We invest to try and do more with our money.

And while it might not seem like a biggy, the account you choose to keep your investments in can make a huge difference to your goal.

To help you decide which investment account is right for you, we’re going to look into two of the main ones: the general investment account (GIA) and the stocks and shares investment savings account (ISA).

Before we start, it’s important to understand that the value of your investments can fall as well as rise, so you might get back less than you originally invested. You also need to be aware that pension and tax rules can and do change. Any tax treatment depends on your individual circumstances. This should not be read as personal investment advice and individual investors should make their own decisions or seek independent financial advice.

What is a GIA?

A GIA or general investment account does what it says on the tin. It’s an everyday account for you to hold a wide range of investments in.

GIA’s are quite flexible when it comes to which investments you can hold. You should be able to invest in most things from stocks to ETFs, investment funds, investment trusts and beyond.The investment choices are all yours to make.

The main thing to know about GIAs is that they don’t protect your investments from the big UK investment taxes:

- Capital gains tax (a tax on any profits you make when you sell your investments and a few other assets).

- Dividend tax (a tax on UK dividends).

- Tax on savings (a tax on any savings interest you’re paid).

Now, you might not face taxes straight away, there are certain amounts we can earn each year without needing to pay tax (more on that later on) but it’s definitely something to keep in mind when choosing an investment account.

If your investments do well you could face an unwelcome tax bill.

What is a stocks and shares ISA?

A stocks and shares ISA (also known as an investment ISA) is a tax-efficient investment account.

This means that, unlike a GIA, any money you earn from your investments will be free from UK taxes.

Inside an ISA, you won’t pay income tax on any UK dividends or interest and you won’t need to worry about capital gains tax if you sell your investments for a profit.

However, given these juicy tax benefits, ISAs come with a few more strings attached.

There’s a limit on how much money we can put into ISAs each year.

Each tax year HMRC sets an ISA contribution limit and it’s the total amount of money you can put into ISAs that tax year.

💡 A tax year runs from 6 April to 5 April the following year, so the current tax year 2024/2025 ends on 5th April 2025.

The ISA annual allowance for the 2024/25 tax year is £20,000. That's your individual limit, which means it's up to you how you spread it around. You can invest all £20,000 in a stocks and shares ISA or spread it across different ISA accounts, perhaps in a cash ISA or Lifetime ISA.

You can open or add money to multiple stocks and shares ISA each year.

Previously, you could open and pay into one of each type of ISA per tax year. For example, you could split your allowance and pay into one cash ISA and one stocks and shares ISA.

As of 6 April 2024, the rules have changed and you can open and pay into multiple ISAs of the same type each year. For example you can have multiple cash ISAs, and multiple stock and shares ISAs.

It’s great to have this additional flexibility, but be wary of fees - you could end up paying more fees if you have different ISAs with different providers. On this point, if you have old stocks and shares ISAs elsewhere, you could think about keeping them in one place by transferring your ISAs to the same provider. It could reduce your fees and allow you to see all your ISA investments in one place.

If you have old stocks and shares ISAs elsewhere, you could think about keeping them in one place by transferring your ISAs to the same provider. It could reduce your fees and allow you to see all your ISA investments in one place.

For the full ins and outs of stocks and shares ISAs check out our ISA guide.

UK investment taxes to know about for the 2024/25 tax year

Disclaimer: This table assumes you have used your £12,570 personal allowance for 2024/25. Comparisons are based on our understanding of the gov.uk information as at 18 April 2024. For confirmation of up-to-date information, you should visit gov.uk. Please note that tax treatment depends on the individual circumstances of each client and may be subject to future change.

Remember, dividends or capital gains earned in your ISA are protected from these tax rates noted above. Those benefits, however, are capped in a GIA and will only apply up to the allowances indicated above.

New UK dividend tax rates from April 2024

Let’s start with dividend tax.

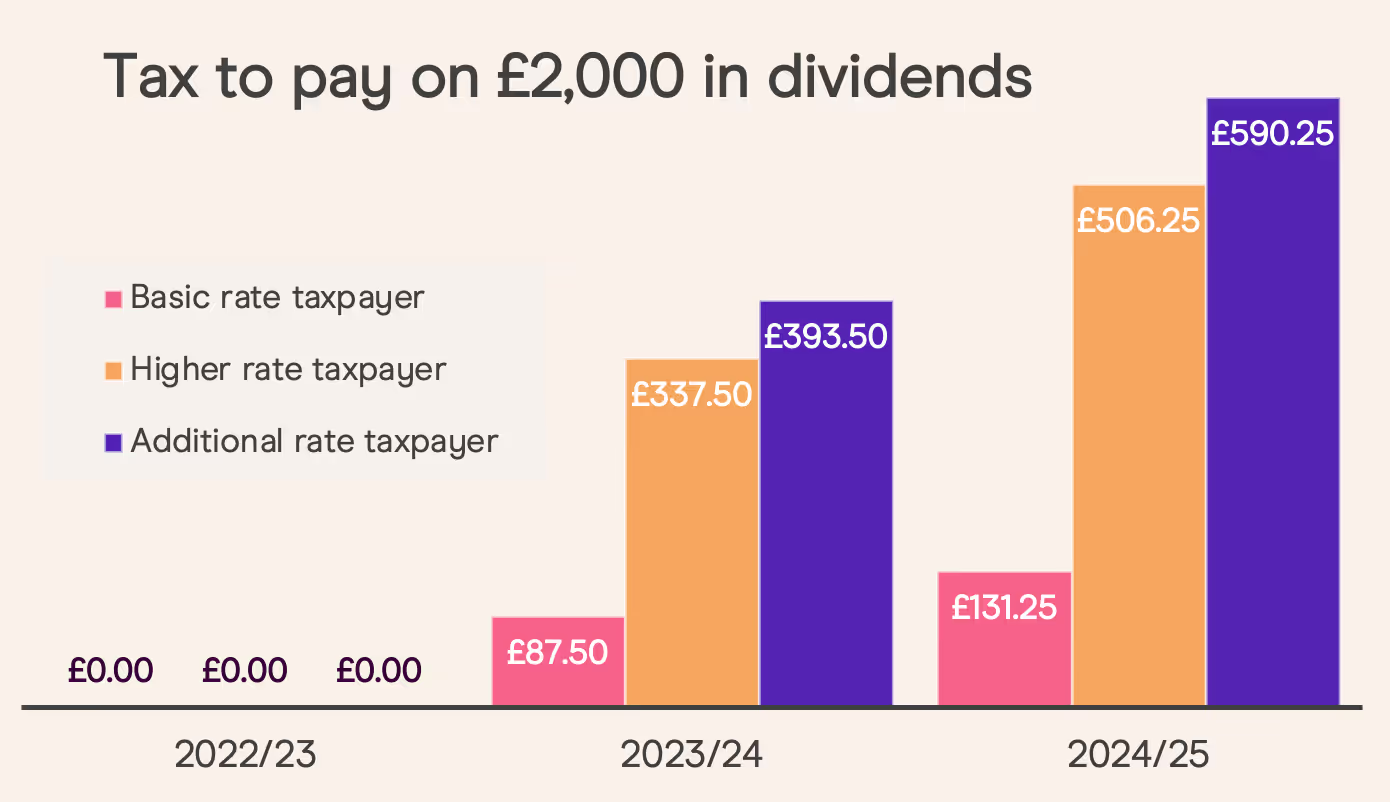

Putting the changes to the dividend allowance into perspective, a basic rate taxpayer earning £2,000 in dividends in the 2022/23 tax year paid no dividend income tax as the allowance was previously set at £2,000. If they earned the same dividend income for the next two years, would suddenly have had to pay £87.50 in 2023/24, and now £131.25 in 2024/2025.

Read more:

Your pocket guide to ISAs

What is a stocks and shares ISA?

The rise in dividend tax is even more pronounced for higher rate taxpayers, who would now pay £506.25 in 2024/25, and additional rate taxpayers, who’d owe £590.25.

So, it’s a double whammy. Your dividend allowance is getting sliced, while the tax rate you’ll pay for any dividends above that threshold is getting bigger.

That’s a big chunk of change for anyone, and let’s not forget it could be even bigger if your dividend payments grow, like we all hope they do.

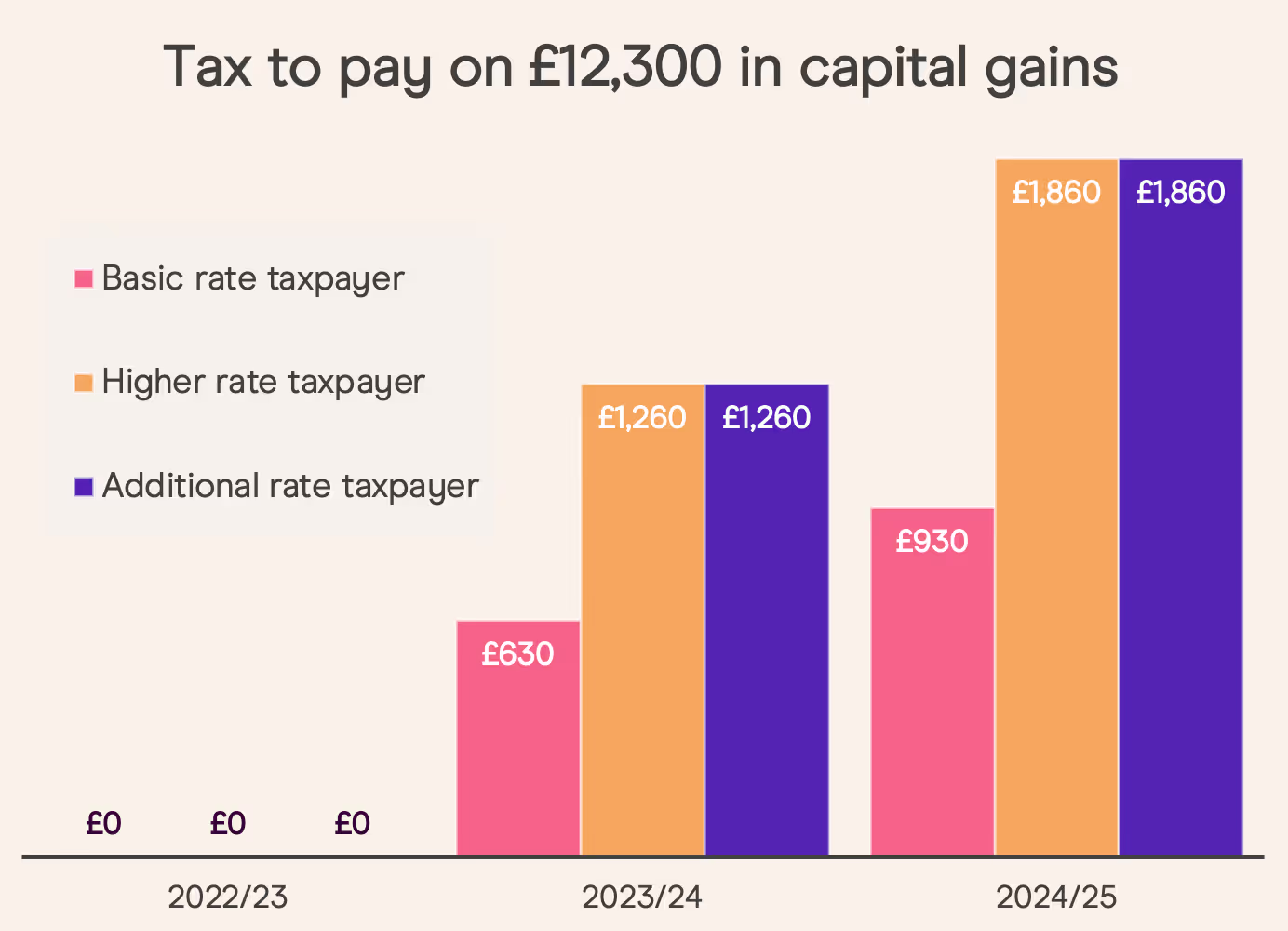

New UK capital gains tax rates from April 2023

Dividend allowances aren’t the only limits that got the chop over the past two tax years. The amount we can earn from the growth of our assets and not pay UK tax each year (also known as your capital gains tax allowance) fell from £12,300 to £6,000 in 2023/24, and now sits at just £3,000 for 2024/25.

Of course, if you don’t sell any assets it doesn’t matter all that much right now. But eventually, we all want to hit the sell button and actually put that money to use. And it’s at that point that we’ll potentially have to pay tax on any gains we’ve made.

The thing is, making all that hopeful growth tax efficient needs to start long before you actually sell up and move on. If you get to that stage, the last thing you want is to be kicking yourself just because you didn’t use the most tax-efficient account to begin with.

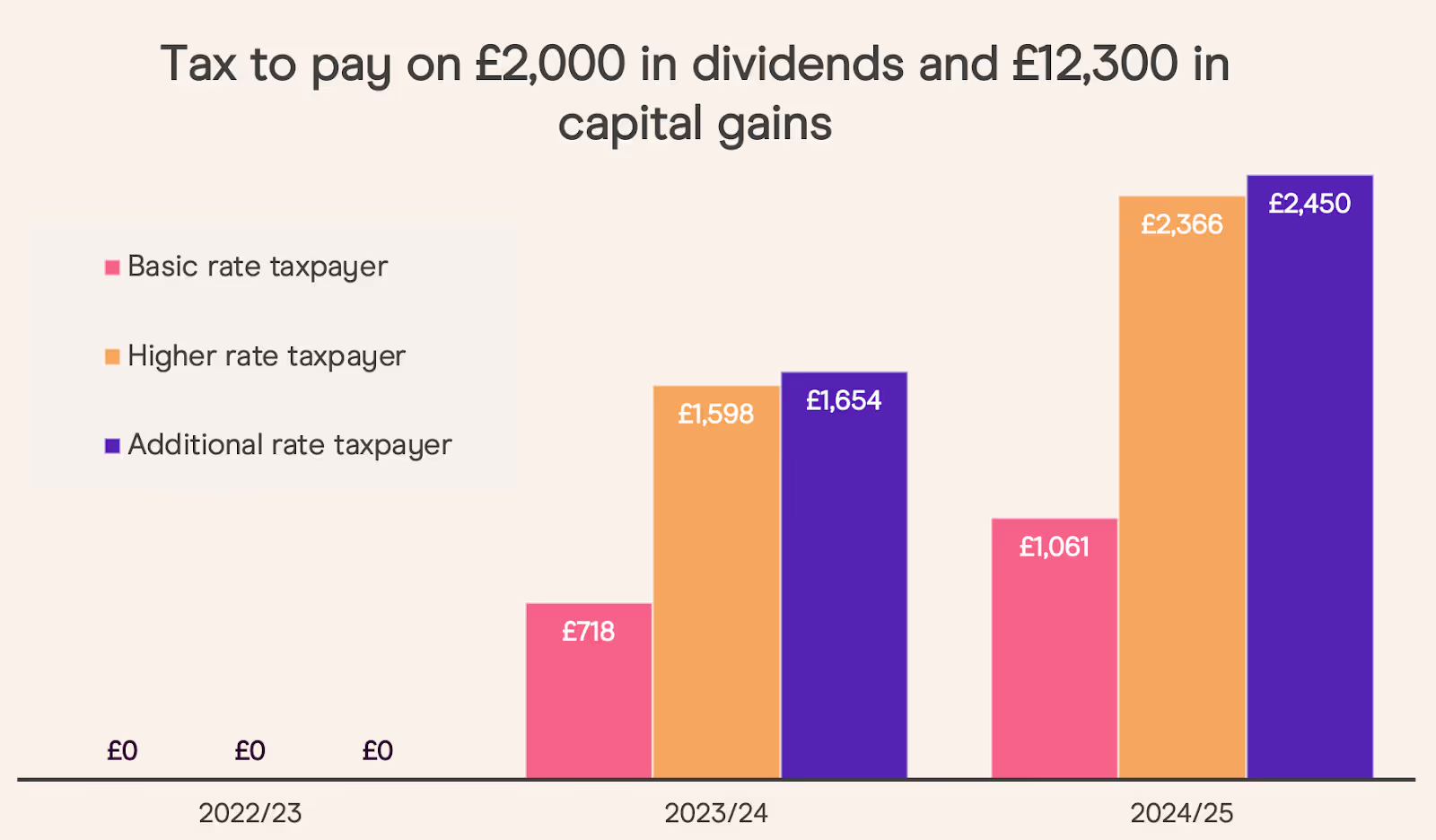

Get planning for lower allowances and higher tax rates

When you consider the route most of us want to take is into the higher tax bands at some stage in our working lives, ISAs and their tax-efficient ways become all the more important. Because with your dream salary rise comes a rise in your income tax rate, dividend tax rate and capital gains tax rate too.

For example, going from being a basic rate taxpayer to being a higher rate taxpayer means potentially paying 33.75% instead of 8.75% on dividends above the allowance.

That’s even more of an issue for the UK’s highest earners as of 6 April 2024 as the additional rate income tax threshold will come down from £150,000 to £125,140. Granted, this bunch might not get a whole lot of sympathy from the rest of the nation’s savers and investors.

Read more:

2023 ISA income investing

Dividends and your stocks and shares ISA

Choosing the right investment account: GIA or ISA?

But the fact remains that anyone tipping the scales above £125,140 will now suddenly find themselves in a 45% income tax band, a 39.35% dividend tax rate, 20% in capital gains tax and staring down the barrel of two successive reductions in investment tax allowances.

GIA vs ISA

Now we’re on the same page about the two investment accounts, let’s take a look at the pros and cons of each.

GIA pros and cons

ISA pros and cons

Choosing the right account for you

Ultimately which account is right for you, is up to you. It’s important to remember too that you can have both a GIA and an ISA.

However, when it comes to comparing an ISA and a GIA, the main deal-breaker is tax.

Inside an ISA your investments are protected from key UK investment taxes but with a GIA they are not.

How much tax could you save with an ISA?

If you aren’t investing using a stocks and shares ISA or a longer-term tax-efficient account like a SIPP you could be forking out a load of extra tax come April.

Often, investors will opt for the cheapest investment account out there and on the surface that makes sense. Why pay more than you have to? But investing solely in a general investment account (GIA) because it has a lower headline cost than an ISA risks missing the whole point, tax.

Does an ISA protect you from all taxes?

While an ISA protects you from the main investment taxes in the UK there are a few charges it can’t protect you from.

Stamp duty (SDRT)

This is a 0.5% charge, paid and deducted at the time you buy a UK stock, with the exception of AIM stocks and some ETFs. You do not pay stamp duty on US stocks.

Withholding tax on US dividends

The US Government charges non-US residents a 30% tax on any income received from US investments. Thanks to an agreement between the UK and the US, UK residents can generally reduce this tax to 15%.

To do this you’ll need to fill in a W-8BEN form, which declares you’re not a US tax resident. If you’re a Freetrade customer we’ll prompt you to fill it in in-app.

Final thoughts

That’s probably enough tax chat for now.

Hopefully, it’s clear that an ISA could save you both from taxes and the hassle of calculating them.

Check out our guide for more information on how your investments are taxed.

Learn about opening an ISA with Freetrade or transferring your ISA to Freetrade.

Learn more about ISAs:

The (more realistic) ISA millionaire

ISA myths

Is crypto right for your ISA?

When you invest, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you invest.

Past performance is not a reliable indicator of future returns.Freetrade does not give investment advice and you are responsible for making your own investment decisions. If you are unsure about what is right for you, you should seek independent advice.ISA and SIPP eligibility rules apply. Tax treatment depends on personal circumstances and current rules may change. Check before you transfer an ISA and/or SIPP that we can accept your investments, you won’t lose any guarantees, and that you know what charges you may incur.

A SIPP is a pension designed for you to save until your retirement and is for people who want to make their own investment decisions. You can normally only draw your pension from age 55 (57 from 2028), except in special circumstances.

At present, Freetrade only supports Uncrystallised Fund Pension Lump Sums (UFPLS) for customers who wish to withdraw funds from their SIPP after their 55th birthday. We strongly encourage you to seek financial advice before making any withdrawals from your SIPP.

Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

.avif)