Big tech and healthcare stole the show last year for good reason, but in the second half of 2020 commodities started to make a comeback.

A whole host of unknowns around virus spreads, Brexit and the US election sent investors towards ‘safe haven’ assets like gold.

Iron ore prices boomed during the year too, with big gains in palladium, uranium and copper.

So commodities are firmly back on investors’ radars. But what defines the sector, what drives its performance and what products are out there to help us invest in it all?

Here’s your need-to-know on the sector and a few ideas on how it might fit into your portfolio.

What are commodities?

Think of commodities as raw materials we use to make basic products related to food, energy, clothing and a range of human activities.

Unlike a lot of other things we invest in, which have some sort of unique selling point, commodities tend to be standardised the world over and mass-produced. Regardless of who produces them or where they are produced, oil, soybeans and sugar tend to be standardised for quality and quantity.

That means, when we’re talking about buying or selling them, commodities tend to have one price point for the whole sector. You can search online for the price of coffee, sugar or silver as opposed to individual company prices on the stock market.

Like company shares, commodities are bought and sold on exchanges. Some of the best known commodity exchanges include the London Metal Exchange (LME), the New York Mercantile Exchange (NYMEX) and the Chicago Mercantile Exchange (CME).

Brief history of commodities

Agriculture and crop production began what we now know as commodity trading, with the buying and selling of produce dating back to around 8,500BC, according to commodity boffin Bruce Babcock.

Supply and demand were driving forces behind the market even then, with factors like weather exposure, seasonal change and war affecting prices.

Babcock notes that buyers and sellers started to make agreements on future prices and quantities of their produce to keep the market going and make sure they eventually got what they wanted. These were the first futures contracts and there is some evidence they were being used as early as 4,000BC in China’s rice markets.

Fast forward to the 1800s and Chicago’s grain stores. These raw farmed materials were brought to the city to store before being sent further east.

But perishable products perish, especially when they’re left in storage and not used. So, purchase prices would naturally change to reflect current quality and quantity.

The result was the creation of the first recognised futures contract, which allowed a buyer to pay for a commodity and lock in what they could expect long before it was delivered.

Chicago made a name for itself in this regard and the first US exchange, the Chicago Board of Trade (CBOT) was set up in 1848.

Traders created an efficient and standardised way of exchanging goods and payment by creating futures contracts. They used measures like quality of produce and delivery time to give buyers a current price, which reflected broad levels of stores rather than individual hauls.

Agricultural products remained the focus until the CBOT introduced soybeans in 1936. Cotton, lard, livestock and precious metals were steadily added through the years and in the 1970s the futures contracts themselves became available to trade.

In the 21st Century, investors with a shares trading app can now track the price of copper, wheat or coffee through investing in exchange traded funds (ETFs) and choose whether these represent physical piles of those commodities or just the change in price.

We can still obviously invest in actual materials like gold bars, or gain access to the sector by investing in companies that mine or produce these raw materials.

The big change from the early days is that investors aren’t that interested in receiving the products anymore. Rather they want to benefit from the change in prices brought on by many of the same supply and demand factors that kicked the whole thing off.

Performance of commodities over time

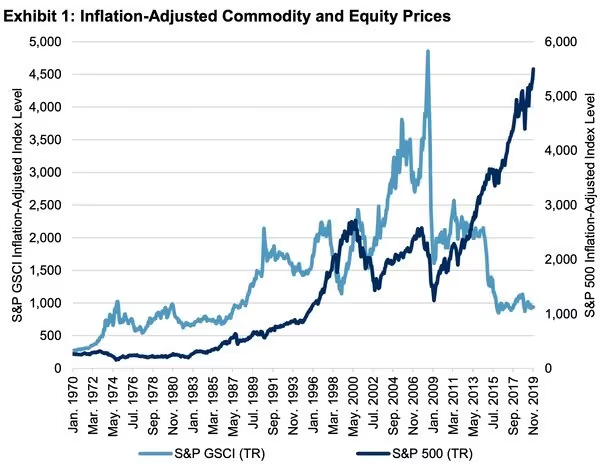

Commodities can perform very differently than stocks and shares over time because they often have very different push and pull factors.

But it goes further than that. While it makes sense to talk about commodities as a separate asset class to the likes of stocks and bonds, even among themselves there can often be little in the way of common ground. When it comes to market performance, there isn’t much that links corn and crude oil.

One of the draws of company shares is that the whole market tends to drift higher over the long term as economic activity grows.

Commodities can end up being uncorrelated with equities because they represent the underlying supply and demand of the physical materials we use in the background.

They give a snapshot of the current real world demand and present prices, whereas shares look forward and anticipate earnings.

What impacts commodity prices?

As we’ve said, supply and demand are pretty intrinsic factors to commodity prices. And there are a lot of influences behind that balance.

Macroeconomics

When the broader economy is weak, demand for commodities can drop particularly when it comes to anything used in building, transport and large government projects.

When growth kicks in, better economic conditions can drive those projects, increasing demand and influencing higher prices.

Seasonality

A lot of the attention might have gravitated towards futures contracts and the rather complicated end of the market but let’s not forget agriculture is at the heart of the market. With that comes the cyclical nature of farming, production and harvesting.

Prices often rise at times of positivity around harvest forecasts, and fall after all that agricultural produce has been reaped and sent to market.

Technology

The world changes everyday and the pace and magnitude of that change is a big factor in determining the demand of commodities. As technology develops, what was previously thought to be a stalwart commodity could have the rug pulled out from under it.

A good example of that is the proliferation of renewable energy which threatens to vastly reduce our reliance on oil and gas.

Politics

International politics have an effect on all markets but when it comes to commodities one of the main influences can come from changes to policies surrounding imports and exports.

An increase in taxes tied to imports can increase prices, for example.

Weather

Natural disasters, extreme weather conditions and general changes to the norm can affect production and harvest yields. Where volumes fall as a result of weather, prices can rise as a result of the relative scarcity of what’s being produced.

Changes to weather can have other knock-on effects like increasing transportation times. Where this decreases the eventual amount of a commodity that gets to market, prices can rise.

Inflation

Commodity producers tend to raise their prices in line with inflation because their cost of production goes up.

Holding the commodity gives investors an opportunity to hedge against the effects of inflation.

Record low interest rates since 2008 seem to be on the cards for the next few years at least but central banks like the US Federal Reserve and the Bank of England will aim to bring them back to more ‘normal’ levels eventually.

Throw in Joe Biden’s plans to put dollars in Americans’ pockets, lift the minimum wage and a host of smaller initiatives and inflation could appear on the radar sooner than we think.

How can I use commodities to prepare for inflation?

If you’re thinking of getting your portfolio ready for inflation, you aren’t alone.

According to Bank of America, investors recently poured near record-high amounts into assets that typically do well when inflation returns like energy companies and inflation-protected Treasury bonds.

In terms of commodities, gold and oil tend to lead the way judging by their inflation-busting track records.

But you can get access to agricultural materials and industrial metals too, through broad commodity ETFs like iShares Diversified Commodity Swap or Lyxor CoreCommodity.

Exchange-traded instruments like the iShares Physical Gold ETC or WisdomTree Physical Silver might be useful for anyone looking for exposure to precious metal prices.

Infrastructure

Away from inflationary pressures, the past few years have seen one country influence commodity markets more than any other: China.

Vast industrial and infrastructure projects have meant the country has swallowed up the global supply of oil and metals used in production processes, like copper. The hike in price of iron ore, which provides the steel these structures need, is a direct result of China’s economic growth.

And even with its programme to transition into a consumer-led society, it isn’t done with the public projects just yet.

In fact, with retail taking a dive due to lockdowns in 2020, the industrial side of the economy has been keeping the ship steady.

If the retail malaise continues and infrastructure shoulders even more of the country’s growth ambitions, its commodity usage will become even more important.

Types of commodities:

Hard commodities

These tend to be mined natural resources used in industrial processes like metals, oil and gas.

Soft commodities

Commodities connected to agriculture or grown and reared, not mined, fit in here. Think coffee, wheat right down to pork butts.

You might see commodities classified in different ways. Here are some of the main ones you’ll see mentioned on their own, along with a few things to be aware of if you are considering investing in them.

Investing in oil

We might be steadily shifting towards renewable energy but for now oil is still an important part of our everyday lives and our global economy.

You will often hear oil prices referred to as Brent Crude or West Texas Intermediary. While they’re shorthand for prices, their main difference in the crude oils is where they are produced.

Brent Crude comes from oilfields between the Shetland Islands, off the coast of Britain, and Norway. West Texas Intermediate comes from US oilfields. Both are refined into gasoline.

It’s useful to also think beyond the commodity itself to how it is traded in the real world.

When the price of oil changes in accordance with supply and demand there are knock-on effects, particularly in industries like freight and airlines, where usage is high.

There are also governmental bodies that try to influence the price of oil because of its importance to their national budgets.

The most notable of these is the Organization of the Petroleum Exporting Countries (OPEC) is an intergovernmental organisation of 13 countries, founded in 1960. Its role is to coordinate oil prices between oil-producing nations and so, set a baseline for global oil markets.

You can gain access to the market through ETFs tracking indices of companies in the exploration and production of oil and gas like the iShares Oil & Gas Exploration & Production ETF.

And of course you can invest in the oil producers themselves like BP, Shell and Tullow Oil.

Investing in gold

Having been some way off its 2011 peak since a brief period in 2013, last summer gave the precious metal the boost it needed to scale new heights and cross $2,000/oz.

The reason for the record breaking rise this time round was the prospect of much lower growth in the US, on the back of virus-induced hits to business, and the resultant weakness in the dollar.

As the yellow metal is priced in dollars, the currency going lower is good news for the gold price. It brings down the cost to buyers around the world who need less of their foreign notes to buy the same weight of bullion.

With lower interest rates and bond yields coming down too, investors saw even less reason to give up gold and go for income-generating assets like bonds.

Gold doesn’t offer an income but when bonds don’t really either, suddenly the metal starts to look more interesting.

If you’re looking to add a bit of a shine to your holdings, you don’t have to go panhandling or safe-shopping.

Exchange-traded instruments like the Xtrackers Physical Gold ETC might be useful for anyone looking for exposure to the gold price.

Other options like the L&G Gold Mining ETF track the performance of a range of global gold mining stocks.

And then there are the stocks themselves.

Gold mining companies usually have high fixed costs. When the gold price rises that means all revenues over and above these costs turn into profit.

Among the many options on Freetrade are Egypt-focused Centamin, Toronto-based Barrick, and the UK’s Greatland Gold.

Investing in silver

Gold and silver aren’t just popular for their displays of wealth or use in jewellery. They are both used in industrial processes, with silver a heavy presence in solar panels, batteries and photography materials. It has the highest electrical and thermal conductivity of all metals, which makes it close to irreplaceable in many of these processes.

Like gold, it is often used as a ‘safe haven’ asset in times of uncertainty in the stock market. This is because, as a physical asset, it has intrinsic value unlike currencies. And because it has real-world applications too, it tends to hold its value when interest rates are low.

Investing in metals

Away from the headliners, metals like copper, platinum and palladium offer investors a different way into commodities.

The price of Dr. Copper, as it’s known, tends to give an overall view of the strength of the global economy because of how much of it is needed in construction, manufacturing and technology.

Thanks in large part to developing countries like China and India, copper demand has outpaced copper production in recent years, meaning its price has hit its highest level in nine years and is edging towards all-time highs.

Platinum has its place in jewellery but it is also important in the construction and performance of catalytic converters in vehicle engines.

It may not have the allure of silver and gold among investors but, historically, it hasn’t shown the same volatility as it isn’t seen as a natural safe haven when times are tough.

Nevertheless, its applications are significant in the global economy and could serve as a stabiliser in commodity portfolios.

Palladium has very similar characteristics to platinum in that it is used in auto manufacturing as well. It’s less popular in jewellery but the metals tend to move in lockstep where price is concerned.

These are just some examples of the metals segment. Beyond the top-level precious metals, investors could also look to those with important electrical and industrial uses like ruthenium, rhodium, iridium and osmium. Their value is in their extreme density, making them strong and durable.

Investing in energy commodities

On top of traditional energy sources like crude oil and natural gas, investors can get access to the burgeoning renewable energy sector.

Renewable energy accounts for about 20% of global electricity generation and just over 12% of our overall energy consumption.

Solar, geothermal, wind, biomass and hydropower are some of the ways companies are replacing legacy technologies with more sustainable energy sources.

The iShares Global Clean Energy ETF aims to track the performance of an index composed of 30 of the largest global companies involved in the clean energy sector.

The ETF’s top holding Plug Power concentrates on replacing the batteries we’ve grown used to with hydrogen fuel cell systems. So far, its tech has appeared in the likes of Amazon’s warehouse forklifts, with the company also teaming up with car maker Renault on developing their own fuel cell applications.

Other popular members of the hydrogen gang are UK-listed ITM Power and Ceres Power.

In terms of investment trusts, Impax Environmental Markets invests in small and medium-sized companies which aim to make at least 50% of their revenues from products or services in the energy efficiency, renewable energy, water, waste, sustainable food and agricultural markets.

The Renewables infrastructure Group offers investors the chance to invest in a portfolio of around 70 energy projects, mainly in solar, wind and battery storage technology.

And if you’re particularly interested in investing in wind energy there is the Greencoat UK Wind trust.

Soft commodity trading (cotton, grains, cattle, cocoa, livestock, coffee)

The soft commodity world gets a lot less attention than the precious metals but these materials are still important to everyday life, and are based on human consumption.

We tend to split them into two sections:

- Agriculture, where commodities are grown for humans to use, as food or in clothing and building materials

- Meat and livestock, wherein animals are farmed for consumption as food or through products like leather.

Environmental factors can have a much greater effect on prices in the soft commodity sector as harsh conditions and even animal illnesses can dramatically change the outlook quickly.

Should you invest in commodities?

Commodities act differently and respond to the economy differently than stocks, so is investing in commodities a good idea?

The sector can feel miles away from investing in the likes of dating companies or supermarkets and that’s kind of the point.

There are different factors at play in the supply and demand of commodities than in a lot of other sectors, so investors usually gravitate towards them at least in part for diversification.

Holding a range of assets which act differently from each other can help manage volatility levels in your overall portfolio.

A lot of people will find they’ve naturally become tech-heavy over the past year - what would happen to you if tech suddenly took a nosedive?

Would it take the majority of your holdings with it?

Holding a blend of uncorrelated assets like commodities is a way to try and mitigate against these big movements.

Volatility in commodities

While diversification is a key reason why many investors hold the likes of gold, commodities do bring their own bouts of volatility.

Short-term fluctuations in price can come about by sudden changes to supply and demand. OPEC restricting oil production volumes is a good example of this.

How to trade commodities

1. Physically buying a commodity

There are still investors who choose to fill up their vaults with physical precious metals. Obviously, as a store of value, this makes little sense on the soft end of the spectrum. But sometimes we like the security of a physical asset.

The downside of this is paying for insurance and storage. Then, when it comes to selling, you have to go out and try to find a willing buyer, agree the price and hand over the goods.

Physical ETFs could be a compromise here, as they are backed by holdings in physical commodities but provide investors with a way to deal in and out of the market without ever having to receive the actual product.

2. Invest in future contracts

As we’ve said, many producers and suppliers in the early days bought futures contracts to protect or hedge against sudden spikes in commodity prices. The contracts lay out the quantity, quality and delivery terms of the goods.

Today there is a significant market in trading these contracts for financial gain with no intention of receiving a shipment of oil or soybeans.

There are ETFs to track the broad range of these commodity futures prices, and might be more appropriate for personal investors than derivative-based products that can carry extra risk.

3. Invest in commodity stocks

Rather than think about the actual materials being produced, investors can access the commodity sector by investing in companies involved in commodity production and supply chains.

These might be oil refiners, grain harvesters or gold miners.

As some commodity prices move in opposition to stocks, it can make them an attractive way for investors to hedge their portfolios.

If there is an unexpected problem in the oil supply chain for example, oil companies could suffer in the short term, but the price of oil is likely to rise as demand outstrips supply.

Other commodity prices move in line with their stocks. For example, the price of gold tends to inform the price of a mining company getting it out of the ground.

4. Invest in commodity ETFs

We’ve been speaking a lot about exchange-traded funds but just what is an ETF?

These are investment instruments which hold or track the performance of a basket of assets, like commodities or company shares. Some ETFs hold the physical assets they’re invested in. For example a gold ETF might hold a certain amount of gold bullion.

Others use a more complicated way to synthetically represent the underlying market.

Buying and selling ETFs can be a great way to gain exposure to a range of commodities or commodity-linked stocks from a single holding.

Advantages of investing in commodities

1. Diversification

The uncorrelated nature of a lot of commodities and stocks means there is the opportunity for them to complement each other in personal portfolios. Diversification is about having a range of assets that can pass the baton between each other and change leadership to reduce the volatility and potential losses in your portfolio.

2. Potential returns

Increased demand for a lot of commodities, thanks to massive global infrastructure initiatives, has driven the prices of materials in those sectors higher. In general, a rise in commodity prices has been a tailwind for the stocks of companies in related industries.

3. Potential hedge against inflation

Inflation can end up eroding the value of stocks and bonds but it can often prompt higher prices for commodities.

Disadvantages of investing in commodities

1. Risk

Commodity prices can be volatile and the commodities industry can be affected by global politics, import taxes, competition, regulations, and even weather. There's a chance your investment could lose value.

2. Volatility

ETFs tracking a single sector or commodity can bring higher than average volatility. Where these movements are amplified by futures, options, or other derivatives, that volatility can be noticeably higher.

3. Lack of income

One of the biggest reasons investors hold company shares is because of the dividends they provide. The same is true of the regular income payments that come from bonds.

When it comes to commodities, and gold in particular, there is no income stream so investors can’t build up that compound growth over time.

How Freetrade users invest in commodities

Investors can head straight for a physical commodity like precious metal bullion but the UK market is home to some of the biggest names in commodities too. Multinationals like Glencore, Anglo American, Rio Tinto and Antofagasta are available on Freetrade and are there for investors wanting direct exposure to these companies’ shares.

On top of the ETFs we’ve already mentioned, there is a wealth of options on the Freetrade app. Options include those following spot prices like iShares Physical Platinum and Gold Bullion Securities and those tracking futures contracts like the iShares Bloomberg Roll Select Commodity Swap ETF.

You can learn how to invest in stocks and see the full list of stocks to invest in, on Freetrade here.

At Freetrade, we think investing should be open to everyone. It shouldn’t be complicated, and it shouldn’t cost the earth. Our investment app makes buying and selling shares simple for both beginners and experienced investors and keeps costs low. So download the app and start investing today. You can keep your investments as part of a general investment account, a tax-efficient stocks and shares ISA or a self-invested personal pension (SIPP).

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication.When you invest, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

.avif)

.jpg)