper can grow without additional tax. This means you can save up to £20,000 yearly and earn tax-free interest on your money.

2. Stocks and shares ISA: this investment ISA allows you to put as much money as you’d like up to your £20,000 annual allowance into investment options of your choice. Investments held here receive favourable tax treatment, which in most cases means tax-free gains that are not subject to UK dividend or capital gains tax. Another key advantage is that any money you take out won’t count towards your income tax for the year.

3. Innovative finance ISA: a slightly more advanced and restrictive investment ISA. Again, you can invest up to your whole annual limit of £20,000, but into fewer investment options than you can with a stocks and shares ISA. An advantage could be the potential profits and income returns from a P2P lending scheme, but remember, these come with higher risks attached.

4. Lifetime ISA: the standout upside of the LISA is the 25% government bonus. Also, you can choose whether to keep your holdings as cash or invest it. But, you’ll have to pay a hefty penalty charge if you withdraw it before 60, or for a reason other than buying your first home.

3. What are the disadvantages of an ISA?

Here’s an explanation of the main drawbacks you should be aware of when using different types of ISAs:

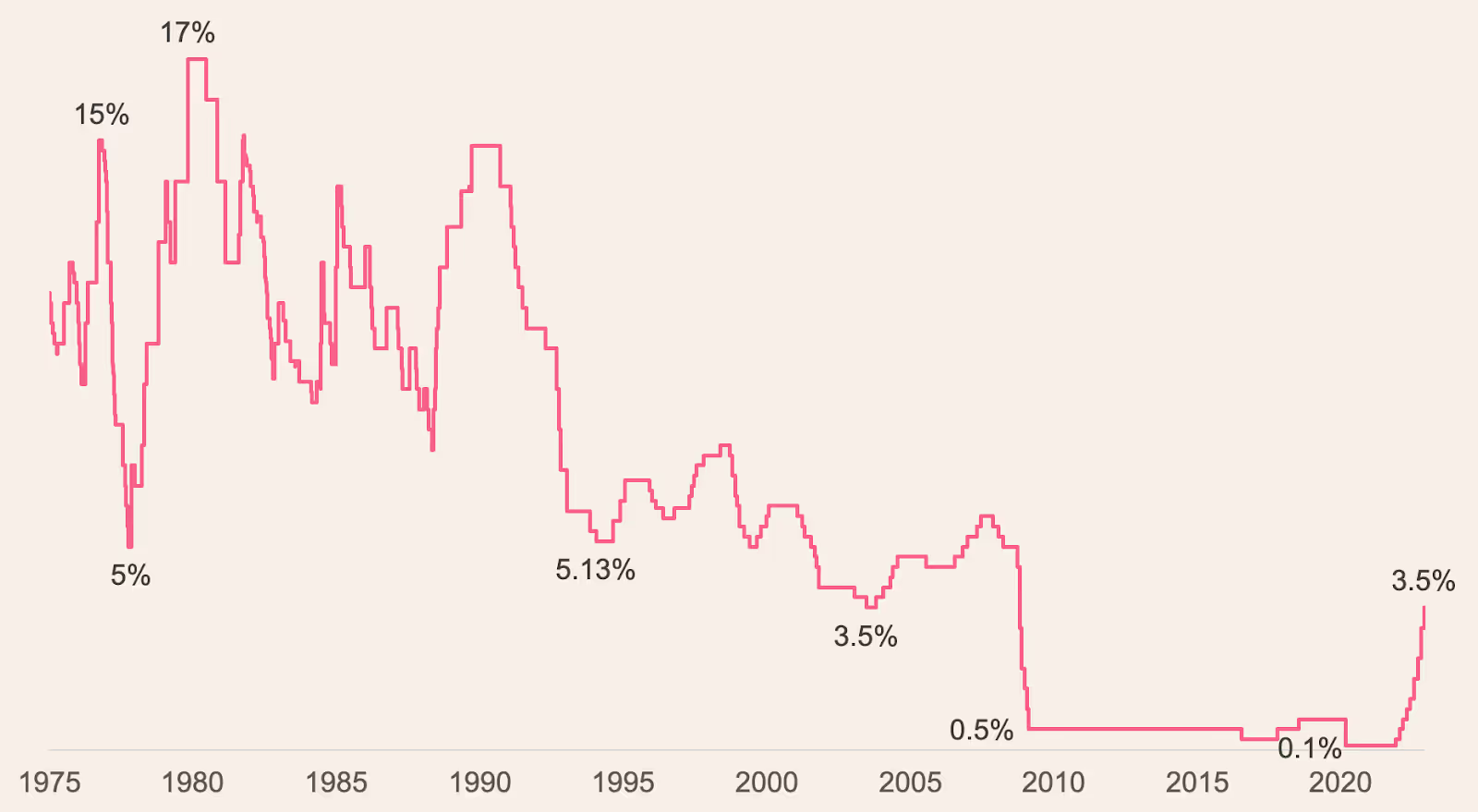

1. Cash ISA: The interest rates on offer with cash ISAs have been meagre (to be polite) over recent years.

Even in an environment of rising interest rates, the return on cash held in an ISA is far lower than the current level of inflation, which means your money will be losing value over time.

2. Stocks and shares ISA: It’s important to remember that you may get a higher return when using this type of ISA, but you’ll also have to accept a level of investment risk compared to ordinary cash savings. Though, this level of risk is entirely within your own control. It’s up to you to choose the right broker for your individual needs, and the best investments for your financial goals and risk appetite.

3. Innovative finance ISA: This type of ISA doesn’t offer a deposit guarantee scheme, and scheme administrators are not members of the FSCS. This means your deposits are not protected, and you are wholly reliant on your provider. Investing with P2P lending can also be confusing and complex, so it might be worth seeking out independent financial advice if you want to utilise this type of investment account (which may involve an added cost too).

4. Lifetime ISA: you can only use up to £4,000 of your total allowance in a LISA, and this type of ISA is only for buying your first house or as a retirement fund. Otherwise, you’ll face a withdrawal charge on any balance you take out.

4. When should you not use an ISA?

In most cases, ISAs are best used for long-term investing and saving. If you need access to your savings in the immediate or short term, you may want to use something other than an ISA. That said, a cash ISA could still be useful if it’s an easy-access account that offers a decent interest rate and doesn’t tie up your money so it’s out of reach.

5. Is an ISA a good investment?

An ISA is just an account. So, it’s the investment options you hold within the tax-efficient ISA wrapper which determine the answer to this question.

It’s now easier than ever to research and find investments that may suit your needs and financial goals. Our resource hub for investing in the stock market might be able to help make that blend a bit clearer for you and our guide on how to invest in stocks is a great start for a first-timer's investment decisions.

And if you are still unsure of how to pick investments, speak to a qualified financial advisor to develop your own investment strategy.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

.avif)

.avif)

.jpg)