The UK market is looking achingly cheap.

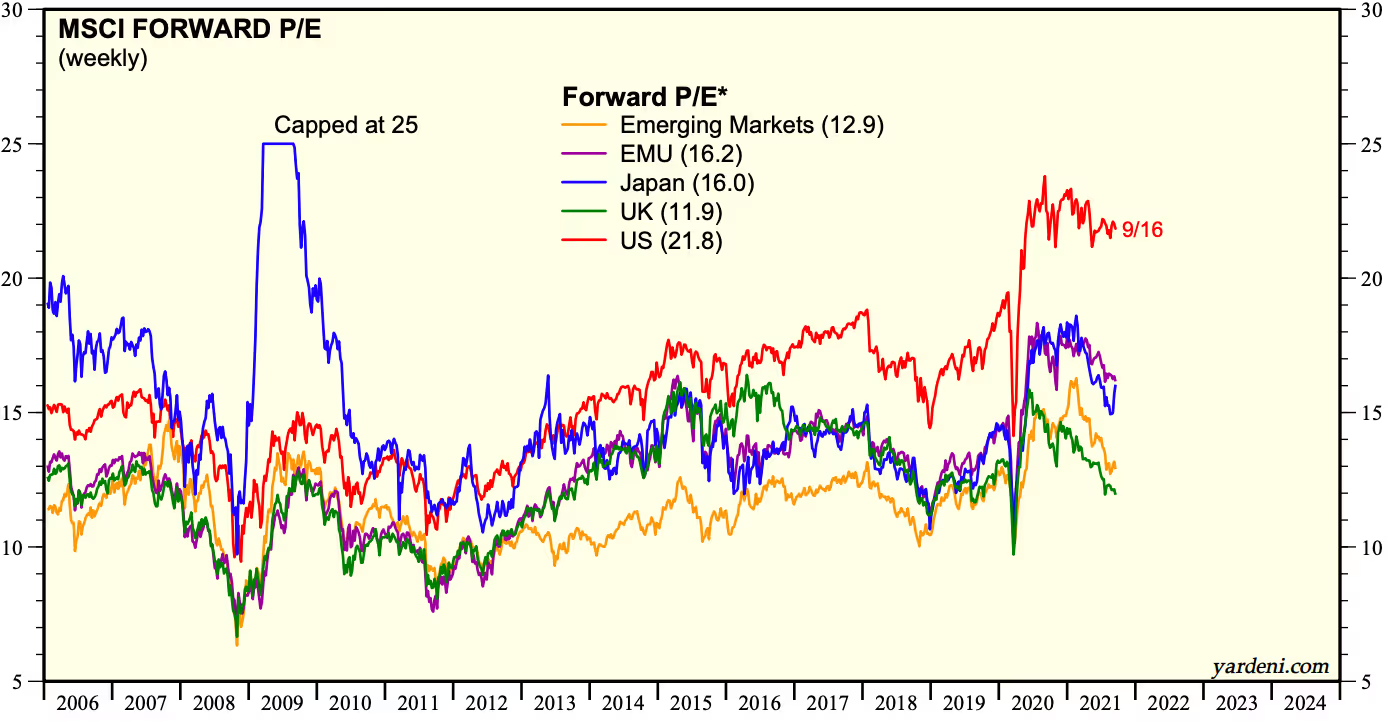

Stacked up against its global peers, the market has the lowest forward price-to-earnings (P/E) ratio of all major regions.

The measure gives us an idea of how optimistic the market is around a company’s growth or, in this case, the growth of UK plc.

The gap between the shiny tech-led US market and the UK index, laden with backward-looking industries, couldn’t be more stark.

Investors are struggling to get excited about UK companies but why is it all doom and gloom?

Well, as we’ve alluded to, the pandemic has shone a light on just how out-of-touch the large cap firms on the UK 100 are looking.

Financials and consumer staples dominate the big UK names, making up 18% and 17.8% of the Vanguard FTSE 100 ETF (VUKG). At a time when the likes of Amazon, Apple and Alphabet have soared and taken the US market with them, the tech sector makes up only 1.8% of the Vanguard ETF’s holdings.

Adding to the dim view of the UK are persistent Brexit worries. Trade deals are still being navigated and, if the recent failure to attract EU lorry drivers to the UK is anything to go by, post-divorce relations will feel a bit frosty for some time yet.

Then there’s the issue of a Covid bounceback and the extent to which UK companies can recover. With tech as the clear driver behind the global recovery so far, if it continues to gain traction, the index could lag the US even more.

Time to be cautious or brave?

We’ve started with the negatives but there are bound to be a few ardent value investors eyeing up that forward P/E of 11.9 and licking their lips.

They aren’t alone.

A recent survey of professional money managers by small cap investor MBH Corporation showed appetite for UK equities is returning among the big leagues.

Nearly 90% of the cohort, who collectively manage over $300bn, believe UK shares are now undervalued, with 47% saying they plan to up their allocation to UK equities over the next year.

Only 5% of those surveyed plan to reduce their exposure to the UK.

Read more

The Americans are coming

Has the UK's top investor got it wrong?

Sign up to Honey, our daily market newsletter

The key reason behind the optimism is the country’s Covid-19 vaccination programme. It hasn’t been perfect but its efficiency relative to much of the world has led to a much quicker recovery than many other regions.

The belief here is that the UK could get back on its feet and prompt greater economic growth quicker than many other developed nations.

Even if it doesn’t produce a stellar course-correction, they’re suggesting the UK is in a much better place than it’s being given credit for and valuations haven’t caught on yet.

Price is what you pay, value is what you get

So, valuations are low and maybe undeservingly so if we believe the pros.

Just because the market looks less expensive than other regions doesn’t mean there’s great value on offer though. There are still very real hurdles ahead.

But writing off an entire market risks throwing the baby out with the bathwater. This is where these money managers think the market has become too negative on the UK’s prospects.

Yes, the UK’s large cap relics have been sluggish in their efforts to get back above pre-pandemic highs but that doesn’t tell the full story.

Further down the size scale, the mid cap 250 index and smaller companies on AIM have leapt back above the levels investors saw before the pandemic pulled the rug out from under them.

Such is the weight of the biggest names on the UK 100 though, that a slow recovery up top has masked this performance lower down the order.

All of this means that, while some have clearly chosen to dismiss the UK, investors willing to turn over a few rocks and look past the headline names could have ended up finding some mispriced gems.

Small can be beautiful

So where is that value?

Well first let’s look at maybe where it isn’t. As my colleague David Kimberley pointed out, UK tech is looking particularly pricey. For a lot of investors that will be worth paying up for, after all what’s wrong with buying into high valuations if they go even higher?

But it won’t attract investors looking for undervalued opportunities.

For that, we need to be a bit more discerning.

This means taking a view on the longer term themes at play as opposed to the immediate winners and losers of a Covid narrative that seems to change by the day.

What are the changes spurred on by the pandemic that are likely to stick around? Will commercial real estate be all about warehousing instead of fancy flagship stores now? Will online retailing stick around, even if it does dip below lockdown peaks? In a hybrid working-from-home world, will cybersecurity become more important?

These are questions for the next few years at least, not the next few months.

And if investors are indeed too negative on the UK’s bouncebackability, a quicker economic revival could help small and mid cap names first. That’s because firms lower down the order tend to serve the domestic economy more than the internationally-facing UK 100.

The UK economy is also heavily weighted towards business-to-business services too. That paves the way for Britain-focused firms to aid and benefit from a long-term sustained recovery.

An example to illustrate this line of thinking might be hotel laundry provider Johnson Service Group (JSG). Its partners are crossing their fingers for the tourism industry to boom again and if they do, JSG could benefit.

Bath-based magazine publisher Future has been busy snapping up online titles and trying to generate revenues from advertising and reader click-through.

And businesses like kettle temperature control firm Strix have used the time to expand meaningfully, hoping to capitalise on a resurgence in global trade.

These are just illustrations and not inducements or invitations to buy or sell any investments. But they do serve to show us that there is a world beyond the big names. And not only does it exist, it has been thriving and could still offer value for investors willing to get their hands dirty.

Active stock pickers’ time to shine?

As we head into the final chapter of 2021 and beyond, we simply can’t predict what’s up next for the Covid storyline.

What we can say is the UK’s low valuation deserves attention. Whether you take that as a sign to steer clear or delve in, there are some big takeaways for stock pickers to keep in mind.

- An active approach will be key. Investing passively and capturing performance from the whole market risks exposing investors to the laggards as well as the winners. That may mean supplementing broad market ETFs with high conviction stock selection, or just being more careful about which stocks have little to offer from here.

- Keep an eye on small and mid caps. The UK isn’t just the top 100 names. There could still be opportunity lower down the scale, especially if the UK economy recovers quickly and business-to-business services flourish.

- Quality counts. The true value now is arguably to be found in firms temporarily marred by the pandemic hit to trade, or businesses set to come out of the pandemic swinging.

- None of this is nailed on. The route out of the pandemic is step one. Only then will a lot of businesses be able to truly assess the damage. That’s why a strong cash position is becoming incredibly valuable. Once the tide goes out, there will be a lot of companies, from the largest to the smallest, left in a precarious position and nursing a hefty debt pile. Once again, it’s about being highly selective and not waiting to see which ones have lost their trunks over the past 18 months.

What's your take on the case for investing in the UK? Let us know on the community forum:

Freetrade is on a mission to get everyone investing. Whether you’re just starting or have loads of experience, you can buy and sell thousands of UK and US stocks, ETFs and investment trusts commission-free via our trading app. Download our iOS trading app or if you’re an Android user, download our Android trading app to get started investing.

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)

.avif)